What happened to Turkey’s 99 percent?

Yasemin Satır Çilingir*

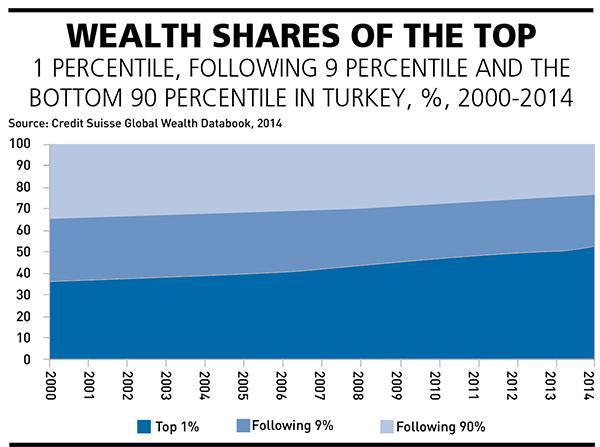

When the Occupy Wall Street protests began in Lower Manhattan’s Zuccotti Park five years ago, the catchiest slogan was “We are the 99 percent!” The rationale behind the protests was the share of income and wealth of the richest percentile in the U.S. and the inequality of distribution. Since 2000, the richest 1 percentile of the U.S. society owns around 37-38 percent of the total American wealth. At the turn of the millennium, Turkey’s wealth distribution was almost identical to that of the United States; the richest 1 percentile of our society owned 38 percent of the total wealth in Turkey. If I was to say, “today’s situation is quite different; the share of the top 1 percentile in Turkey is around 55 percent, and Turkey is competing for world leadership,” would you be happy that Turkey is getting richer or worried that the poor are becoming poorer? However, the truth cannot be explained without knowing the evolution of the middle class.

A report published by Credit Suisse in 2014, analyzing global survey of household balance sheets, shows that the wealth share of Turkey’s 99 percent has been on a steady decline since 2000. The current figures put Turkey in the same league with notoriously unequal societies such as Indonesia, India, Russia and Thailand, where the 2015-wealth share of the top percentiles were 53.5, 53, 70.3 and 56 percent, respectively.

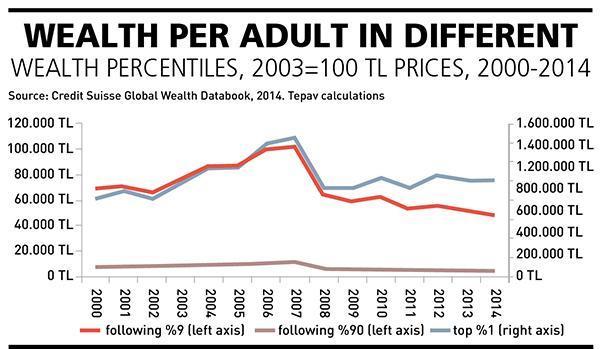

From 2007 to 2015, Turkey’s real wealth in 2003 Turkish Lira prices decreased by 32 percent. You may wonder how wealth in Turkey has been diminishing in spite of the real estate boom. Here is the catch: one-third of all house sales in Turkey during 2015 were via mortgages. From 2011 to 2015, the number of people who could not pay their personal loans and credit card payments increased by 74 percent and 49 percent, respectively. Hence, personal debts increasingly counterbalance the volume of both financial and non-financial wealth in Turkey.

Although the wealth growth trends are similar in all groups, in 2014, the wealth per adult for only the top percentile was higher than its 2008 level. This means that in Turkey, so far, only the top percentile was able to recover from the global crisis. As a result, the vulnerable and the poor disproportionately bear the burden of diminishing wealth. Hence, the result is double trouble; less wealth overall coupled with more inequitable wealth distribution.

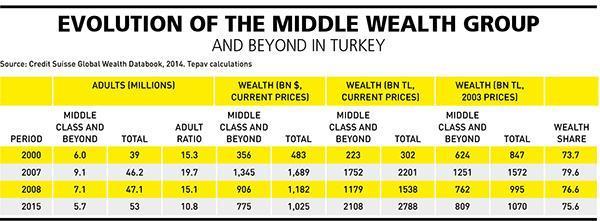

The Economic Policy Research Foundation of Turkey (TEPAV) recently calculated provincial GDPs in Turkey that have not been published by the Turkish Statistic Institute (TÜİK) since 2001. According to that report, in 2013 Turkey had more provinces in the middle and upper income group than in 2001. Although the process slowed down after 2007, on average Turkey’s provinces are getting richer over time. Nonetheless, having more provinces in the middle-income group neither implies that more people are in the middle-income group nor in the middle wealth group. One millionaire can increase the average GDP per capita in a city without any real effect on other people’s income. Further, even if income increases in all groups, high level of consumption or risky environments for investment might prevent wealth accumulation. Actually, Turkey’s middle wealth class has been shrinking since 2007. In 2015, only 5.3 million adults were qualified to make it to the middle wealth group while the rich group consisted of only 400,000 people. Table 1 shows that the proportion of the middle wealth class and above in Turkey has been seeing a dramatic decrease since 2007. In 2007, the share of adults in the middle class and above was almost double in comparison to 2015, yet diminishing middle wealth class was not the promise of the growing Turkey. While “why is the strength of the middle class so important for the economy?” could be a subject for another article, in short, I could say that seeing the middle class only as a stable consumer base, and therefore as the engine of economic growth, is an insufficient assumption. The size and the strength of the middle class are also important because it unlocks other national and societal conditions that lead to growth. It is a prerequisite for robust entrepreneurship and innovation, a bastion of civic engagement that produces better governance and a promoter of education and other long-term investments. Therefore, it is only more worrying that both the size and the strength of the middle class in Turkey are diminishing.

Turkey ranks at the bottom of the OECD in terms of net household financial wealth. Many reasons could account for low levels of household wealth in Turkey such as income inequality, high levels of household debts and insufficient savings. Since 2001, private savings in Turkey do not follow an increasing trend. Moreover, consumer tendency surveys by TÜİK reveal that consumers do not expect to be able to save money in the near future and that their monthly trust for the statement “today is a favorable time for savings” is falling over time. However, to build up a fair wealth distribution, Turkey needs to raise its household savings. In order to be able to save more, either the household net income should rise or spending should fall (especially spending on non-durable goods). Yet the dilemma is that Turkey is growing on income per capita but national savings are not getting any better. A recent research published by Turkey’s Central Bank shows that income elasticity of consumption is much higher in Turkey than in industrialized countries. Therefore, if you give extra $1 to a Turkish household, the household would consume more pennies and save less. The finding of a strong income effect in Turkey can be explained by the fact that Turkish households are relatively more liquidity-constrained and rely more heavily on their disposable income for spending as compared to their industrialized country counterparts. Therefore, the debate on Turkey’s wealth accumulation and the fair distribution of total wealth is not directly attributable to income growth. People can earn more income now compared to 20 years ago; however, either due to high prices or due to new consumption attitudes, their consumption spending may not allow them to aggregate wealth. If the latter is true, then call it capitalism and end the discussion!

* Yasemin Satır Çilingir is a policy analyst at the Economic Policy Research Foundation of Turkey (TEPAV)

When the Occupy Wall Street protests began in Lower Manhattan’s Zuccotti Park five years ago, the catchiest slogan was “We are the 99 percent!” The rationale behind the protests was the share of income and wealth of the richest percentile in the U.S. and the inequality of distribution. Since 2000, the richest 1 percentile of the U.S. society owns around 37-38 percent of the total American wealth. At the turn of the millennium, Turkey’s wealth distribution was almost identical to that of the United States; the richest 1 percentile of our society owned 38 percent of the total wealth in Turkey. If I was to say, “today’s situation is quite different; the share of the top 1 percentile in Turkey is around 55 percent, and Turkey is competing for world leadership,” would you be happy that Turkey is getting richer or worried that the poor are becoming poorer? However, the truth cannot be explained without knowing the evolution of the middle class.

When the Occupy Wall Street protests began in Lower Manhattan’s Zuccotti Park five years ago, the catchiest slogan was “We are the 99 percent!” The rationale behind the protests was the share of income and wealth of the richest percentile in the U.S. and the inequality of distribution. Since 2000, the richest 1 percentile of the U.S. society owns around 37-38 percent of the total American wealth. At the turn of the millennium, Turkey’s wealth distribution was almost identical to that of the United States; the richest 1 percentile of our society owned 38 percent of the total wealth in Turkey. If I was to say, “today’s situation is quite different; the share of the top 1 percentile in Turkey is around 55 percent, and Turkey is competing for world leadership,” would you be happy that Turkey is getting richer or worried that the poor are becoming poorer? However, the truth cannot be explained without knowing the evolution of the middle class.