The indigenous electric car developed by Turkey’s Automobile Initiative Group (TOGG) has given us hope and is a very good project, Zafer Sönmez, the managing director of Turkey’s Wealth Fund, has said.

“I attended the launching ceremony of the electric car. It is a very good project. I would like to thank Gürcan Karakaş [the CEO of TOGG)] and his team. We need to have projects that give Turkey hope,” Sönmez told private broadcaster CNN Türk in an interview on Dec. 29.

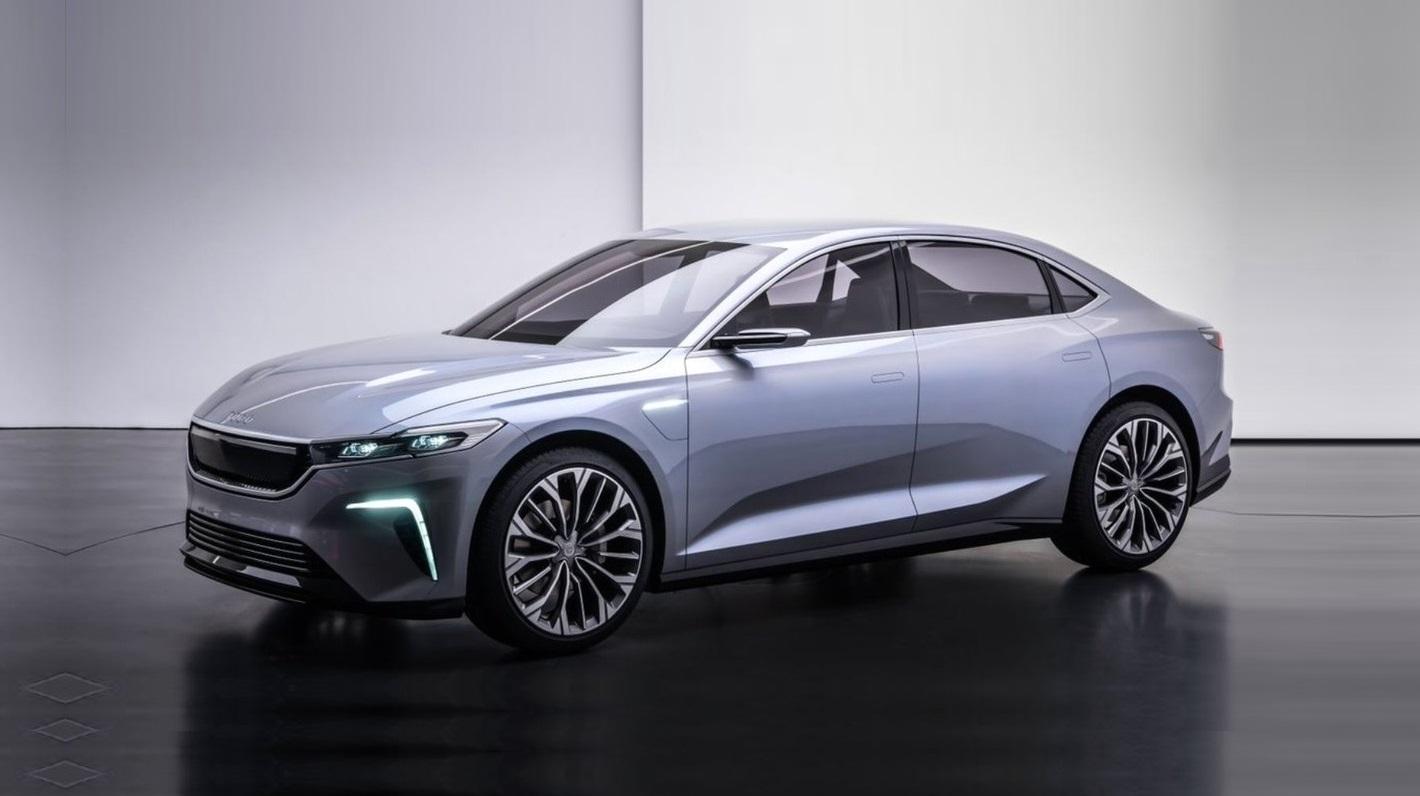

The prototype of Turkey’s first indigenous electric car was unveiled on Dec. 27 with a ceremony held in the northwestern province of Kocaeli’s Gebze district, attended by President Recep Tayyip Erdoğan.

Erdoğan said that the factory to produce the electric vehicle will be built on a 1-million-square-meter land that belongs to the Turkish military in nearby province of Bursa’s Gemlik district.

The first car is expected to be produced in 2022.

In the interview, Zafer Sönmez also said that works to establish a $10 billion petrochemicals complex in the Ceyhan district of the southeastern province of Adana are underway.

He noted that the project was recently made public and said that the process for investment in the land on which the complex will be built and consultations with advisors have already begun.

Sönmez underlined that the main purpose of this investment was to help Turkey reduce its current account deficit.

“A one third of Turkey’s current account stems from petrochemicals imports. It simply means Turkey imports nine out of 10 petrochemical products it uses...We need to create a petrochemicals cluster in Turkey.”

“This is a major investment which the private sector is not likely to carry out by itself alone. At this point, the Wealth Fund acts as an investor and plays the role of a catalyst which draw foreign and domestic capital into this cluster,” Sönmez said.

Launched in 2016, the Wealth Fund aims to develop and increase the value of Turkey’s strategic assets and consequently provide resource for the country’s primary investments.

The fund’s portfolio includes Turkey’s largest companies, such as Petroleum Pipeline Company, Turkish Petroleum, Turkish Airlines, lenders Halkbank, Ziraat Bank, and Borsa Istanbul.