Wall Street girds for Facebook frenzy

NEW YORK - Agence France-Presse

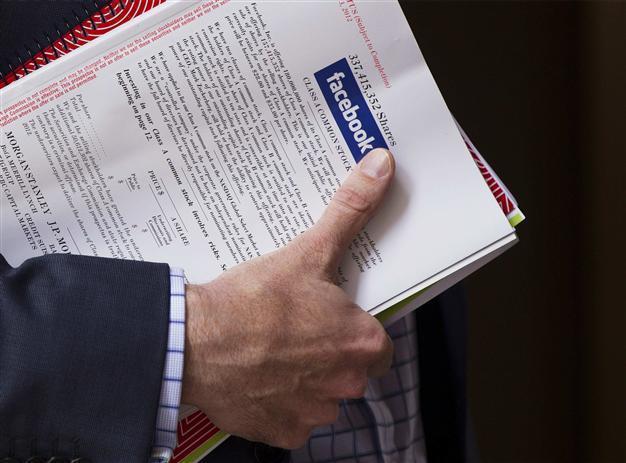

A man stands outside of the St. Regis hotel holding a pamphlet of information on investing in the upcoming IPO of Facebook in New York in this file photo taken May 10, 2012. REUTERS photo

Wall Street and investors around the globe girded for a frenzy for Facebook shares with investors hungry for a piece of share offering expected to be launched on Friday.

In the past few days, Facebook boosted the estimated price for the shares, placing a value on the social network around a whopping $100 billion, and added to the number of shares being offered from insiders.

With a definitive price still not set, Facebook estimated shares to be offered at between $34 to $38 per share, translating to a value of $93-104 billion for the company.

But London bookmakers were anticipating a stampede for shares. At the betting firm Spreadex, clients have been speculating that shares could rise above $56 after their first day.

"Our market on the percentage change in the price of Facebook shares after the first day's trading has seen appetite from clients in buying on the price as the big day approaches, moving the spread up from 30-35 percent earlier in the week to 35-40 percent," Spreadex spokesman Andy MacKenzie said.

Spreadex noted that among other tech IPOs, LinkedIn rose 109 percent the first day while Groupon surged 31 percent. Social game maker Zygna lost ground on its first day.

But MacKenzie noted that "we have had some customers holding back based on their belief that Facebook shares may well fall in value after the furor over the initial launch has died down." Lou Kerner, founder of The Social Internet Fund, said he expects a strong response.

"US institutional demand has been good, the retail and global demand has been overwhelming," he said.

Kerner said the definitive offering price may go up again ahead of the launch, possibly to $40.

"I would expect it to be priced at the top of the range or beyond -- a couple of dollars above the top of the current range wouldn't be surprising," he told AFP.

The excitement about social networks was highlighted separately when Pinterest, a bulletin-board style sharing website, attracted a $100 million investment led by Japanese online giant Rakuten, with existing investors Andreessen Horowitz, Bessemer Venture Partners, and FirstMark Capital, and "a number of angel investors." "The funding will allow Pinterest to continue improving its service and expanding its community globally," a statement said.

Facebook will reportedly go public hacker-style with an all-night software bending bash to culminate at its new California campus with co-founder Mark Zuckerberg remotely ringing the Nasdaq opening bell.

Employees were signing up for a "hackathon" to start late Thursday at Facebook's offices in the Silicon Valley city of Menlo Park and continued until the social network's initial public offering of stock on Friday, according to tech news websites TechCrunch and All Things Digital.

"Hackathons are a big tradition at Facebook," the company explained on a Facebook page devoted to the events.

"They serve as the foundation for some great (and not so great) ideas," the message at facebook.com/hackathon continued.

Under the share plan, Zuckerberg will hold 55.8 percent of the voting power, down slightly from an estimated 57.3 percent. The 28-year-old controls the firm through a dual class stock structure and certain shares that give him a "proxy" for voting.

The net proceeds to the company were estimated at $6.4 billion, the filing with regulators said.

At the midpoint price, the IPO could net some $16 billion for all the sellers at the latest estimate, and at the maximum price more than $18 billion.

Depending on the final value, the IPO would be one of the largest of a US firm on Wall Street, comparable to the 2008 offering of Visa ($17.8 billion) and that of General Motors in 2010 ($15.7 billion).