Unlicensed forex trader’s bankruptcy rings alarm bells

ISTANBUL - Hürriyet

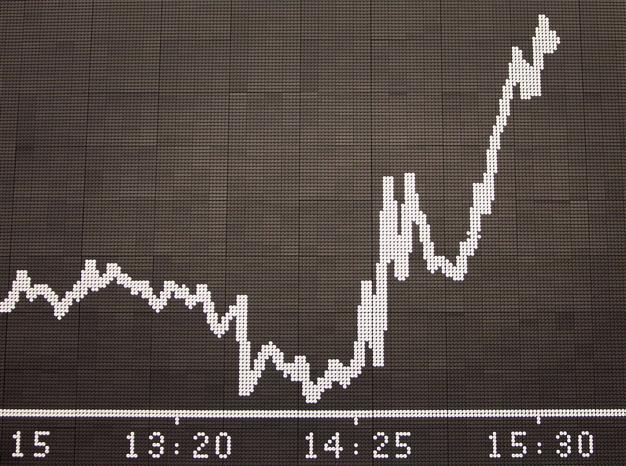

Sector representatives are warning investors against unregistered Forex companies. AFP Photo

The recent bankruptcy of an unlicensed forex trading mediation website in Turkey has once more demonstrated the importance of investing in trustworthy institutions, sector representatives have said.Hedefonline, a Cyprus-based forex mediation firm serving Turkish investors, has gone bankrupt, causing 20 million Turkish Liras in investors’ money to evaporate.

The company, owned by Hüseyin Kırçıltepeli, has been unable to pay investors back since last summer due to financial constraints the firm experienced amid the tumult in the financial markets, according to local media reports.

The mediation institution, which was founded in the Aegean province of İzmir in 2000, had been operating without a license in Cyprus. The company had moved to the island in 2011 after Turkey’s capital markets watchdog, the Capital Markets Board (SPK), filed a criminal complaint against the company.

Investors who have lost money with the site have established a blog called hedefonline-forex.blogspot.com.tr with the aim of expressing their complaints and organizing themselves to take unified action to extract their money.

Sector representative, who spoke to Hürriyet, warned investors against such unregistered companies.

“Even though the forex market is designed for companies to control their risks, with the individual saving owner’s entrance to the sector, it has turned into a speculation area you can earn money in through buy-sell dealers and leverages,” said Arif Ünver, head of the Capital Markets Investors Association.

Underscoring that the forex market was very delicate, Ünver said investors should opt for trustworthy and licensed mediators.

“There are very important issues to pay attention to in the forex market. Firstly, it is not easy to audit as there is not an organized market like Borsa Istanbul,” Ünver said.

“Forex transactions in Turkey used to be carried out under the counter but lately Capital Markets Board has introduced a regulation and handed out licenses to companies. Therefore, owners with savings must check the companies with the SPK to see if it has a permit. The license of employees at these kinds of institutions should be questioned as well,” he said.

In addition to the SPK control, Anıl Alpak, CEO of the forex trading company FXTCR, said Takasbank, the Settlement and Custody Bank of Borsa Istanbul, provided a security system for traders by recording all transactions.

“The usage of customers’ money by intermediary institutions as their own is avoided thanks to the Takasbank process,” he said. “Intermediate institutions are obliged to disclose their daily transactions to Takasbank.”