UK lender complains of calls from claims firms

MANCHESTER - Reuters

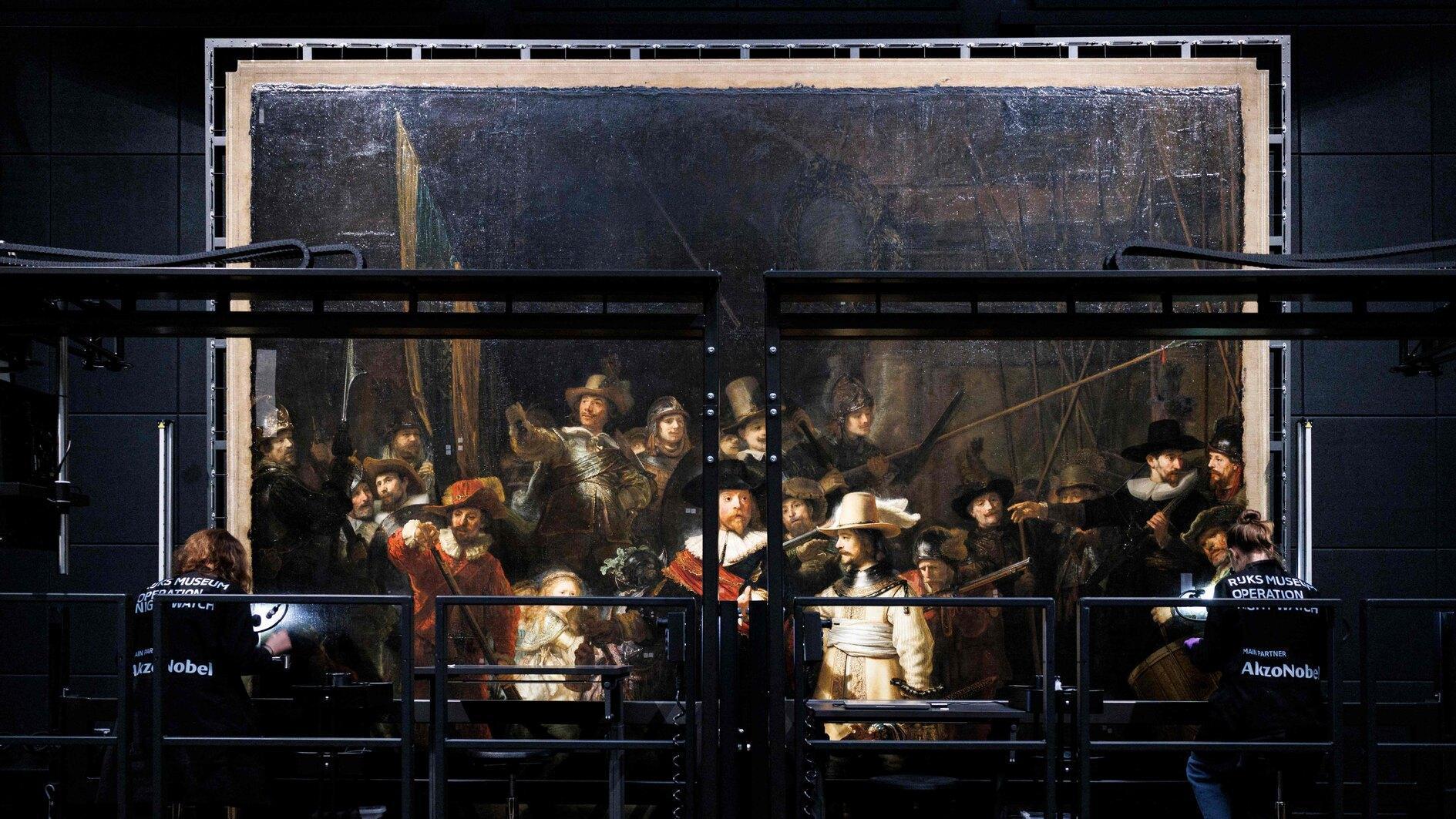

Craig Lowther, founder of Money Boomerang, poses after an interview.

The boss of Britain’s biggest retail bank struck a chord with the public when he complained of getting unsolicited calls from claims management firms promising him compensation from his own and other banks. But while people share his irritation with calls and text messages about fantastic sums from claims they have not made, more and more are turning to claims management firms to help return billions tricked or bullied from them by the banks.Facing a huge backlog of claims from the biggest mis-selling scandal in British banking history, the country’s lenders are beginning to turn to claims firms for help th om firms claiming compensation for unwanted or unsuitable payment protection insurance (PPI) - meant to protect borrowers who lost jobs or became ill - did not even have a PPI with Lloyds. “We have to stop this,” he said. “It’s fraud.”

The tables were turned by figures from the country’s Financial Ombudsman Service showing that Lloyds lost 98 percent of cases referred to the service in the year to March 2012, the worst record of any bank, compared with just 18 percent at Britain’s biggest building society, Nationwide. Now claims firms report a more cooperative atmosphere as the banks, which face a bill likely to far exceed the 12 billion pounds they have already set aside, seek to save costs and restore their battered reputations.

Craig Lowther, founder of claims company Money Boomerang, said it had been approached by several banks looking to speed up the process of dealing with claims and avoid the extra cost of referrals to the Financial Ombudsman Service. “We’re starting to see some lenders approaching us with the idea of working in a smarter way,” Lowther, said in an interview in Manchester, England.