Turkish Lira over-valued, even now: Former minister

ISTANBUL - Anadolu Agency

The lira is still highly appreciated, a former minister, Kemal Derviş, has said.

The Turkish Lira remains over-valued even now from a long-term growth perspective, said Kemal Derviş, a former minister of economic affairs in Turkey and Vice President of the Brookings Institution, during a TÜSİAD meeting at the weekend.“I’m specifically afraid of a highly appreciated Turkish Lira as Turkey needs to export more, but import less. The exchange rate should help them become more competitive in global markets,” Derviş said, during the meeting of the Turkish Industrialists’ and Businessmen’s Association (TÜSİAD). He added that sudden changes in exchange rates were challenging for companies.

Turkey’s exports increase, but the share of imported goods is very high in exports, he said, adding that this made Turkey’s high current account deficit and high growth dilemma more robust.

“Turkey needs to grow by 6 percent on average, but should also keep the current account deficit at a maximum of 6 percent of the GDP to maintain a healthy growth,” Derviş said.

He also addressed the growth hike years of Turkey, but again with a very high current account deficit.

“Turkey should increase its domestic savings, but there is no ‘right’ or ‘magical’ way of doing this. All parts of the financial sector and insurance sector may be restructured to encourage more savings,” he noted.

‘Growth will slow down’

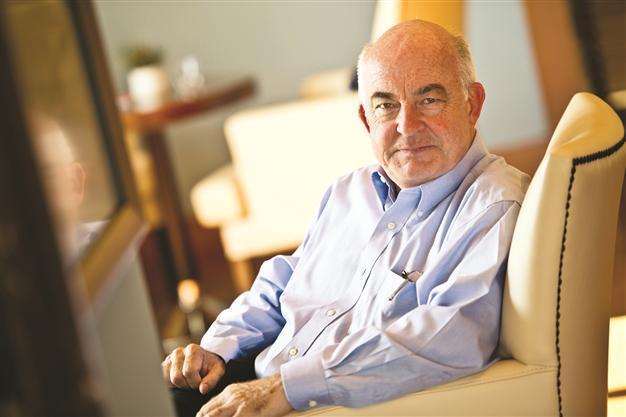

Robert J. Gordon, a well-known macroeconomist from the Northwestern University, addressed the growth dilemma in the world at his presentation during the meeting.

“We haven’t seen any real growth on the basis of income per capita since 2004. The growth rates have slowed down due to a number of elements, including high population, high educational expenses, rising income disparities and increasing debt levels,” he said.

On the basis of productivity growth, the U.S. grows by 1.47 percent, and Turkey by 2.51 percent.

“What is next? We need to keep the high innovation rates of the past gold days, but we won’t be able to do this. This will inevitably slow down economic growth across the world,” he noted.