Turkey's exports unable to catch the dollar’s wave

Mustafa Sönmez - mustafasnmz@hotmail.com

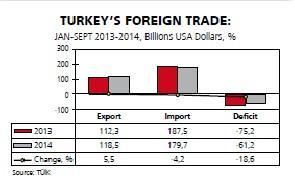

Turkey's export figures only increased 5.5 percent in the first nine months of 2014, to become $118.5 billion. AFP Photo

The U.S. dollar has been gaining value since May 2013 in all developing countries, including Turkey. The dollar, was 1.86 Turkish Liras between January and September 2013 before rising to an average of 2.16 liras, a 16 percent hike. It is normally expected that this would affect both exports and imports. It would have been expected that exporters in Turkey would have made use of this sharp hike in the dollar to increase exports. Likewise, the expensive dollar would be expected to deter imports. Well, what actually happened in the first nine months of the year?

We can see that the dollar did not quite facilitate exports, or not as much as expected, and that the increase was limited. The January-September 2013 exports figures only increased 5.5 percent in the same period in 2014 to become $118.5 billion. It could be said that despite the 16 percent increase in the dollar, the fact that exporters were only able to increase their exports by 5.5 percent is a result of the inertia of the exporter, its muscle relaxation and its bone loss.

The expensiveness of the dollar only decreased imports 4.2 percent. In the first nine months of 2013, imports were $187.5 billion, rolling back just $8 billion. This shows that Turkey’s dependence on imports is not a flexible one while also showing that the dependence of imports has largely solidified.

The result? Turkey’s foreign trade posted a $75 billion deficit in the first nine months of last year. This year, the deficit only decreased to $61 billion, in other words, increasing exports by 5.5 percent and restricting imports around 4 percent have only been able to shrink the deficit by $14 billion. This means narrowing the foreign trade deficit nearly 19 percent. However, because the contribution of tourism and other foreign currency-generating activities was not sufficient to finance the deficit, the foreign currency deficit neared $30 billion in the first eight months of the year.

According to the medium term program (OVP), exports will total $160 billion this year. Imports, on the other hand, will complete the year as $244 billion. This means a foreign trade deficit of $84 billion. This deficit could be lowered to $46 billion with tourism and other foreign currency-generating activities. The OVP expects $810 billion national income this year. If this estimate proves correct, then the planned current account deficit will correspond to 5.7 percent of national income. This figure was a very high one in 2013 at 7.9 percent. Even though it has been possible to create a 2.2-point drop in the current account deficit with a modest growth rate of 3 percent, it still looks as if it will continue to be the most important issue causing Turkey to be categorized as fragile.

Effect of gold

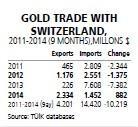

In light of the developments experienced especially in past years, while analyzing Turkey’s foreign trade it has become a must to include the “effect of gold” into the analysis. As a tool for paying, Turkey’s scrap gold exports and imports with Switzerland affect foreign trade data and equilibriums to a significant extent. This has especially been influential in the foreign trade balances in the period between 2011 and 2014.

Because Turkey was not able to pay for the natural gas it imported from Iran with foreign currency due to the embargo, this situation produced the formula of payment with gold. The gold trade with Switzerland, which was also an issue in the Dec. 17 and 25 graft investigations, has affected foreign trade figures. According to Turkish Statistical Institute (TÜİK) data, while Turkey imported gold worth $14.4 billion from Switzerland between 2011 and September 2014, it returned – that is, exported – $4.2 billion in gold, resulting in a foreign trade deficit of $10.2 billion.

In the first nine months of 2014, exports appear to have increased nearly $6 billion compared to the first nine months of 2013. One third of these exports come from reselling gold to Switzerland. When this happens, the increase in exports – when gold is excluded – falls two points to 3.6 percent. Again, in the first nine months of this year, what looks like a fall of $8 billion in imports is related to the decrease in the import of gold from Switzerland.

While gold worth $6 billion was imported from Switzerland in the first nine months of 2013, imports went down to $1.4 billion during the same period. Thus, gold imports decreased $4.5 billion. Consequently, what looks like a total decrease of $8 billion in Turkey’s imports is actually only $3.5 billion when gold is excluded, a decrease of just 1.6 percent.

Therefore, when the effect of gold is taken into account, it can be seen that the appreciation in foreign currency actually has produced much fewer exports, and that it did not decrease imports as expected. In terms of the Turkish economy and foreign trade, all of these are not considered as healthy signs.

Middle East in exports

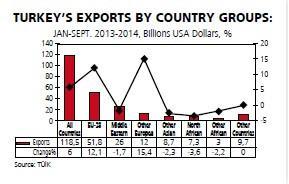

Middle East in exports What kind of a regional panorama do the exports present? Turkish exporters, who were not able to take advantage of the increase in foreign currency, were only able to near $119 billion. What is the situation for EU markets and did the Middle East markets grow?

The regional analysis of exports shows that Turkey’s exports even decreased, let alone increasing its exports to regions dominated by Muslim populations. From the regions in this category, exports to Near East and Middle East was $26.4 billion dollars in the first nine months of 2013; in the same period in 2014, there seems to be a decrease of over $400 million. Turkey’s exports to North Africa have also decreased nearly $300 million to $7.3 billion. Exports to other African and Asian countries have also decreased up to $300 million.

The decrease in exports to these regions is expected to continue in the coming months as well. It is estimated that the wars in the Middle East and the fall in oil prices will continue to affect negatively the exports to these regions.

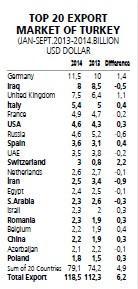

Exports to Iraq, a country that has become Turkey’s second biggest market, fell $500 million in the first nine months to $8 billion; there have been drops also in exports to the United Arab Emirates and Saudi Arabia. Turkey, in this period, seems to have increased its exports to Israel by $300 million.

In North African markets, on the other hand, exports to Egypt have decreased $100 million, and in the Asian markets, exports to Iran decreased almost $1 billion.

European markets There was also an increase in exports to EU and non-EU countries in Europe in the January-September 2014 period. Exports to the 28 members of the EU increased 12 percent when compared to the first nine months of 2013, nearing $52 billion. It is meaningful that at a time when the EU is going through a recession, exports to this market increased 12 percent.

Exports to Germany, which is the biggest market for Turkish exporters, also increased $1.4 billion in nine months to reach $11.5 billion. This is important. Also, exports to the third biggest market, the United Kingdom, also increased $1.1 billion to $7.5 billion. This is also important. Exports to other markets, to Italy, for instance, look like they were limited to $400 million and to France $200 million. It is appropriate to remember the partnership of these two countries in the automotive production chain with their Fiat and Renault companies.

Exports to non-EU European countries generally increased 15 percent to $12 billion. But again, in this region, exports to Russia dropped $600 million. It can be said that Russia’s restriction of imports due to falling energy prices has had an impact in this, as well as the rapid devaluation of the ruble.

The increase in exports to Switzerland in the non-EU European zone is noteworthy. In 2013, these exports were not even $1 billion, but they exceeded $3 billion this year. There is an increase of approximately $2.3 billion in exports.

This increase is related to the scrap gold sent to Switzerland. At a time when the payment of the natural gas imported from Iran was done with gold and a figure such as Reza Zarrab emerged, gold imports from Switzerland went up to $6 billion in 2013. Then there was some kind of a return of this gold in 2014 when this payment style lost its popularity, although there was an increase in gold exports to Switzerland to the tune of $2.3 billion.

The result? Turkey’s foreign trade posted a $75 billion deficit in the first nine months of last year. This year, the deficit only decreased to $61 billion, in other words, increasing exports by 5.5 percent and restricting imports around 4 percent have only been able to shrink the deficit by $14 billion. This means narrowing the foreign trade deficit nearly 19 percent. However, because the contribution of tourism and other foreign currency-generating activities was not sufficient to finance the deficit, the foreign currency deficit neared $30 billion in the first eight months of the year.

The result? Turkey’s foreign trade posted a $75 billion deficit in the first nine months of last year. This year, the deficit only decreased to $61 billion, in other words, increasing exports by 5.5 percent and restricting imports around 4 percent have only been able to shrink the deficit by $14 billion. This means narrowing the foreign trade deficit nearly 19 percent. However, because the contribution of tourism and other foreign currency-generating activities was not sufficient to finance the deficit, the foreign currency deficit neared $30 billion in the first eight months of the year.  According to the medium term program (OVP), exports will total $160 billion this year. Imports, on the other hand, will complete the year as $244 billion. This means a foreign trade deficit of $84 billion. This deficit could be lowered to $46 billion with tourism and other foreign currency-generating activities. The OVP expects $810 billion national income this year. If this estimate proves correct, then the planned current account deficit will correspond to 5.7 percent of national income. This figure was a very high one in 2013 at 7.9 percent. Even though it has been possible to create a 2.2-point drop in the current account deficit with a modest growth rate of 3 percent, it still looks as if it will continue to be the most important issue causing Turkey to be categorized as fragile.

According to the medium term program (OVP), exports will total $160 billion this year. Imports, on the other hand, will complete the year as $244 billion. This means a foreign trade deficit of $84 billion. This deficit could be lowered to $46 billion with tourism and other foreign currency-generating activities. The OVP expects $810 billion national income this year. If this estimate proves correct, then the planned current account deficit will correspond to 5.7 percent of national income. This figure was a very high one in 2013 at 7.9 percent. Even though it has been possible to create a 2.2-point drop in the current account deficit with a modest growth rate of 3 percent, it still looks as if it will continue to be the most important issue causing Turkey to be categorized as fragile.  Because Turkey was not able to pay for the natural gas it imported from Iran with foreign currency due to the embargo, this situation produced the formula of payment with gold. The gold trade with Switzerland, which was also an issue in the Dec. 17 and 25 graft investigations, has affected foreign trade figures. According to Turkish Statistical Institute (TÜİK) data, while Turkey imported gold worth $14.4 billion from Switzerland between 2011 and September 2014, it returned – that is, exported – $4.2 billion in gold, resulting in a foreign trade deficit of $10.2 billion.

Because Turkey was not able to pay for the natural gas it imported from Iran with foreign currency due to the embargo, this situation produced the formula of payment with gold. The gold trade with Switzerland, which was also an issue in the Dec. 17 and 25 graft investigations, has affected foreign trade figures. According to Turkish Statistical Institute (TÜİK) data, while Turkey imported gold worth $14.4 billion from Switzerland between 2011 and September 2014, it returned – that is, exported – $4.2 billion in gold, resulting in a foreign trade deficit of $10.2 billion. Middle East in exports

Middle East in exports