Turkey’s exports get going when growing gets tough

Mustafa Sönmez - mustafasnmz@hotmail.com

Higher dollar/lira ratio and higher interest rates made exports more lucrative for Turkish businessmen in the first quarter, shifting focus of growth to foreign markets.

Before 1980, the Turkish economy concentrated on the domestic market. As in many similar countries, it was trying to develop its “baby industry.” The state grew local industrialists in an incubator fed with low foreign exchange rates, low interest rates and high customs walls. Public corporations, public banks, tax incentives - everything was for the capital owner growing in the domestic market.

However, the life of this model, in which domestic products were consumed domestically, expired toward the end of the 1970s. The reason for this was that the economy was producing for the domestic market and selling there but was buying the machines, input, energy and technology it needed from outside, while not earning the needed necessary foreign for these. Turkish governments constantly tried to bridge the foreign currency gap with loans from the IMF and the World Bank.

At the end of the 1970s, these organizations also said Turkey should expand internationally, integrate with the world economy and transform its economy into one based on industries earning foreign currencies. This was how the Jan. 24, 1980 economic decisions and their political complement - the Sept. 12 coup - arrived. Because it was believed that to expand internationally and to be able to export, cheap labor and an anti-unionist order were necessary, also required was a more authoritarian political structure.

All of these were actually done and delivered, but the Turkish economy was not able to expand internationally as desired after 1980. A foreign currency earning mechanism was not able to be formed. The economy took two steps forward and one step backward and, in the final analysis, it remained an inward-oriented economy. In times when it had to - and especially when the foreign exchange rate increased in value - Turkey became a temporary exporter, but it always went back to the domestic market at the first opportunity.

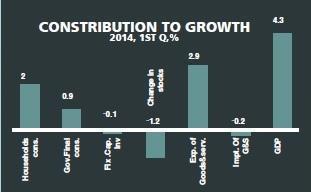

We witnessed the re-staging of this play in the first quarter of 2014. The economy grew 4.3 percent in the first quarter and the motor of this growth was exports.

The annual growth target of 2014 has been determined at 4 percent. Of course, growth of 4.3 percent in the first quarter is a good outcome at first glance. In fact, when considering the ongoing political muddle, it is an outcome that would even please the government. The air was fluctuating with the Dec. 17, Dec. 25 corruption operations. The foreign exchange rate exploded, with the dollar seeing 2.40 Turkish Liras. Upon this, the Central Bank increased repo interest rates 6 points to reach 10 percent. In Turkey, in the first three months - leaving aside the flow of new money - existing money escaped, and hands reached for wallets for the financing of the current account deficit.

Exports stand out as the motor of growth in this period. Out of the 4.3 percent growth, 2.7 percent comes from exports, while the share of domestic consumption is 1.6 percent.

External conditionsOne factor that made exports attractive has been the climb in the foreign exchange rate. In the first quarter of 2013, the U.S. dollar was around 1.80 liras. In the first quarter of 2014, however, it was around 2.20 liras - an increase of 22 percent. The euro was 2.35 liras and jumped to 3.05 liras - an increase of almost 30 percent!

Also, interest rates rose domestically, the consumer started to wait, bank loans were narrowed, discipline was introduced for credit cards, domestic sales shrank. What does a businessman do in this situation? He desperately throws himself into international waters, especially when the foreign exchange rate has made exports so attractive. As a matter of fact, that happened. While exports in the first three months of 2013 amounted to $37 billion, in the first quarter of this year they had gone up to $40.2 billion. The EU market was forced from automotive to textiles, at the cost of cutting prices. As a result, destocking was possible and the wheels were tuned this way or that way.

Domestic consumption remained of secondary importance in terms of contribution to growth. It can be seen that kitchen expenditures in the first quarter stayed at a 2 percent increase, while transportation expenditures almost did not increase. However, with the added influence of election campaigns, significant increases occurred in renewing household goods and clothing, contributing to growth.

Indeed, there is also public expenditure. Because 2014 is an election year, the Justice and Development Party (AKP) government has not decelerated in the purchase of goods, services and public investments. These expenditures have positively affected the growth figure.

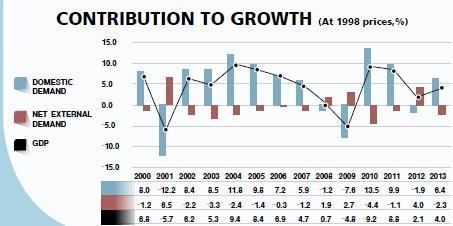

As the example of the first quarter of this year shows, international expansion and growth based on exports can only happen with the force of life. It has been like this for years. For example, if we turn our back on those years when exports were the locomotive of growth, it was always those years when the economy contracted, was in a crisis, and when the domestic market had shrunk.

In these years, when the flow of foreign currency decreased, the foreign exchange rate increased, the domestic demand narrowed and a situation emerged that motivated, or even forced, industrialists to export. Immediately, with price cuts from time to time, the export volume increases and new markets are desperately sought.

But when the flow of foreign currency starts, along with low foreign exchange rates and low interest rates, the domestic housing market, with its automobile and white goods, start to become appealing again and so exports are ignored.

In the 2001 crisis, which is considered to be the biggest in Turkey’s history, an economic shrinkage of nearly 6 percent was experienced. However, it was the performance of exports that kept it from shrinking even further.

From the end of 2002, when the AKP came to power, to 2008, foreign demand did not contribute much to growth. In 2008, however, economic growth was as low as 1 percent, and would have been much lower if not for exports. In 2009, the economy experienced one of its deepest shrinkages. While the economy shrank nearly 5 percent, exports prevented an even worse outcome, contributing 2.7 points.

The following years of growth took their energy always from domestic demand and almost never received any support from foreign demand.

In 2012, while the economy was being cooled, foreign demand gained importance but last year, in the 4 percent growth of 2013, domestic demand was again at the forefront while foreign demand lagged behind.

Now, in 2014, it is observed that foreign demand has become important in the first quarter of the year, but we will have to wait and see what happens next.

Domestic consumption remained of secondary importance in terms of contribution to growth. It can be seen that kitchen expenditures in the first quarter stayed at a 2 percent increase, while transportation expenditures almost did not increase. However, with the added influence of election campaigns, significant increases occurred in renewing household goods and clothing, contributing to growth.

Domestic consumption remained of secondary importance in terms of contribution to growth. It can be seen that kitchen expenditures in the first quarter stayed at a 2 percent increase, while transportation expenditures almost did not increase. However, with the added influence of election campaigns, significant increases occurred in renewing household goods and clothing, contributing to growth.