Turkey bids farewell to $9.6 billion in hot money in 2015

Mustafa Sönmez - mustafasnmz@hotmail.com

There was a net capital inflow into Turkey in just two months of 2015, but capital left the country in the remaining months.

2015 was quite unusual for both Turkey and the world, leaving a series of risks behind for 2016. Amid escalating economic, political and geopolitical risks, around $10 billion in hot money has departed Turkey, the largest amount since the 2009 crisis. The question is whether this huge amount of money will ever come back. Or will we see a further outflow? If so, how much should we expect?

What will be the value of the U.S. dollar against the Turkish Lira in 2016 after rising 24.3 percent in 2015? The crucial factor here will be the amount of foreign capital. Foreign investors will decide upon global and regional risks, which are quite high.

What to expect in 2016

IMF Managing Director Christine Lagarde said 2016 might be “disappointing” for the global economy. She said the prospect of rising interest rates in the United States and an economic slowdown in China were contributing to uncertainty and a higher risk of economic vulnerability worldwide.

According to the chief economics commentator at the Financial Times, Martin Wolf, at least one of the G-20 countries will request an IMF financial assistance program in 2016. Turkey is not in that bad a position. Does he mean Brazil? To him, the number-one candidate among all developed countries is Italy. In the emerging markets league, Argentina, Russia, Brazil and Saudi Arabia may knock on the IMF’s door for help...The realization of such a pessimistic scenario will depend on how the global risks will trigger.

US, eurozone and China

One scenario claims that the rate hike process of the U.S. Federal Reserve (Fed) may slacken with a slowdown in the economic growth and the plunge in the inflation rate below the targeted 2 percent. Any further hike may not follow the first increase in rates. The European Central Bank did this before, as did Sweden, Norway, Australia and Israel. If the Fed makes this move, the global markets will sink into more pessimism with the fear of a new burst at the door.

The eurozone is another risky area as it is exporting recession to the world through its orthodox economic policies. Germany has posted the largest current account surplus at $276 billion, leaving China behind. The Netherlands has also posted around $75 billion in surplus. Europe’s exports may, however, see a dramatic plunge and a new climate of crisis may arise if the Chinese economy shows further slowdown and commodity producing countries witness a further decline in demand. We have already seen the alarm bells ringing for the Italian banking system.

The fluctuations in Chinese markets have already affected all global markets. The yuan was devaluated by 1.4 percent against the dollar. Even such a small revision caused harsh fluctuations across the world. Chinese markets may face a sharp sale wave amid an excessive rise in property supply and the resulting balloon effect on property prices in 2016.

The IMF has warned of a slowdown in global investment trends in its April 2015 Economic Outlook Report. Instead of making investments, companies prefer to buy their own stocks, distributing high amounts of dividends and acquiring new companies. “The centralization of the capital,” namely of the monopolies, has created new problems in the world economy. Some $4.6 trillion worth of mergers and acquisitions were seen in 2015. Two chemical giants, Du Pont and Dow, recently merged with each other in a $130 billion deal. These deals will also result in mass layoffs, cuts in production volumes and asset sales. 2016 may be a year during which several balloons are inflated and even blown up.

Emerging currencies

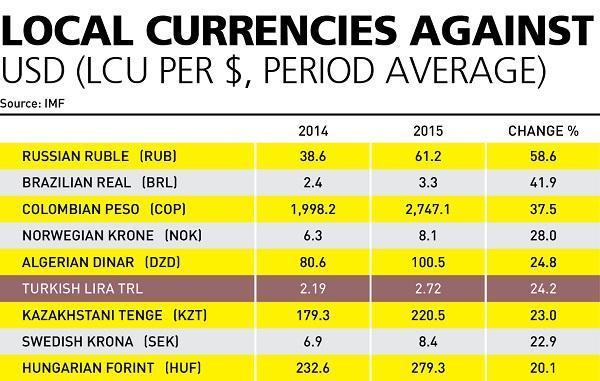

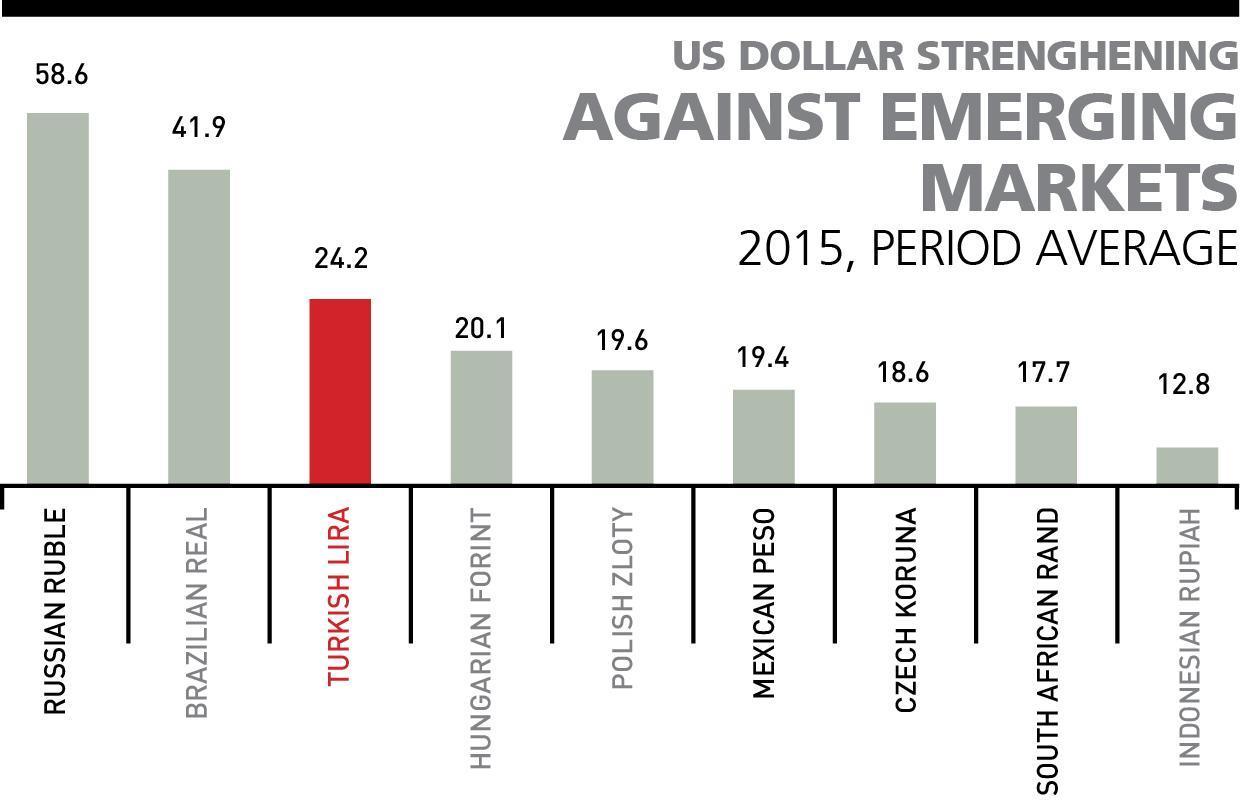

The Fed’s rate hike signal has mobilized global capital that had temporarily been parked in emerging markets since May 2013. These markets have started to see huge capital outflows since then. This accelerated the rise in the dollar’s value against local currencies in 2014 and 2015. Local currencies have lost value against the greenback from anywhere between 10 to 40 percent in 2015 compared to 2014.

According to data from the IMF, despite a partial recovery, the Russian ruble has fallen dramatically. While one dollar was an average of 38.8 rubles in 2014, this figure rose to 61.2 rubles in 2015. The dollar witnessed a roughly 59 percent rise against the ruble in 2015 compared to 2014. From a different perspective, the ruble lost around 37 percent against the greenback in this period of time.

The Brazilian real also lost over 27 percent against the dollar in 2015 compared to the previous year.

Among all emerging currencies, the Turkish Lira was the third worst performer, as the dollar gained over 24 percent against the Turkish currency in 2015 compared to 2014. This rate was just 15 percent in 2014.

The dollar’s value also hiked around 20 percent against the currencies of Hungary, Poland and Czech Republic.

The private sector’s debt stocks in emerging markets rose from $4 trillion in 2015 to $18 trillion in 2015. These debts have now become heavier amid sharp losses in local currencies against the greenback. Brazil’s Petrobras, Mexico’s Pemex and Russia’s Gazprom have become severely indebted to the global bond markets as the oil plunge and the currency fluctuations have seriously hit these companies’ financials. The bankruptcy of such big companies may send the global markets into a freefall. It should also be kept in mind that shale oil and shale gas companies are also highly indebted, creating another risk factor across the globe.

Turkey’s dollar challenge

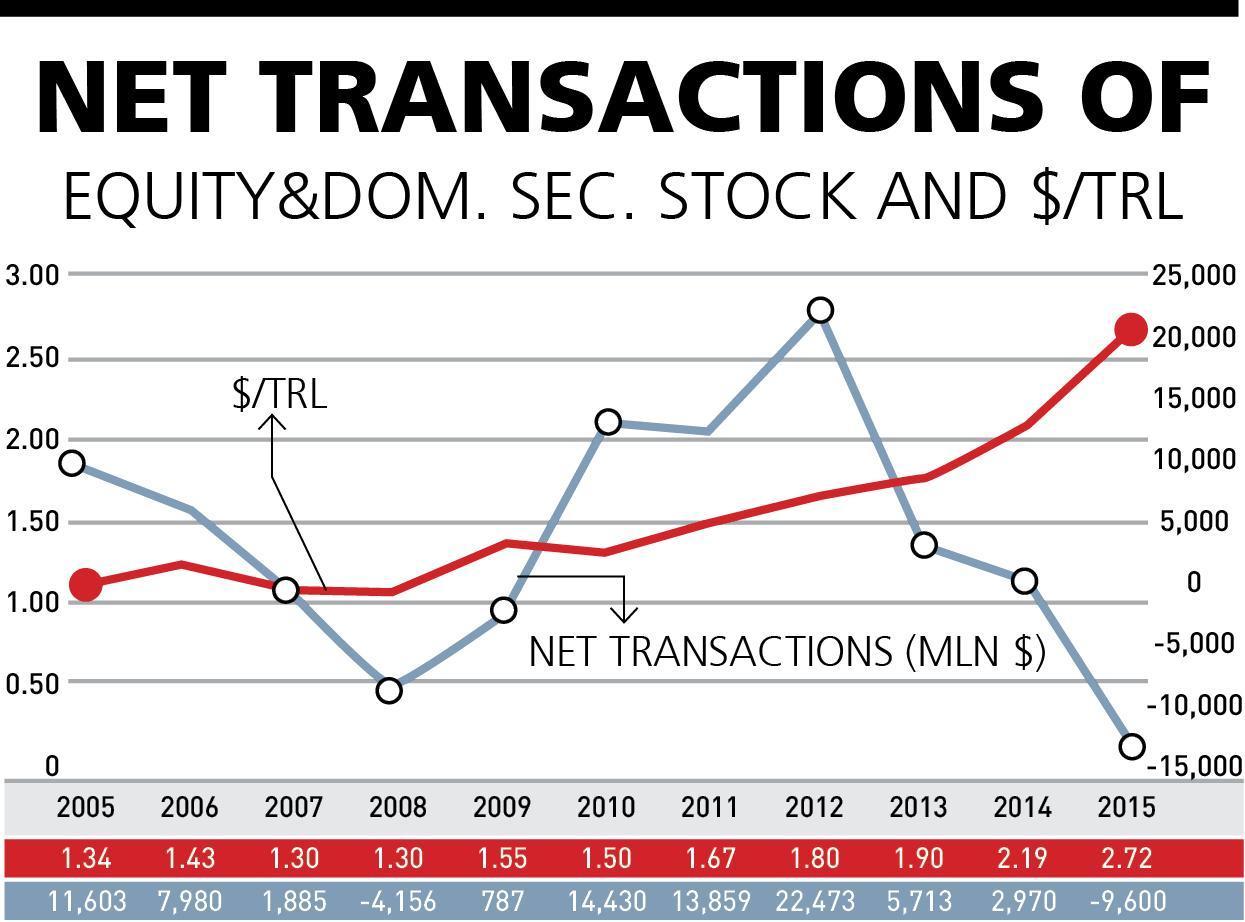

The dollar-lira parity witnessed sharp moves in 2015 as the greenback’s value rose around 24.3 percent against the lira, a first since the 2001 banking crisis in Turkey.

The lira lost over 19 percent against the dollar in 2015 compared to 2014. The outflow of foreign capital played a crucial role in these dramatic moves. When more foreign capital flows into Turkey, dollar-lira parity decreases more, making the dollar cheaper against the Turkish currency. The higher the level of foreign capital outflow, the more expensive the dollar becomes against the lira. This happened in 2015 and around $9.6 billion in hot money left the country. Such a huge outflow has not been the case for years. Even in 2008, only $4.2 billion in capital left Turkey.

There was a net capital inflow into Turkey in just two months of 2015, but capital left the country in the remaining months. February saw the highest outflow at around $1.6 billion, followed by December at $1.5 billion and November at $1.4 billion in 2015.

It was quite remarkable to see high amounts of capital outflows in the last two months of the year despite a relative decrease in political uncertainties after the Nov. 1, 2015, elections. We can say that the election results barely decreased the risk perceptions, while escalating geopolitical risks fueled concerns.

Foreign investors had $41 billion in stocks and $32 billion in state bonds at the beginning of 2016. If the concerns about a further hike in the dollar’s value increase due to new negative developments, we could see more capital outflows.

If foreign investors have 100,000 liras of assets in hand but are worried by the possibility that the lira could fall to 3.5 against the dollar, they will prefer to exit Turkey as soon as possible as their assets would be worth less than $30,000 abroad, rather than around $33,000 at today’s rates.

Risks still exist

Turkey’s risks are unfortunately not decreasing. We are especially seeing geopolitical risks on the rise. While Russian sanctions against Turkey have negatively affected almost all sectors, we still don’t know whether the punishing sanctions will end on that front.

In addition, the possibility of increasing tensions between Saudi Arabia and Iran constitutes another huge risk over investments in addition to several domestic risks, including the conflicts in Turkey’s eastern regions and discussions over the presidential system.

The rising trend in the 8.8 percent inflation rate, which is 3.5 percent higher than the target, and the decreasing trend in Turkey’s exports have also fueled pessimism that could even negatively affect rating agencies’ decisions about the country.

If all these factors accelerate the capital outflow, the dollar will gain more value against the lira, creating huge damages to the economy, especially for the most vulnerable actors, who are highly indebted in foreign currencies.