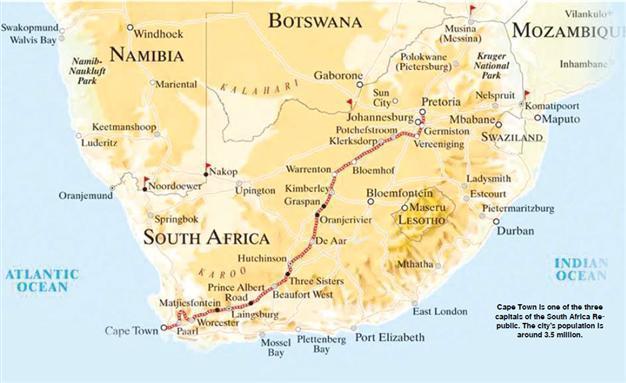

Cape Town is one of the three capitals of the South Africa Republic. The city’s population is around 3.5 million.

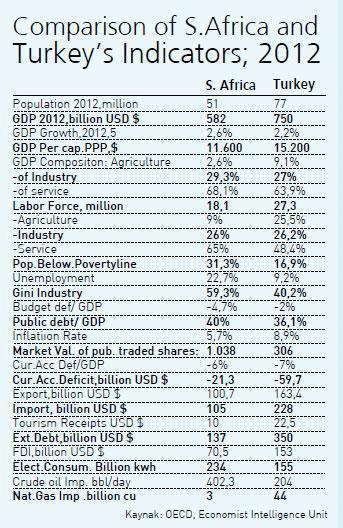

When you are reading this article, its author will be in Cape Town on the 5th day of his South Africa visit. Cape Town is one of the three capitals of the South Africa Republic, as you know. The city’s population is around 3.5 million. It’s a beautiful global city, where African, Dutch and English cultures are harmonized very well at the most distant end of the African continent to Europe. South Africa is the most developed country in the continent with a national income of around $600 billion and a population of 51 million. Its income per capita is a bit lower than Turkey’s, around four-fifths. The income per capita was announced at $11,500 in 2012 in South Africa. The agricultural sector is not very flourishing in the arid South African land. Only 9 percent of the population cultivates land, and the share of the sector does not constitute more than 3 percent of national income. The principal source of income is mining-oriented industries and the services sector.

South Africa is the most developed country in the continent with a national income of around $600 billion and a population of 51 million. Its income per capita is a bit lower than Turkey’s, around four-fifths. The income per capita was announced at $11,500 in 2012 in South Africa. The agricultural sector is not very flourishing in the arid South African land. Only 9 percent of the population cultivates land, and the share of the sector does not constitute more than 3 percent of national income. The principal source of income is mining-oriented industries and the services sector. South Africa is the world’s leader in precious metals and mines and mine processing. It has 80 percent of manganese resources in the world, 68 percent of chrome, 56 percent of metals in platinum group and 35 percent of gold reserves. South Africa is the largest platinum and chrome producer and the second largest gold producer in the world. Despite its gold exports, which made 50 percent of the world’s total exports in the 1980s, fell today, it has still importance.

Even though the mines in South Africa have the world’s most advanced and profound mining technology, their productivity is falling and strikes often take place. The gold amount in one ton decreased from 4.6 grams in 1999 to 4.5 grams in 2000, data show. So, some big mining companies shut down and the sector relatively shrank. Now, the metals in the platinum group make up the major part of exports, surpassing gold exports. South Africa is home to the fifth largest diamond industry in the world, as local De Beers is the largest diamond producer and controls the world’s diamond supply and distribution from its headquarters in London. Anglo Gold, Implats and Iscor are the other big mining companies. Mines have an important place in the country in terms of raising employment and providing foreign exchange input. The mining sector made a 10 percent contribution to the country’s added value in 2009 and created employment for 1 million persons.

The tourism sector in South Africa started to develop along with the period of change in the 1990s. South Africa has many advantages in tourism because it has a convenient climate, natural beaches, mountains, natural parks, wild animals and many common languages are spoken such as English. Also, tourist numbers increased in South Africa due to the decline in tourist numbers in the Arab countries that have been experiencing uprisings since 2011.

While South Africa aims to reach an annual growth rate of 6 percent by 2014, tourism is one of the focused sectors in framework of the Accelerated and Shared Growth Initiative for South Africa (AsgiSA). Around 10 million tourists visit South Africa a year and its annual tourism income is nearly $10 billion. The tourism sector makes around 8 percent of national income.