Top bosses paint a gray picture for the economy

Mustafa Sönmez - mustafasnmz@hotmail.com

The Turkish Industry and Business Association (TÜSİAD) has been the leading interlocutor of global economic players, although the association has lost some power during the Justice and Development Party (AKP) term. TÜSİAD is less powerful vis-à-vis governments, but at the end of the day, TÜSİAD is the umbrella association for Turkey’s largest businesses. The association’s economic diagnoses are therefore significant, especially for foreign businesses which make investments in Turkey.

What does TÜSİAD think about the recent economic picture? The association has expressed its opinions in a report, the “Turkish Economy and World Economy at the Onset of 2016,” which was released last week.

The report has been much more objective, more reflective and more aware of the current risks in comparison to the official reports.

Desperation in the world…

“Almost seven years have passed since the beginning of the global economic crisis, but the world economy is still far from overcoming the effects of the crisis. We couldn’t do this as maybe we have not figured out what is really happening or we are unable to fix the problem if we know,” said the report.

Many central banks have injected huge amounts of money into the markets for the last seven years, creating liquidity. However, people have not spent enough, and companies have not used this money for loans either. Under normal conditions, such high liquidity was supposed to enliven consumer demand and hike prices. We have, however, not seen any rise in the inflation rate in any developed economies. The plunge in oil and other commodities has also lowered prices further. Monetary policies are not working, falling short of occasioning a recovery in demand.

The TÜSİAD report has summarized why the quantitative easing policies have still been used, although they have not worked for one reason: desperation. “Why are the quantitative easing (QE) policies still in use and even is there a tendency for negative rates despite all of the problems that are created by such policies? This is because of desperation, we believe,” said the report.

TÜSİAD has agreed with several suggestions that say low growth rates will be unavoidable in the world economy in the next two years. “The world economy is like a patient who is connected to a respiration unit. Both the International Monetary Fund (IMF) and the World Bank have estimated that the world economy will see lower growth rates in the next two years,” said the organization.

Emerging markets

TÜSİAD is not optimistic about “emerging markets,” including Turkey. The association has underlined that developing markets, which posted skyrocketing growth rates thanks to cheaper financing, imported from developed countries in the post-crisis period, are not doing good now.

“The growth rates of developing economies, which saw huge capital outflows last year, has now been cut almost in half. There are many developing countries which have now been caught by a cycle of higher private sector debt and lower consumer demand, particularly China. India may be the only emerging country which can keep its growth rate higher. It should be remembered that the oil plunge has dragged the oil exporters into recession, particularly Russia,” said the report.

The TÜSİAD report has drawn attention to the high risks for these countries due to decreasing exports and an increasing debt burden. Despite a significant devaluation in their local currencies, these countries’ exports are decreasing and their debts are rising dramatically.

“There is no safe haven in the world now. The weakening in the real sector investments should not surprise any of us in this environment,” said the report.

What about Turkey?

The report noted that the geopolitical risks have created a dramatic effect on the Turkish economy in addition to the global economic uncertainties and the slump in global demand.

“With Russia’s active involvement in the Syrian war, Turkey has started to experience tensions with one of its largest trade partners. While Turkey has already suffered problems in its trade with the Middle East, the country has now hit be Russian sanctions. Furthermore, Turkey also hosts around 2.5 million refugees,” noted the report.

Despite these negative developments, the Turkish economy is expected to close 2015 with around 4 percent growth, said the report, adding that the growth was mainly on the rise in domestic demand, but the increase in investments is limited and the exports have made a negative contribution to GDP growth.

TÜSİAD has also underlined the lower growth tendency since 2011, and the growth is mainly based on the rise in domestic demand and public expenses rather than exports.

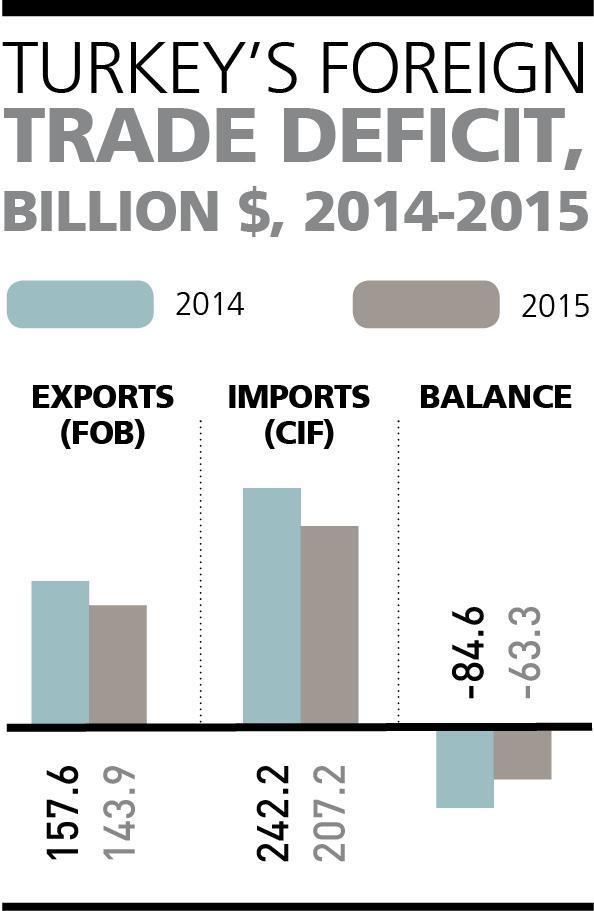

“How long can this trend be sustained? The first things that come to mind are a hike in debt levels and the current account gap. We all know that the higher growth levels have a triggering effect on the country’s current account deficit. 2015 brought about an opportunity in this area as the oil plunge enabled the current account gap to decline thanks to decreasing energy costs. The drop in the exports, however, constrained this positive effect,” said the report.

Consumption and banking

The energy slump and the loss in the euro’s value against the dollar by around 18 percent stimulated the domestic demand in several sectors, mainly in automotive and home appliances, especially in the first half of 2015. Noting this fact, the TÜSİAD report has said the domestic demand was later negatively affected by the uncertainties after the June elections as well as the loss in the Turkish Lira’s value, adding that some recovery was seen both in loans and consumer confidence following the November 2015 polls, but this positive trend has lagged behind the pre-June levels. Why? “Here, we can consider the escalating terror attacks and the rising tensions in the Syria issue. We estimate that the negatively affected regions and sectors from these developments, mainly exports and the tourism sector, will face further problems in 2016,” said the report.

TÜSİAD has directly mentioned an issue which is generally untouched by official authorities: banking risks. “The rise in the hurdles experienced by European banks and by American energy companies has the potential to create negativities over the banking sector. Although the contraction in loan growth is good in terms of financial stability at first glance, some decrease in loan returns and recent weakening in demand may cause the banking sector to spend a difficult year,” said the report.

These warnings are of great importance.

Inflation problem

The world has now been under deflationist rather than inflationist pressure. The inflation rate is lower than 2 percent in many developed countries. In Turkey, the inflation rate has been around 8 percent annually for the last six years, much higher than the average of the developing countries, which is at around 3-4 percent. Besides, Turkey has seen these high rates when its budget deficit and public debt are decreasing.

According to TÜSİAD, the biggest reason why the inflation rate has been higher than the Central Bank’s 5 percent target is the inability of the bank to implement policies to reach this target. TÜSİAD also agrees that some structural problems in the agriculture sector have played a big role in hiking food prices.

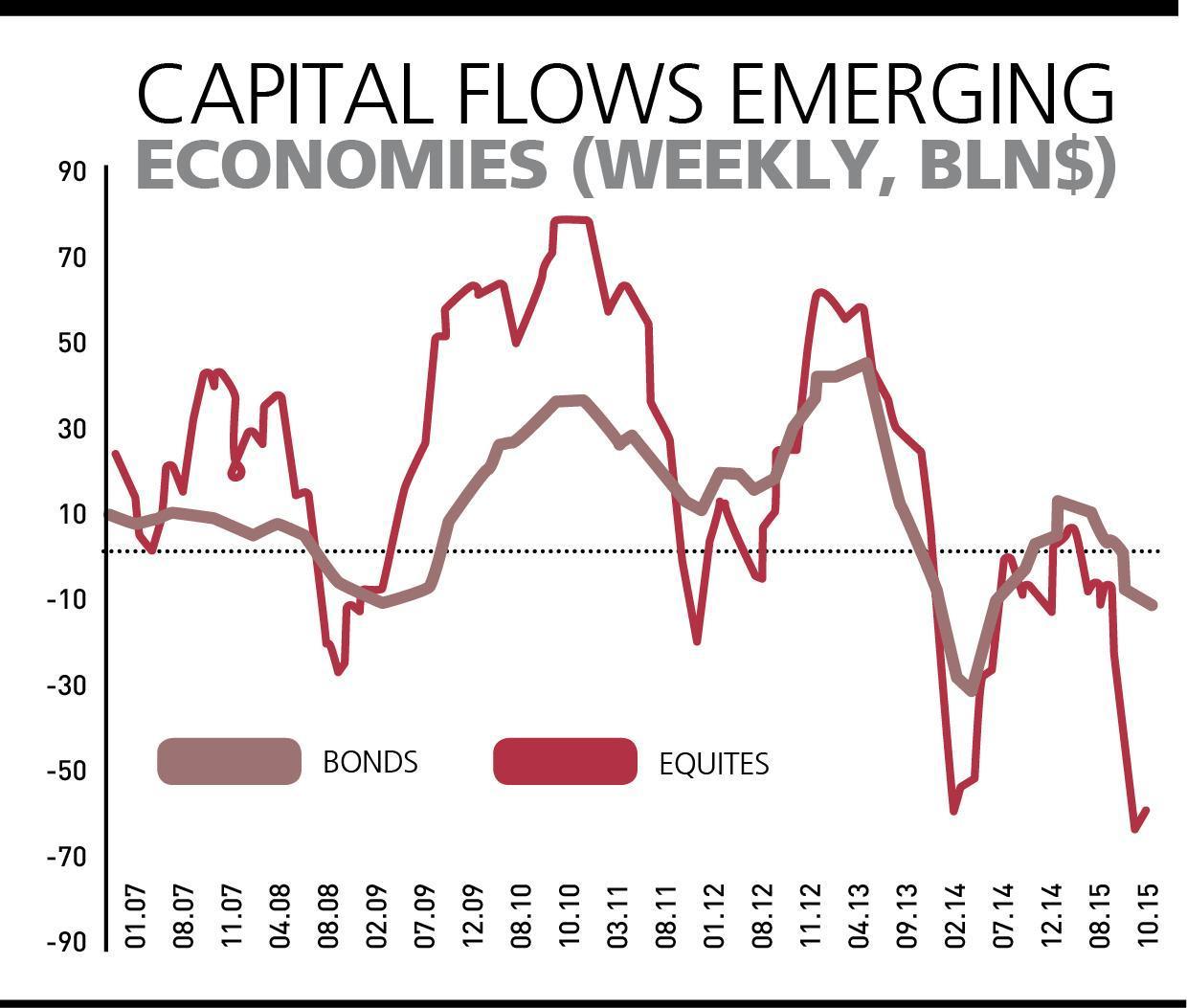

TÜSİAD has directed attention to the capital outflows which started after 2013, especially criticizing the inaction of the Central Bank against mainly dramatic outflows in 2015. “Capital outflows accelerated in 2015. Around $735 billion in capital left developing countries. We saw that around $15 billion of capital flowed out of Turkey’s bond and stock exchange markets. At the same time, the lira lost around 25 percent in value against the dollar. Despite this reverse move in capital and the normalization of the monetary policy of the U.S. Federal Reserve (Fed) through rate hikes, the Central Bank did not make any big change in its policy,” said the report.

Pointing out inflationist risks in 2016, TÜSİAD has said the 30 percent rise in the minimum wage will create further pressure over prices by raising direct costs and domestic demand.

The report also noted that the food inflation rate cannot be decreased in the short term through the existing policies, adding that the monetary policy would be crucial here.

Potential losses from the deteriorating ties with Russia are also underlined in the report. A decrease of around 0.3 percent is expected in the growth rate if all tourism and export revenue from the markets fade away and the losses are recovered through alternative markets.

TÜSİAD’s estimates

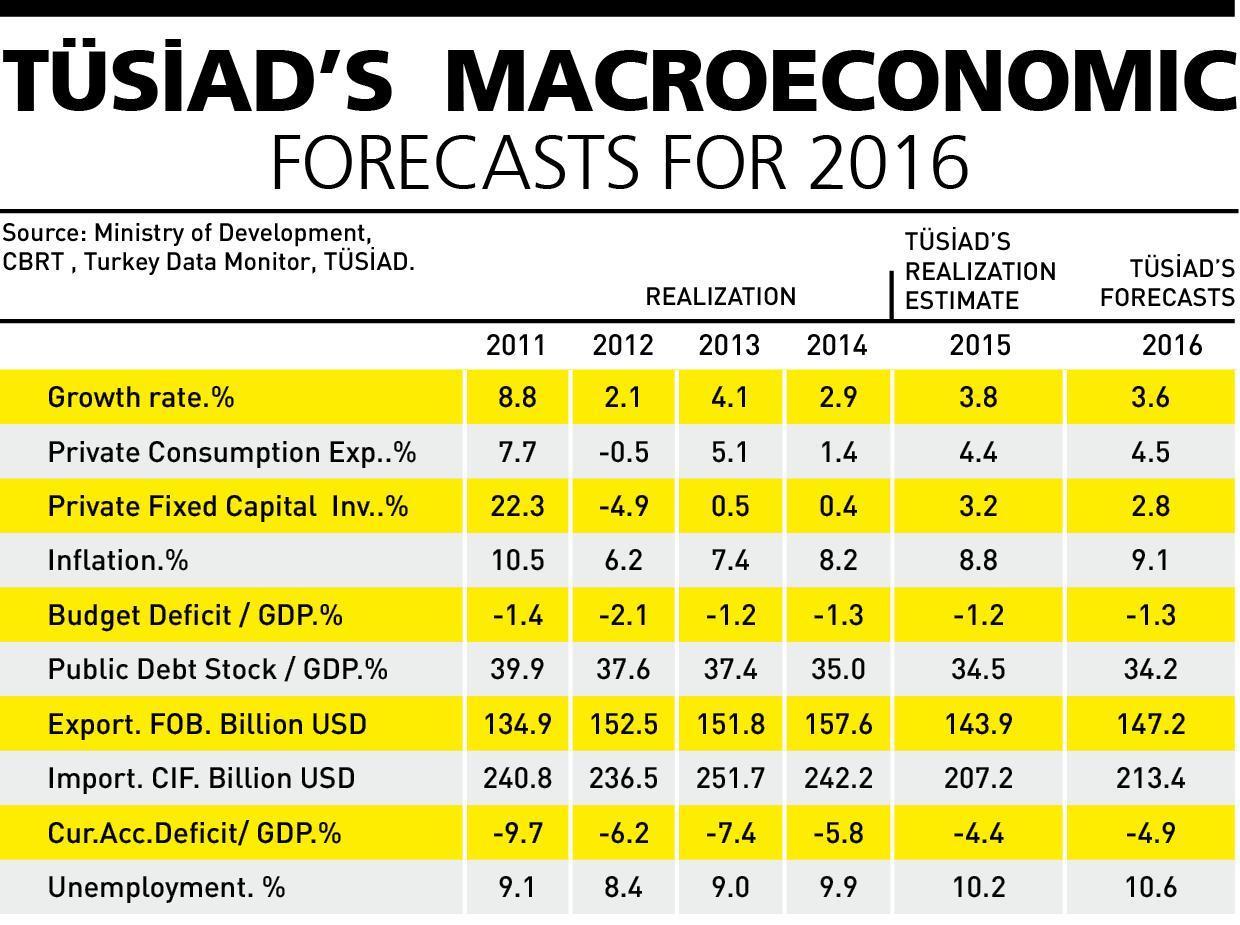

TÜSİAD has projected that the 2015 growth rate will be around 3.8 percent, to be followed by 3.6 percent in 2016. Forecasting that the inflation rate will increase to 9.1 percent in 2016, TÜSİAD has also estimated that the current account deficit will increase to around 5 percent of national income. According to the association, the unemployment rate will rise to 10.6 percent, but private sector investments will increase by only around 2.8 percent.

In sum, the top bosses have faced the fact that the global economy and the Turkish economy are not giving good signals. TÜSİAD has considered the risk of coming double-digit inflation rates, lack of investment, problems in the banking sector, deceleration in capital inflows and potential losses due to geopolitical tensions.

The Turkish Industry and Business Association (TÜSİAD) has been the leading interlocutor of global economic players, although the association has lost some power during the Justice and Development Party (AKP) term. TÜSİAD is less powerful vis-à-vis governments, but at the end of the day, TÜSİAD is the umbrella association for Turkey’s largest businesses. The association’s economic diagnoses are therefore significant, especially for foreign businesses which make investments in Turkey.

The Turkish Industry and Business Association (TÜSİAD) has been the leading interlocutor of global economic players, although the association has lost some power during the Justice and Development Party (AKP) term. TÜSİAD is less powerful vis-à-vis governments, but at the end of the day, TÜSİAD is the umbrella association for Turkey’s largest businesses. The association’s economic diagnoses are therefore significant, especially for foreign businesses which make investments in Turkey.

“With Russia’s active involvement in the Syrian war, Turkey has started to experience tensions with one of its largest trade partners. While Turkey has already suffered problems in its trade with the Middle East, the country has now hit be Russian sanctions. Furthermore, Turkey also hosts around 2.5 million refugees,” noted the report.

“With Russia’s active involvement in the Syrian war, Turkey has started to experience tensions with one of its largest trade partners. While Turkey has already suffered problems in its trade with the Middle East, the country has now hit be Russian sanctions. Furthermore, Turkey also hosts around 2.5 million refugees,” noted the report.