The bill of the rise in the dollar exchange rate will be double digit inflation

Mustafa SÖNMEZ - mustafasnmz@hotmail.com

The increase in consumer and producer prices in January, which reached 1.98 and 3.3 percent respectively, is regarded as the signal of sharp price rises in the coming months, with the foreign exchange rate fluctuations set to continue. DHA photo

The January inflation rate has even exceeded the Central Bank’s expectation survey and hit 1.72 percent. Thus, the 12-month consumer price hikes reached 7.5 percent.The inflation rate that opened the year with 1.72 percent in the month of January looks as if it will cancel even the revised target of the Central Bank of annual 6.6 percent.

In January, the biggest hike in prices occurred in food and beverages, with a 5.2 percent increase. In clothing, on the other hand, instead of a price hike, a fall has been experienced. The inadequacy in the supply of food and a dry winter are signaling a fire in the kitchens in coming months. The cost increasing effects that the duo of high exchange rates and high interest rates will play the leading role in the coming months’ inflation.

The reflection of cost increases in prices may accelerate as of February and we may meet higher inflation in the coming months.

Double digits

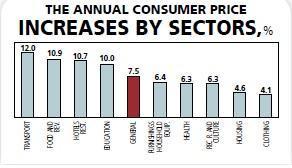

With the 11.7 percent price hike in January, the 12-month inflation has exceeded 7.5 percent. Nevertheless, the annual inflation rate has already reached double digits in certain basic goods and services. While in transportation, the annual hike has been 12 percent, annual increases in food have neared 11 percent. Besides, the annual price increases in restaurant and hotel prices, as well as education, have exceeded 10 percent.

On the other hand, the increase in producers’ prices in January, which reached 3.3 percent, is regarded as the signal of sharp price rises in the coming months. The increase in producer prices was the biggest contributor to the annual producer prices, which are nearing 11 percent. This one has constituted the highest monthly increase since the 4.5 percent in April 2008.

On the other hand, the increase in producers’ prices in January, which reached 3.3 percent, is regarded as the signal of sharp price rises in the coming months. The increase in producer prices was the biggest contributor to the annual producer prices, which are nearing 11 percent. This one has constituted the highest monthly increase since the 4.5 percent in April 2008. When viewed by sectors, the highest annual increase in producer prices has occurred in capital goods and intermediate goods. It has been reported that the accelerated foreign exchange rate increases after May 2013 have been effective in these two sectors, which are primarily based on imports.

While the annual increase in capital goods made up of machinery and equipment imports is nearing 15 percent, the increase in intermediate goods has reached 12.3 percent. The 10.4 percent increase in nondurable consumer goods can be expected to be reflected on consumer goods in the coming months. In durable consumer goods, on the other hand, the fact that the increase in producer prices remained at 6 percent is being associated with shrinking demand. However, in energy, where the annual increase in producer prices was the lowest with 1.5 percent, price hikes are at the door. In March, a heavy natural gas price increase looks inevitable, as well as a high price hike in the electricity produced from natural gas.

Dollar and inflation

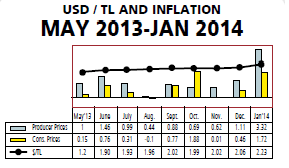

With the U.S. Federal Reserve tightening money, the foreign funds that have started exiting from or slowing down the inflow to countries like Turkey have caused falls in local currencies and the Turkish Lira. The political crisis that erupted after the Dec. 17 corruption operations has accelerated the loss of value of the lira as an additional factor. The loss in the lira reached 23 percent in the May 2013 and January 2014 period and the exchange rate of the lira-to-dollar jumped from 1.82 to 2.23.

It is seen that this leap in the dollar exchange rate is causing cost inflation through imports, and is thus pushing producer and consumer inflation upward.

The hike in the dollar exchange rate has caused significant rises in producer prices, especially capital goods and intermediate goods. Its effect on durable and nondurable consumer goods has been extended in time.

The hike in the dollar exchange rate has caused significant rises in producer prices, especially capital goods and intermediate goods. Its effect on durable and nondurable consumer goods has been extended in time. While the hike in the dollar exchange rate has reached 23 percent since it started climbing in May 2013 to January 2014, the rise in producer prices has been 9.6 percent. However, producer prices of intermediate goods based on imports increased 11.4 percent, capital goods made up of machinery and equipment increased nearly 11 percent. During the same period, energy prices over crude oil increased 10 percent. On the other hand, the rise in durable and nondurable consumer goods has been around 7.7 percent.

Consumer prices

Because the rise in producer prices to reflect on retail prices takes a while, an important portion of the increase in CPI has spread to coming months.

The increase in CPI between May 2013 and January 2014 has reached 6 percent. After the sharp hike in the dollar exchange rate and its reflection on producer prices, it is expected that its transfer to consumer prices will occur in the coming months.

At the beginning of the price hikes that have not yet been reflected on retail prices, comes the natural gas price hike that was postponed to March. Since electricity production is done predominantly with natural gas, this hike is expected to reflect in electric prices, and with a chain reaction, primarily transportation, home and office heating, and to all sectors using energy.

Also, with the effect of a dry winter season, food prices which increased only 5 percent in January are expected to rise significantly in the coming months, thus increasing the rise in the CPI to double digits in a short time.