Spain’s bond yield rises above critical 6 percent

PARIS - Anatolia News Agency

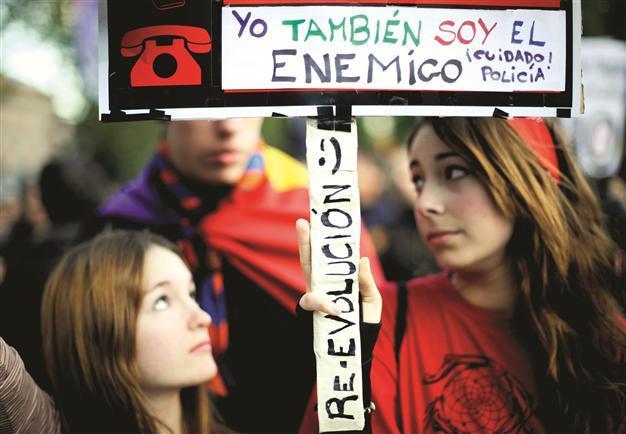

A woman holds a sign reading ‘I also am the enemy’ as protesters attended a rally against financial cuts in health and education in Madrid on April 15. AFP photo

The interest rate which Spain has to pay to borrow rose above 6 percent in early trading on the eurozone bond market yesterday.The yield on Spanish 10-year debt bonds rose to 6.094 percent from 5.960 percent at the close of trading on April 13. The rise in the rate indicated by yields on existing bonds reflects deep concern among investors about the ability of Spain to reduce its annual public deficit.

This has re-ignited tensions in the eurozone bond market, just days before a French presidential election in which the role of the bond market is a central issue.

A borrowing rate of more than 6.0 percent is widely considered to be close to a level that is unsustainable for a country such as Spain, as was the case for Greece, Ireland and Portugal which had to be rescued by the European Union and International Monetary Fund.

Spain is scheduled to issue bonds on Thursday to borrow money to help cover shortfalls in its public finances.

Such bonds are issued for a fixed period up to the date for repayment of the amount borrowed, and at a fixed interest rate which must be competitive with market conditions at the time of issue.

During the life of the bonds, the instruments may be traded, but if the risk attached to them is perceived to have risen, they become less attractive, the price falls, and the fixed interest as a percentage of the new price rises, or vice versa.