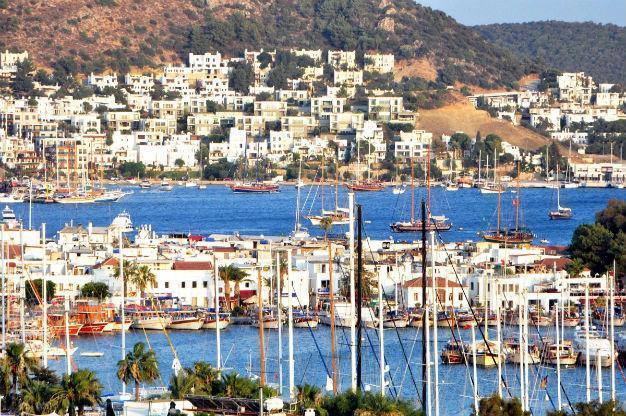

Security fears hit Thomas Cook as tourists choose Spain over Turkey

LONDON - Reuters

DHA photo

Thomas Cook said its summer bookings fell as security concerns meant more holidaymakers opted for breaks in Spain over Turkey, Tunisia and Egypt, outstripping its efforts to adjust flights.

Despite shifting 1.2 million airline seats from the eastern to the western Mediterranean, the British travel operator said bookings were down by 5 percent and full-year profit would now be at the bottom end of market forecasts.

Thomas Cook shares dropped 19 percent to a three-year low of 72 pence after its first-half results, on a day travel stocks fell after the disappearance of an EgyptAir flight.

Chief Executive Peter Fankhauser said Turkey, its second most popular destination last year, had not recovered as he had hoped after an attack on tourists in Istanbul in January.

“This has had a particular impact on our German airlines business, which is the market leader into Turkey.”

The last update from Thomas Cook in March, which sent its shares to a previous three-year low, came on the same day as explosions in Brussels. Fankhauser said holiday bookings in Belgium had come “to a standstill” as a result.

Sudden turn to Turkey ‘may be case’

Thomas Cook shifted airline seats from Turkey, Tunisia and Egypt to the Canaries, Balearics and mainland Spain where it had found extra hotel rooms, but it was not enough to compensate.

Holidaymakers could turn to Turkey at the last minute, Fankhauser said. “There is no late market in Spain, because Spain is filling up extremely fast, and then there may be a shift back into Turkey,” he said.

Thomas Cook’s rival TUI said earlier this month its bookings were up 1 percent, with demand strong.

“We are suffering a bit more (than rivals) because we are much bigger (in Turkey) than other competitors,” Fankhauser said. “We are happy with the demand outside Turkey, we are up 6 percent if you take Turkey out.”

Thomas Cook said operating profit for its year to end-March 2017 would be between 310 million and 335 million pounds. Analysts have forecast a range of 310 million to 359 million.

First half revenue grew slightly to 2.67 billion pounds, it said, and an underlying operating loss narrowed by 5 percent to 163 million pounds thanks to an improvement in margins.

It said it continued to expect to pay a dividend this year.