Saxo Bank prepares to expand in Turkey

ISTANBUL - Hürriyet Daily News

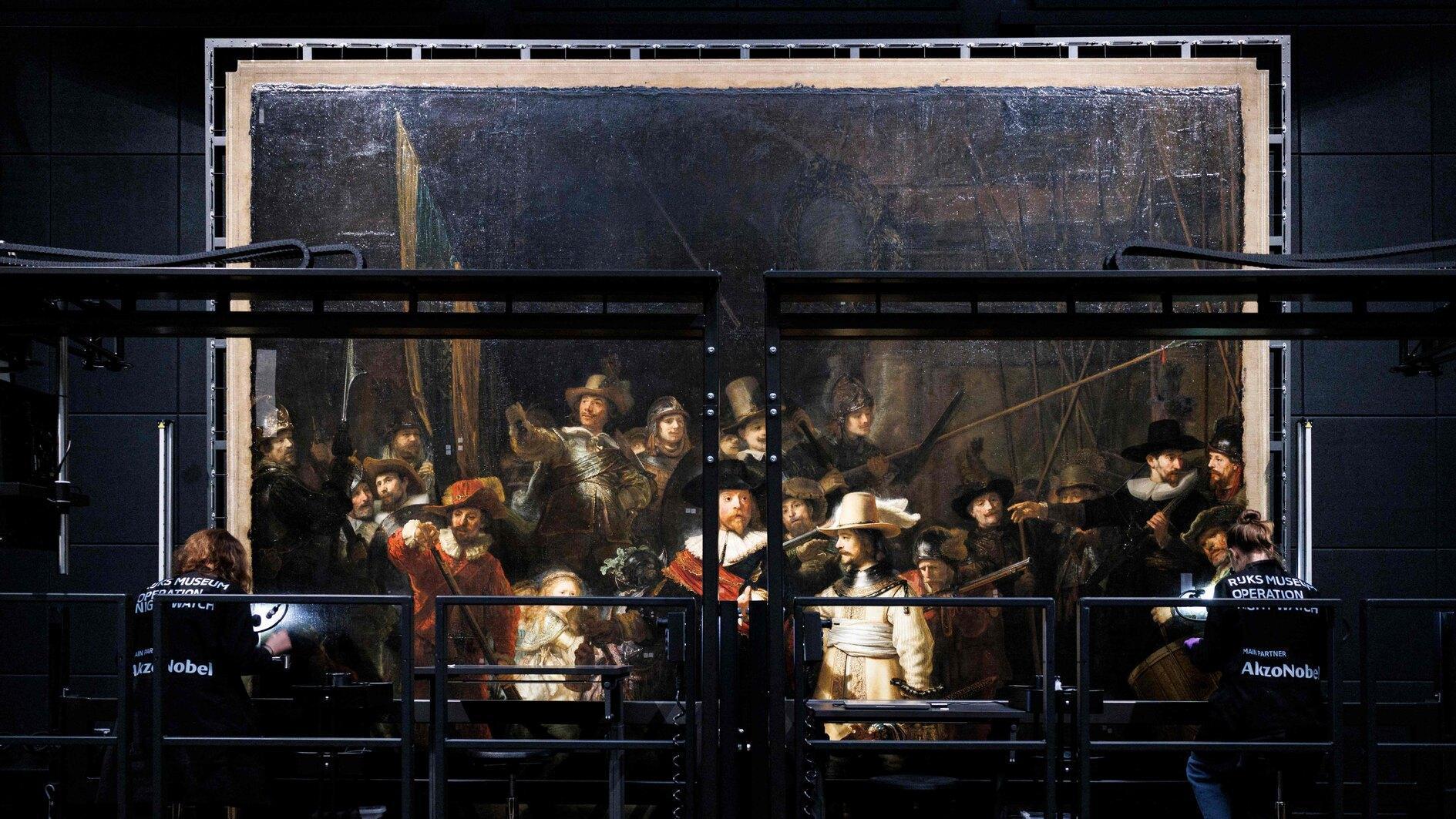

Saxo Bank is boosting its activities in emerging markets with new branches. AFP photo

Danish-based Saxo Bank is gearing up to bring its online trading platform to the Turkish market this year and also plans to open a local office in Istanbul, officials from the lender said yesterday.“We are currently in negotiations to offer our online trading platform to four or five local banks in Turkey,” Egemen Kaya, Saxo Bank Turkey’s general manager, told the Hürriyet Daily News at a roundtable discussion with journalists in Istanbul.

Kaya did not disclose any names of local banks given the fact that the talks were still ongoing but did say one client was a research house. The bank’s strategy for Turkey will become clearer within the next month or two, said Kaya.

“With Europe in financial distress we see the future in diversifying outside of Europe to emerging market countries like Turkey,” Saxo Bank Chief Executive Officer Lars Seier Christensen told the Daily News when asked whether he foresaw any risks in expanding to emerging markets at a time when most European banks were looking to trim their balance sheets.

Saxo Bank has recently opened offices in Moscow, Panama City, Johannesburg, Sydney, and Hong Kong in an effort to diversify its dependence on European customers and markets.

“With the current economic atmosphere in Europe, it is clear that there is less financial trading taking place in Europe,” Christensen told the Daily News.

During his presentation, Christensen said Saxo Bank had only opened one new European office in Brussels and that a country like Turkey was very attractive for the bank given its impressive growth rates, its quest to become a global financial capital and the recently passed Capital Markets regulation that allows for forex trading over the Internet.

Saxo Bank, which was established in 1992, is an international investment bank operating in online trading and investment across global financial markets. The bank enables private and institutional clients to trade FX, CFDs, stocks, futures, options and other derivatives via online trading platforms.

The bank also offers professional portfolio and fund managers. Saxo Bank employs 1,500 employees, 600 of whom are focused on technology, which demonstrates the company’s commitment to technological solutions, according to officials at the lender.

The Istanbul office will employ about 10 to 15 local employees, Christensen told the Daily News.

“We concentrate on innovative technology, which sets us apart from more traditional banks,” he told journalists.

Some of Saxo Bank’s international clients include big players such as Citibank and Barclays.