Saudi Arabia needs $74 crude oil price

RIYADH - Agence France-Presse

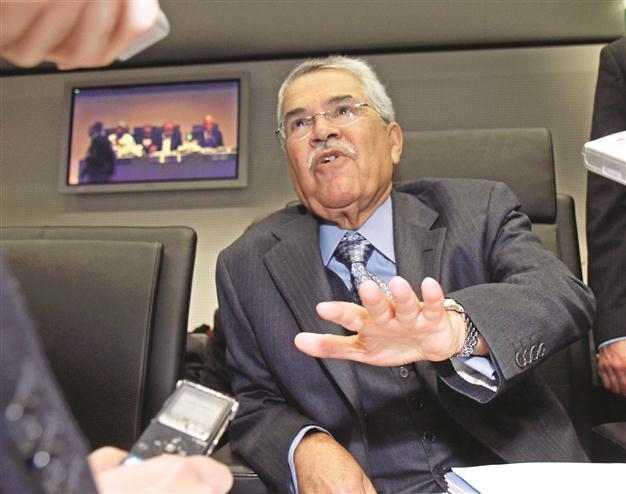

Saudi Arabia’s Minister of Petroleum and Mineral Resources Ali Ibrahim Naimi gestures as he speaks to journalists.

Saudi Arabia will need a breakeven crude oil price of $74 per barrel to generate the funds required to meet its widening expenditure next year, Jadwa Investment said yesterday.The OPEC kingpin announced Dec. 26 yet another expansionary budget with spending marked at 690 billion riyals ($184 billion), and revenues reaching 702 billion riyals.

But Jadwa, a respected Riyadh-based investment firm, said in a report that it expects expenditure to again overshoot the budget, reaching 733 billion riyals.

“The oil price level necessary for revenues to balance our forecast level of government spending... is $74 per barrel for Saudi export crude,” Jadwa said, adding it would amount to about $70 per barrel for West Texas Intermediate (WTI) and $78 per barrel for Brent.

Conservative oil prices

The price of WTI hovers currently around $99 per barrel, but the oil-rich kingdom traditionally uses a conservative oil prices in its budgets, said to be currently around $60 per barrel.

Jadwa calculated the figure on the assumption that Saudi oil production would be at 8.8 million barrels per day while domestic consumption would be around 2.4 million bpd.

The report said that a price of $69 per barrel for Saudi oil is “consistent” with the revenue projected in the budget.

Jadwa said the kingdom’s actual spending has averaged 24 percent higher than the budget during the past 10 years, with overspending surging 39 percent in 2011, due to commitments made by royal decrees.

Out of the 2012 budget, 168 billion riyals ($44.8 billion) would be spent on education, 87 billion riyals on health, 29 billion riyals on municipal services, 35 billion riyals on roads and communication and 58 billion riyals on water, industry and agriculture.

Saudi Arabia on Dec. 26 posted a budget surplus of 306 billion riyals ($81.6 billion) in 2011, as revenues turned out to be double the forecast, hitting 1.11 trillion riyals, compared with forecast of 540 billion riyals.