Russian risk pressing Turkey’s economy

Mustafa Sönmez - mustafasnmz@hotmail.com

AA photo

Something that everybody managed to avoid during the Cold War has now happened. On Nov. 24, Turkey became the first NATO country to shoot down a Russian plane in 62 years. All of a sudden, Turkey became enemies with its most important neighbor and one of its biggest trade partners.

Since the downing of the jet, Russian leaders have repeatedly declared that they have not received an apology, and they have started engaging in harsh criticism. Russian President Vladimir Putin has said “Erdoğan is Islamizing Turkey,” while also claiming that Turkey is mediating in the Islamic State of Iraq and the Levant’s (ISIL) illegal oil trade. In response, Turkish President Recep Tayyip Erdoğan challenged Putin to prove his claims, and Russia escalated the situation by saying it had documents.

At the climate change summit on Nov. 30 in Paris, Putin refused to even reply to Erdoğan’s call to meet to deescalate the tension.

Economic sanctions Not hearing any apology from a state that shot down one of its planes – indeed, for that state to defend this act through its membership of NATO - has escalated nerves and anger in Russia. The entire Russian public feels that national pride has been attacked and demands that Putin hold “them” (us) to account. Putin has started doing this at the economic level and he will continue.

As a start, tourism and export channels have been cut. The biggest weapon of natural gas has not yet been used, but by making up various excuses that flow could be decreased. There is also a red light flashing in the construction sector, while all kinds of goods and workforce inflows from Turkey to Russia, even capital inflows, are facing obstructions.

Turkey’s economy will be negatively affected by all this. Moreover, as a country that has challenged Russia, its political risks have increased and foreign investors have started withdrawing. This has strengthened the dollar against the Turkish Lira, with one dollar now approaching 2.95 liras.

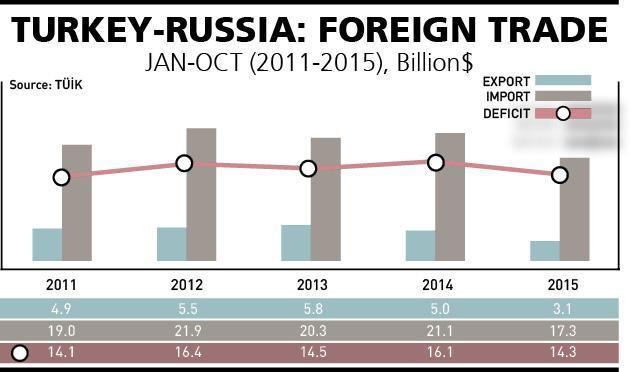

Turkish-Russian trade had been increasing in recent years. Turkey was exporting an average of $5-6 billion yearly and, in return, importing natural gas, crude oil and coal. As a result of this balance, Russia has a certain trade superiority. Turkey cannot easily give up the energy it is importing, but Russia has the means of decreasing its imports and meeting them with supply from other countries.

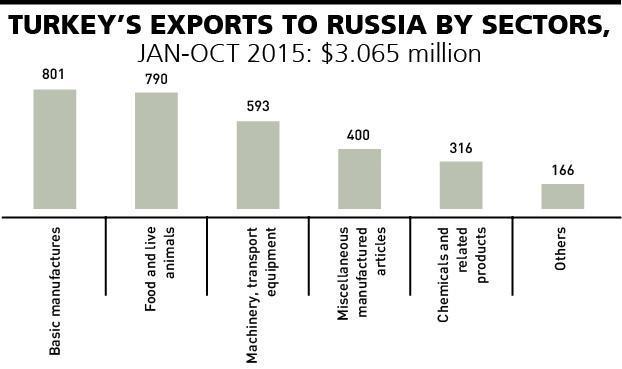

Restrictions on fruit and vegetables It has started by banning vegetable and fruit imports from Turkey, which had made up Russia’s biggest import item from the country. In the first 10 months of the year Russia imported $704.6 million worth of fruit and vegetables from Turkey. Now, it will implement an official ban on these products within a couple of weeks.

According to official Russian statistics, fresh fruit and vegetables from Turkey amount to 20 percent of all food imports. The agricultural product that Russia imports most of all from Turkey is lemon, with a rate of 90 percent. However, price-wise, the greatest damage will be seen in Turkey’s exports of tomatoes; in the first nine months of 2015, Russia bought $281.3 million worth of tomatoes from Turkey.

The second serious item is citrus fruit, with imports from Turkey amounting to $135 million. Other fruits such as apricot, sour cherry, cherry, peach and plum come third with $94.5 million. The last item is grapes with $69 million.

Construction work and workers Russian imports of industrial products from Turkey are set to continue in the short term. But after recent experiences, Turkish contracting companies operating in Russia look due to face increasing difficulties. After the collapse of the Soviet Union, Turkey became one of the countries with the greatest share in Russian contracting services, and over time Russia became the top destination for Turkey’s overseas contracting business. From 1988 until today, 1,920 projects have been undertaken by Turkish companies in Russia. The value of these projects, $62 billion, amounts to a 19.4 percent share in Turkey’s overseas contracting projects overall.

Turkish contractors undertook 47 projects worth $3.9 billion last year, while this year nine projects worth $2.3 billion have been undertaken. Because of the decline in oil prices, the devaluation of the ruble, and the sanctions imposed by the West, Russia was already experiencing difficulty in meeting payments and this situation was sometimes giving Turkish contracting companies a hard time.

Among routine difficulties were delays in payments and obstacles in extending staff residence permits, but from now on concerns center on winning new contracts.

Labor Minister Süleyman Soylu said Moscow’s decision not to employ Turkish workers in Russia as of Jan. 1, 2016 had not been officially confirmed and there is no current pressure or restrictions against current workers.

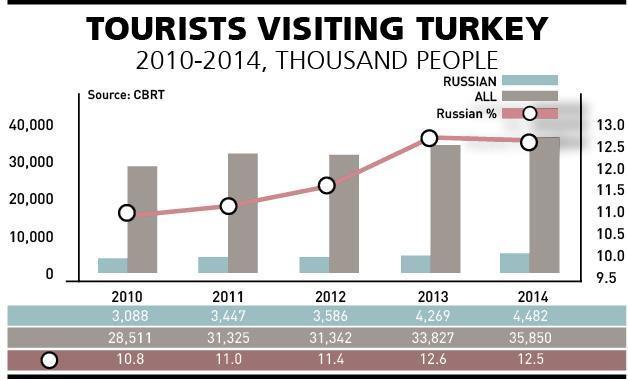

Blow to tourism Putin has also signed a decree banning charter flights to Turkey – amounting to 30,000 flights a year. This means 3 million Russian tourists will not be coming to Turkey next year. After this decision was made, private Russian airlines said they would shift their flights to Europe, North Africa and Far East.

Any non-arrival of Russian tourists in Turkey will hit the Antalya province particularly harshly, sector representatives say. An average of 4 million Russian tourists come to Turkey every year, generally opting for Antalya and its environs. The overall value of this is around $3.5 billion annually.

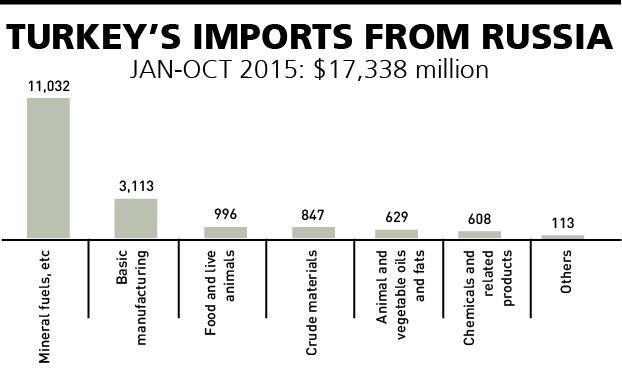

Will natural gas be cut? Turkey has a serious energy dependency on Russia. In the first 10 months of this year, $11 billion of total imports worth $17.3 billion consisted of natural gas and other energy imports.

Almost 60 percent of Turkey’s natural gas imports are met by Russia (20 percent are from Iran and 12 percent are from Azerbaijan). Natural gas is not only used for heating; actually, it is mostly used in electric production. About 45 percent of electricity produced in Turkey comes from power plants fueled by natural gas.

One of the concerns is that Russia may use natural gas as a weapon against Turkey. There has been no step yet in this direction, but the possibility is there.

Generally, experts regard Ankara’s argument that it can buy natural gas from elsewhere, rather than Russia, as unrealistic.

“This business is not like buying bread and cheese from the market. From which country will you buy 90 million cubic meters of natural gas daily? With which pipeline? Through which LNG depot? All related parties know this is not possible, but the Russian side knows this the best,” said energy expert Necdet Pamir.

“The current infrastructure is very inadequate before these volumes ... I wish we were not so highly dependent on natural gas and we really had been able to diversified the natural gas supply. I wish we had been able to activate our idle local and mostly renewable resources over these 13 years of [Justice and Development Party] AKP rule, while gradually decreasing the 31 percent share of natural gas in energy consumption and the 49 percent dominancy of electric consumption,” Pamir added.

Indeed, there is also the very debatable nuclear power plant issue. It is not known what will happen to the planned nuclear power plant to be built by the Russians in Akkuyu. Maybe one of Turkey’s biggest cards it can use against possible Russian sanctions is this nuclear power plant project.

Kazakhstan President Nursultan Nazarbayev recently said Russia and Turkey “need to find common ground and should not upset relations that have been built over many years.” He also called for a joint investigation commission to be formed to probe the downed jet incident. Azerbaijan and Belarus are also said to be conducting a second mediation attempt.

However, despite these efforts, Russia has the exact opposite stance to Turkey in the Middle East, which makes it much more difficult to reach reconciliation. It certainly looks like the Russian crisis will give a hard time to the new Ankara government across a number of different fields.