Russia spends billions to prop up ruble

MOSCOW-Agence France-Presse

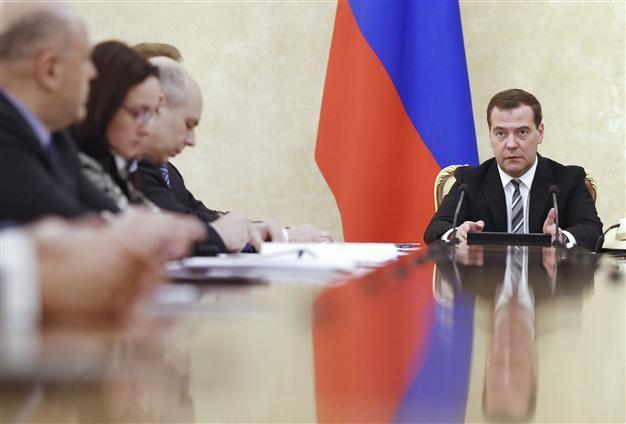

51 Russian Prime Minister Dmitry Medvedev (R) chairs a meeting on economic issues in Moscow, December 17, 2014. REUTERS Photo

Russia stepped up its defense of the ruble Dec. 17 as it sought to halt a run on the currency and stem the worst financial crisis of President Vladimir Putin’s 15 years in power.The intervention comes as Washington prepared to pile further sanctions on Russia over its support for the separatist insurgency in Ukraine, which have combined with falling oil prices to produce the perfect storm for the currency to go into freefall.

The ruble, which lost a fifth of its value in a single day on Dec. 16, has lost 60 percent of its value since the beginning of the year.

After opening down around 3.0 percent, it rallied slightly in afternoon trading, trading at 65.96 to the dollar, from 67.88 on Dec. 16 evening, and at 82.10 to the euro from 85.15.

The rise came after Prime Minister Dmitry Medvedev voiced confidence that Moscow can contain the crisis and the finance ministry said it was selling around $7 billion at its disposal to prop up the ruble.

“We’ll do it for as long as it is needed,” deputy finance minister Alexei Moiseyev was quoted as saying.

Medvedev told a televised meeting of ministers and industry leaders that Russia “has the currency resources to achieve... all the economic and production goals that you have set.”

The Central Bank has announced a series of technical measures to ease access to foreign currency and shore up banks, a day after the government compiled a list of emergency measures to stabilize the situation.

The Central Bank also said it had spent $1.96 billion on Dec. 15 in a bid to prop up the currency, taking to over $10 billion it has spent on propping up the ruble since the start of the month.

The Bank of Russia’s currency reserves were worth $415 billion on December 5.

Russia’s economy had already been slowing before it annexed Crimea earlier this year and supported insurgents in eastern Ukraine, but the sanctions and the halving oil prices threaten to push Russia into a sharp recession.

Heavily dependent on the export of natural resources, the Central Bank estimated the Russian economy could contract by five percent next year, before it hiked interest rates that will slow activity further.

The collapse of the value of the ruble will squeeze Russians as most consumer goods are imported.

The economic storm clouds present a major challenge for Putin and will test his ability to pursue his confrontation with the West over Ukraine.

Putin, who has remained conspicuously silent on the ruble collapse, came into the firing line yesterday.

Putin is scheduled to hold his annual end-of-the-year news conference ton Dec. 18.

Meanwhile Alfa Bank said “calming the population and preemptively addressing any banking sector issues is of the utmost importance, especially ahead of the weekend.”

The Central Bank’s strategy faced harsh criticism as well.