Punishment of twelve banks for collusion on loan rates ‘fair’: Economy Minister

ISTANBUL - Hürriyet Daily News

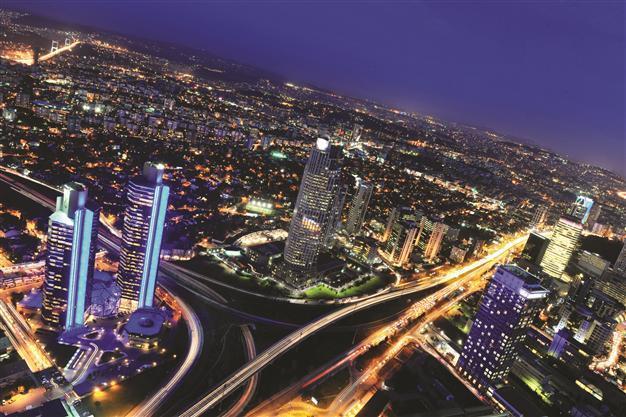

Istanbul’s financial district where headquaters of most of the banks are seen in this aerial photo. DAILY NEWS photo, Emrah GÜREL

Turkish Economy Minister Zafer Çağlayan has praised the Competition Board’s decision to fine 12 Turkish banks on March 8, after it found evidence of collusion in determining loan rates.

“The Competition Board did the right thing. Actually it was very fair. Those who make the citizens suffer must be punished,” said Çağlayan at a press event in the southern province of Kahramanmaraş on March 9.

The board’s investigation into complaints they received regarding alleged misbehavior concluded that all 12 banks investigated had adopted anti-competitive policies regarding loan and return-on-assets rates, as well as on credit card services. The board imposed fines of up to 1.5 percent of total revenues, amounting to a total of 1.1 billion Turkish Liras. The 12 Turkish banks - Akbank, Denizbank, Finansbank, HSBC, ING, TEB, Garanti, Halk Bank, Isbank, Vakıfbank, Yapı Kredi, and state-owned Ziraat Bank - had claimed they were the backbone of the Turkish economy, suggesting that their fall would shake the economy.

Çağlayan stated that the amount of the fine, 1.1 billion liras, might look high, but was dependent on the high turnover of the banking system as the fine was calculated based on the banks’ overall turnover. “If the banks collectively determine the interest rate, credit card charges, and the [credit] interest rates, and thus violate the competition, they must be fined,” he said, adding that he was still waiting for the justified decision from the board.

However, the Consumer Rights Association (THD) said it would protest banks because of the charges taken from customers for not using credit cards and for not making bank transactions on March 13 and 14. “This fine proves that our actions are right,” it said.

‘Unjust decision’The Banks Association (TBB) reacted to the decision by labeling it “an unjust decision that does not reflect the truths” in a statement on March 9. “This not-finalized administrative decision at the inspection phase harms the reputation of the banking sector, and will be appealed by the banks,” it said. The TBB also said it would begin to work on revising the legislation of the banking sector in order not to experience such a situation again.

Ergün Özen, the General Manager of Garanti Bank, which was hit with the highest fine worth 213.4 million liras, argued that there had been no violation of the law to justify this fine, adding that they would be using all their legal rights in an interview with daily Milliyet.