Turkey in the age of current account reversals

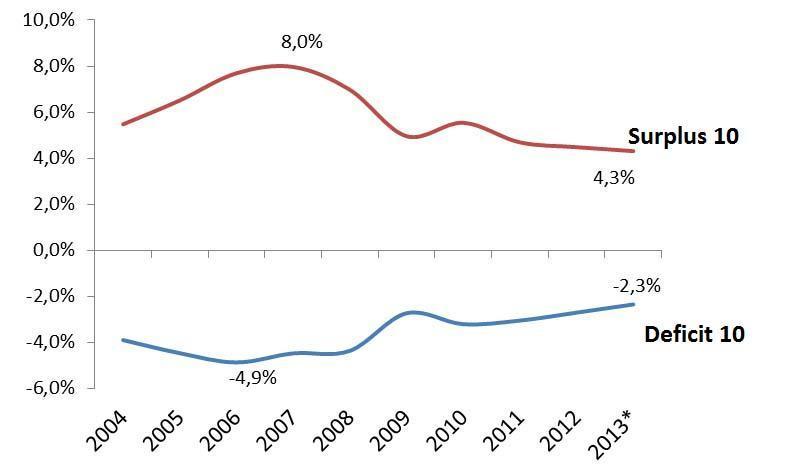

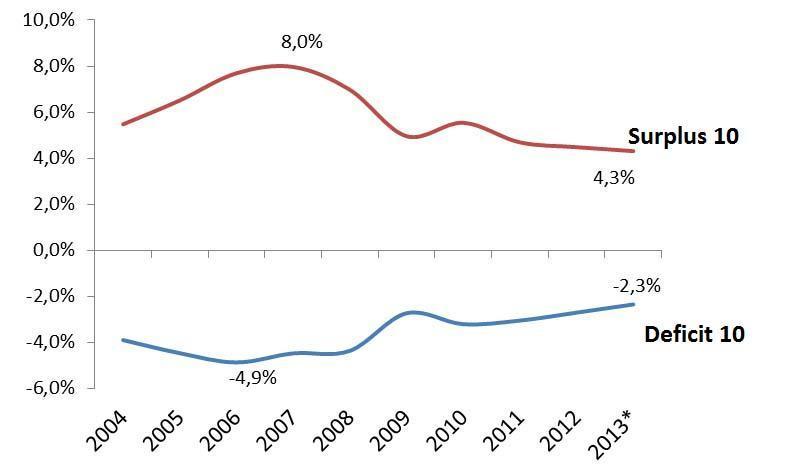

We appear to be living in an age of current account reversals. Just have a look at the graph below, taken from a TEPAV study. If you take both the current account surplus and deficit countries, i.e., top 10 from each side, there is a convergence in the past decade. That makes it a period of current account reversal – meaning less macro imbalance in the World. Analysis shows the growth impact of the current account surplus reversals is more benign than that of current account deficit reversals. Turkey has always been, and still is, a current account deficit country. There are countries that took measures to lower macro imbalances and those that did not. Turkey belongs to the second group.

Current account reversals in the highest 10 surplus and highest 10 deficit countries (as % of GDP)

Source: IMF

WEO (October 2013)

The Turkish Lira is now around 2.18, testing deeper waters. Wonder why the lira is still under pressure? Just look at the graph. There is less imbalance in the world now. The U.S. current account deficit has declined from 4.8% in 2007-2008, to 2.7% in 2012-2013. China’s current account surplus has also declined from 9.7% to 2.7% in the same time period. So is there less imbalance in the world? Yes, but not in the case of Turkey. The Turkish current account deficit has widened from 5.7% to 6.7%. If you take a longer period, it has increased from 5.4% in 2005-2008, to 7.4% in 2010-2013. In a period of less global macroeconomic imbalances, Turkey has chosen to become more unbalanced. That is not good when the time comes for the tide to go, and it is going with the relative returns rising in the U.S. Bad omen for Turkey.

The current account deficit is a structural characteristic of the Turkish economy. It is very hard to change. It was with us in the 1950s, and it remains with us today. When it comes to the current account imbalance in Turkey: Ask not what to do to eliminate the current account deficit of the country, ask what is needed to manage the imbalance. That is what we need; a better macro management team that is aware of the changing tides around the globe. Wonder why Turkey is one of the first to implement financial liberalization reforms? It was trying to manage the current account deficit in a time of changing tides. That was at the end of the Cold War. Government-to-government funding in hard currency was on the decline, as private markets became the primary tool of channeling international fund flows. During the Cold War, Turkey received funding because of its location – an ally located closely to the Soviet Union, after all, could not be lost. When that changed, Turkey focused on designing private channels for fund inflows. It created new markets, new instruments and new privatization programs.

It seems that we have missed the change of the tide this time. We need to strengthen the macro management team in Ankara, if you ask me. Turgut Bey was far better in handling such major changes.

We appear to be living in an age of current account reversals. Just have a look at the graph below, taken from a TEPAV study. If you take both the current account surplus and deficit countries, i.e., top 10 from each side, there is a convergence in the past decade. That makes it a period of current account reversal – meaning less macro imbalance in the World. Analysis shows the growth impact of the current account surplus reversals is more benign than that of current account deficit reversals. Turkey has always been, and still is, a current account deficit country. There are countries that took measures to lower macro imbalances and those that did not. Turkey belongs to the second group.

We appear to be living in an age of current account reversals. Just have a look at the graph below, taken from a TEPAV study. If you take both the current account surplus and deficit countries, i.e., top 10 from each side, there is a convergence in the past decade. That makes it a period of current account reversal – meaning less macro imbalance in the World. Analysis shows the growth impact of the current account surplus reversals is more benign than that of current account deficit reversals. Turkey has always been, and still is, a current account deficit country. There are countries that took measures to lower macro imbalances and those that did not. Turkey belongs to the second group.