Wealth amnesty: Bread for the poor?

As I noted in

my Aug. 5 column, the world is slowly but surely moving to a world where emerging markets will no longer be flushed with liquidity.

Unlike most of their peers, neither the government nor the Central Bank seems to be preparing for this new world. Maybe, they are counting on a new wealth amnesty. According to the law, individuals and corporates who declare and repatriate their assets abroad will only be taxed at 2 percent.

The Finance Ministry

stated on Aug. 1 that they had so far collected 991 million Turkish Liras of tax from declared assets of 49.55 billion liras. The deadline to declare assets has been extended from July 31 to the end of October.

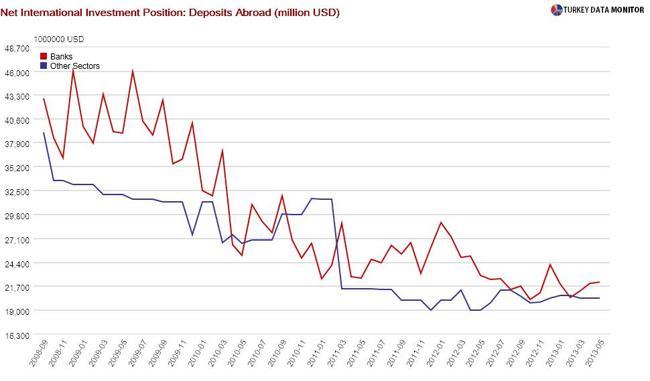

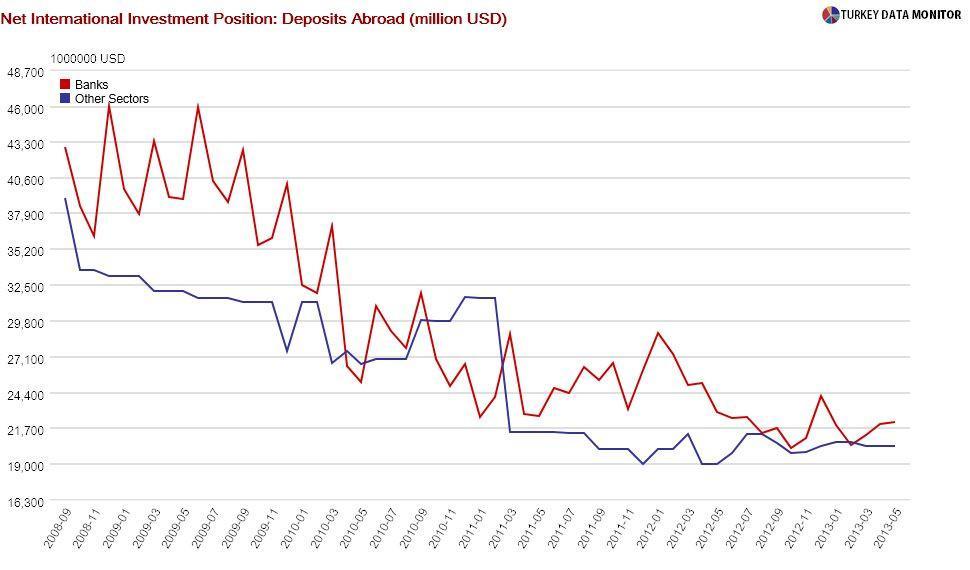

I was somewhat surprised by this figure. After all, according to the Bank of International Settlements, which is in essence a central bank for central banks, financial holdings of non-bank residents abroad are $20 billion. The total amount held by residents abroad is surely larger than this figure, but I find the $130 billion Deputy PM Ali Babacan mentioned back in April to be a bit of an overstatement.

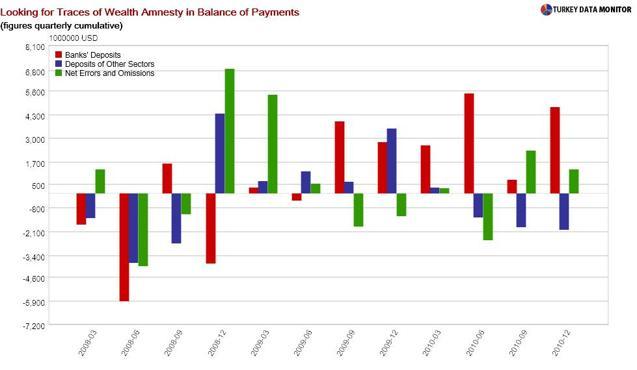

Leaving this technicality aside, I cannot figure out why the government is seeing the wealth amnesty as a lifesaver. After all, individuals registered 47 billion liras during the 2008-2009 amnesty, which included unregistered wealth in Turkey as well. I am not sure how much of this figure was from abroad, but the relevant items in the Balance of Payments accounts hint that the total repatriated sum was not a lot.

Since I could not reach a satisfactory answer from data, I had to resort to conspiracy theories, which are

never in short supply in Turkey. Some economists I talked to claimed that conservative businessmen close to the ruling Justice and Development Party would be bringing home their wealth to save Turkey

from a crisis.

Others thought that connected Turks would be intermediating regional funds to Turkey from the Middle East. I even heard that Iranian companies based in Turkey would be bringing money, to be used for gold exports to Iran.

Hope is the bread of the poor,

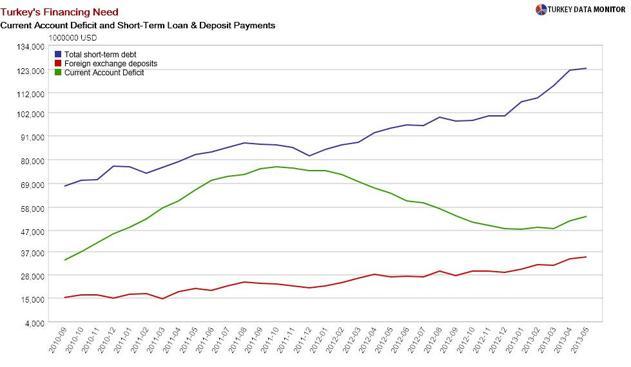

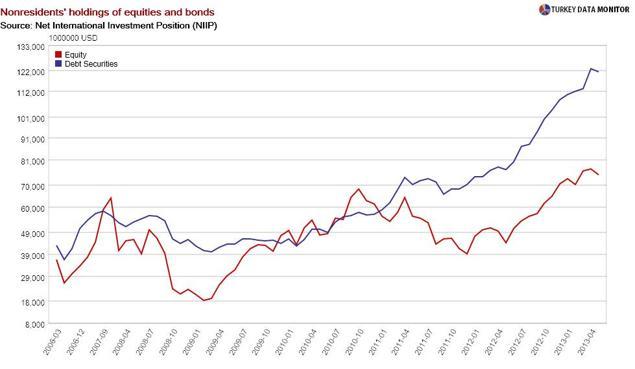

Hope is the bread of the poor, as a Turkish proverb goes, but in this case, there is no loaf – just crumbs: The money that could come from the wealth amnesty would be peanuts compared to Turkey’s $220 billion external financing need: A $60 billion current account deficit plus $160 billion of short-term loan and deposit payments. And I did not mention the $200 billion of non-residents’ stock of bonds and equities!

Even if it were successful, the wealth amnesty would only buy Turkey some time. Turkey instead needs a new story, as

Turkey Data Monitor’s Murat Üçer recently noted. Rather than find short-term patches like the wealth amnesty to solve Turkey’s external vulnerability, the government needs to come up with real answers to raise the country’s

savings rate and

net exports.

Unfortunately, they are extremely quiet on these issues except for a few showoff measures without much bite, such as the private pensions scheme and knockoff export promotion programs.

As I noted in my Aug. 5 column, the world is slowly but surely moving to a world where emerging markets will no longer be flushed with liquidity.

As I noted in my Aug. 5 column, the world is slowly but surely moving to a world where emerging markets will no longer be flushed with liquidity.