Turkish monetary policy broken

Turkish monetary policy is broken! Kaputt, chingado, cassé, bozuk! I’ve exhausted my knowledge of languages, but I think you get the idea. To see why that is the case, let’s go over the monetary policy developments of the last three days.

The Central Bank

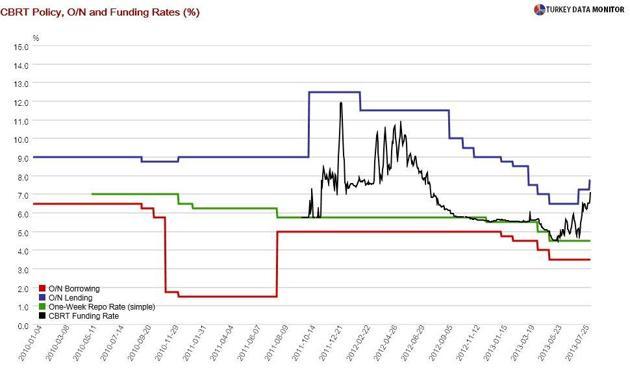

increased its lending rate from 7.25 to 7.75 percent on Aug. 20, but kept the interest rate on borrowing facilities provided for primary dealers via repo transactions at 6.75 percent. This means that the ceiling of the Bank’s interest rate corridor will not be changed on normal days, when the Bank funds markets at the one-week repo (policy) rate of 4.50 percent.

However, since primary dealers have to borrow at the lending rate on exceptional days, money market rates can now rise to 7.75 on such days when the Central Bank will implement additional monetary tightening (AMT) by not funding the markets at the policy rate. In a way, as

J.P. Morgan’s Yarkın Cebeci noted, the Bank has created another corridor within its interest rate corridor.

Almost no Turkey analyst

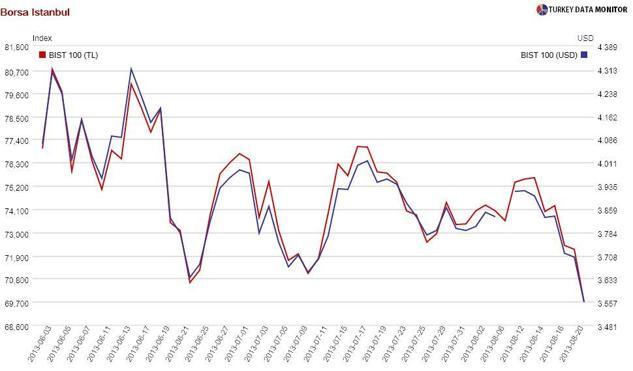

Almost no Turkey analyst found the decisions sufficient, and

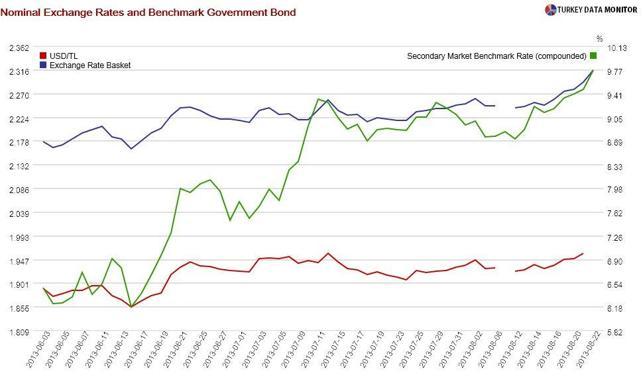

Turkish assets continued to underperform. Governor Erdem Başçı then

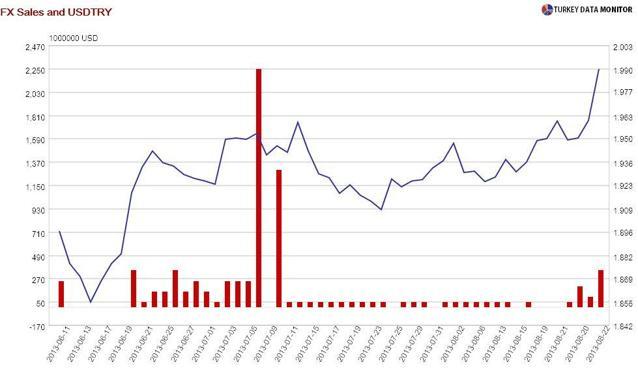

published a short statement the next day, noting that additional monetary tightening would continue every day until further notice. He also stated that a foreign currency (FX) sale auction of minimum $100 million would be held on additional tightening days, giving up

on the decision after the previous rate-setting meeting that no FX sales would be held on such days.

Still not confused?

Still not confused? After Fed tapering worries

shattered Turkish markets early Aug. 22, the Bank

released another statement, noting that “the number of total and remaining days for the already launched AMT and the daily minimum sale amount for the FX selling auctions that are to be held on each of the remaining AMT days” will be announced every morning. In addition, the minimum sale amount may “be revised upwards for only once within the day, if deemed necessary”.

You may think this upwards revision is redundant, as the daily FX auction amount is a floor, but it seems the Bank is playing

game of chicken with markets. They are hoping that if the amount announced in the morning does not stop lira depreciation, a higher amount will work. And if markets know that the minimum amount may be revised, they may not dare to bet against the lira in the first place.

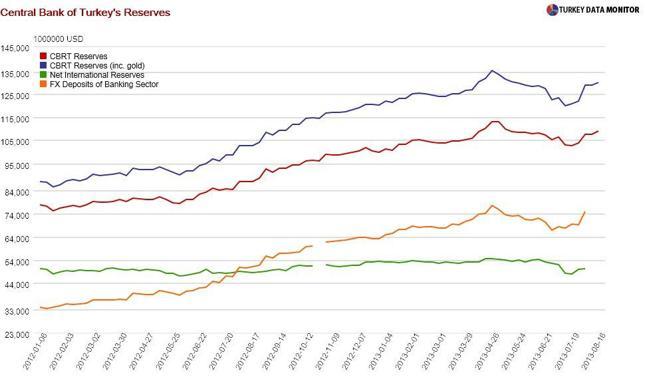

The Bank has not learned the painful lesson that you cannot usually intimidate markets, especially with a small gun. The Central Bank has net reserves of only $50 billion. In fact, in line with the new rules, the Bank announced on the morning of Aug. 22 that it would sell minimum $350 million that day, and it ended up selling that amount. Lira dollar exchange rate hit an all-time high right afterwards.

If FX pressure were temporary, sales might have helped, but it is not. Given the Prime Minister’s dislike of high interest rates, the Bank is

doing the best it can to delay a large hike, but we’ll probably end up with very high rates eventually.

Turkish monetary policy is broken! Kaputt, chingado, cassé, bozuk! I’ve exhausted my knowledge of languages, but I think you get the idea. To see why that is the case, let’s go over the monetary policy developments of the last three days.

Turkish monetary policy is broken! Kaputt, chingado, cassé, bozuk! I’ve exhausted my knowledge of languages, but I think you get the idea. To see why that is the case, let’s go over the monetary policy developments of the last three days.