Turkey Zindabad or, ‘in the bag’

Happy families are all alike; every unhappy family is unhappy in its own way.

I was reminded once again last week that

Leo Tolstoy’s observation holds true for markets as well. For one thing, when markets are happy, they tend to ignore all the bad news, or worse, they cherry-pick something positive from any piece of news.

In this case, their endorphin levels were raised by the rating agencies:

Moody’s noted on Monday that it would consider upgrading the country should Turkey make progress in limiting its external vulnerabilities.

Then, on Thursday, Fitch said

it would review Turkey next month, when it would check whether the country had achieved a “soft landing.” Add to this the second largest weekly fund flows to emerging markets in the past eight months, and the stage was set for one big party.

So when August industrial production came out much lower than expectations it was hailed as Fitch’s soft landing. Markets also liked the fact that it had paved the way

for more easing from the Central Bank at the rate-setting meeting on Thursday.

Similarly,

the record-low current account deficit seemed to satisfy one of the Moody’s conditions. Never mind that a significant part of the improvement is due to the slowdown in the economy and

gold exports. Besides, with nearly 60 percent of the deficit financed by fickle portfolio flows and short-term debt, the financing picture is not bright at all.

This last point was made in a conference call on the Turkish economy by

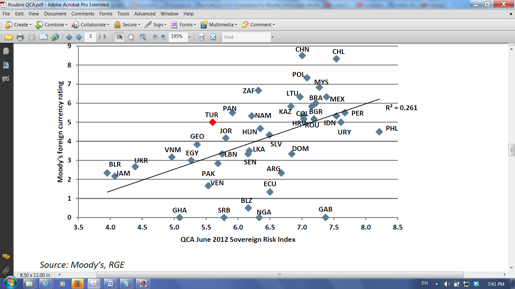

my blog’s host Roubini Global Economics (RGE) on Friday. RGE economists have developed a unified framework to analyze how much a risk a country is exposed to, as well as how able it is to manage these risks.

Their methodology incorporates four pillars: external adjustment capacity, the robustness of institutions, growth and adaptability, and social inclusion. All in all, over 2,500 data inputs spit out one number.

It is not a big surprise that Turkey does not come out well in this model. Rather than a couple of macroeconomic variables that are on the markets’ radar at the moment, RGE also looks at structural issues such as the

sophistication of the country’s exports,

women’s labor force participation and

human capital.

The analysis also sheds light

on the claim that Turkey is underrated. RGE’s results suggest that the country’s rating may be generous given the underlying facts. Moody’s and Fitch’s statements were perhaps aimed at assuring markets the country would not be downgraded, but ended up creating an unintended upgrade-mania instead.

In Urdu, “zindabad” means “long live.” “Turkey Zindabad” is definitely the mood in markets at the moment, but an English-speaker may easily think they heard

“Turkey’s in the bag,” which may well be more appropriate in the longer run.

Happy families are all alike; every unhappy family is unhappy in its own way.

Happy families are all alike; every unhappy family is unhappy in its own way.