The governor’s speech

A stuttering king and a drunkard helped England win World War II, or at least that’s the case if you are as shallow as I am and take Hollywood as your history guide.

A stuttering king and a drunkard helped England win World War II, or at least that’s the case if you are as shallow as I am and take Hollywood as your history guide.On Nov. 12, Central Bank of Turkey (CBT) Gov. Erdem Başçı caused me to start stuttering. Speaking to the newly minted Turkish finance portal AA Finans, where your friendly neighborhood economist’s first column in Turkish is appearing today, he declared that the Turkish Lira was close to being excessively overvalued, which would necessitate a policy reaction by the Central Bank.

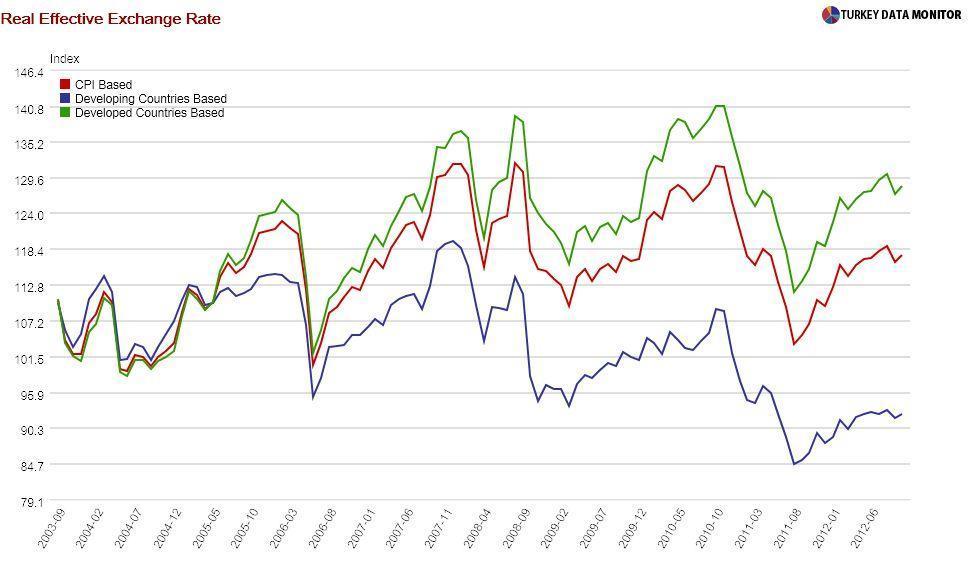

Başçı has made similar statements in the past, but this time he gave specific levels of the real effective exchange rate (REER), which is simply the nominal exchange rate adjusted for price differences between Turkey and its trading partners – you can also think of it as the relative prices of traded to non-traded goods in Turkey. It is an indicator of the competitiveness of the country’s exports.

According to Başçı, if the REER ends up within the 120-125 range, the Central Bank would ease its monetary policy only gradually, whereas 130 would elicit a strong response, whereby the CBT would utilize all the instruments in its arsenal. REER was 117.4 at the end of October. The nominal exchange rate had appreciated around 1.5 percent in November when Başçı made these remarks, bringing it dangerously close to 120. Expectations of monetary easing at next week’s rate-setting meeting were immediately priced in, as the lira weakened and bonds saw all-time lows.

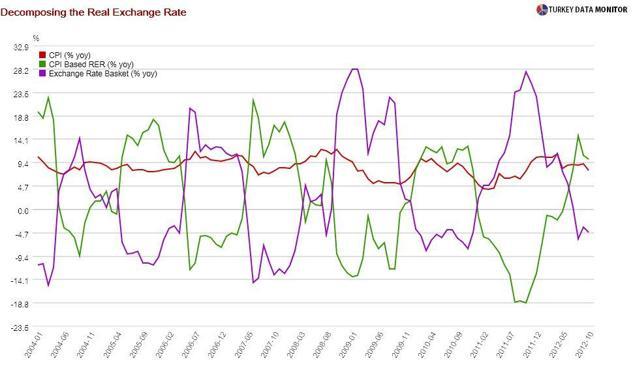

To explain why I was so shell-shocked, I should tell you that REER appreciation is equal to nominal exchange rate appreciation plus the inflation differential between Turkey and its trading partners. Decomposing REER into these two reveals that most of the real appreciation has been coming from the inflation differential rather than nominal appreciation in the past few months. So if the Central Bank had concentrated on bringing inflation down, we might not have had an overvalued real exchange rate in the first place.

I should perhaps not be too harsh toward the Central Bank. After all, Başçı was trying to talk the lira down with a verbal intervention, and he succeeded, at least for now. But I am more worried about the longer-term consequences of targeting specific levels of the real exchange rate: For one thing, such an approach could end up transforming REER into an anchor for monetary policy that would take precedence over inflation. Besides, the move could damage the Bank’s credibility, as Başçı underlined many times that they don’t have an exchange rate target.

When my stuttering refused to go away, I took up the Scotch I had picked up at the duty-free last week as part of every Turk’s traveling ritual, thanks to the high taxes on spirits - a result of the inability of the government to collect income taxes as well as its self-proclaimed distaste for alcohol, but that’s for another column. I was soon drunk and still stuttering. Pity I don’t have a war to win.