The economic impact of the Iraq war

I am settled in Le Pain Quotidien in Southbank Centre (no typo; when in Britain, you have to do as the Brits do) on a beautiful London Sunday morning.

I am in town for the 80th birthday (40+40) of my dear friends Didem and Cüneyt – so dear that I even managed to bring myself to get them Galatasaray jerseys for presents – and extend the Istanbul football (

not soccer, when in Britain…) club’s eventual bankruptcy by a few seconds.

I also met economists to share thoughts. I will summarize my impressions from those meetings on Friday, June 20, as I promised several readers I would address the impact of the Iraq war on the Turkish economy – on the condition that they would

#RememberBerkin,

#RememberEsther,

#RememberSoma, and contribute to the

fund set up for Esther’s 18-month-old son if they felt like it.

A good place to start would be recent statements by ministers in charge of the economy. Even though Foreign Minister Ahmet Davutoğlu

said, in the early days of the war, that there were attempts to create the notion that there is chaos in Iraq, his counterparts in economic policymaking made much more realistic statements.

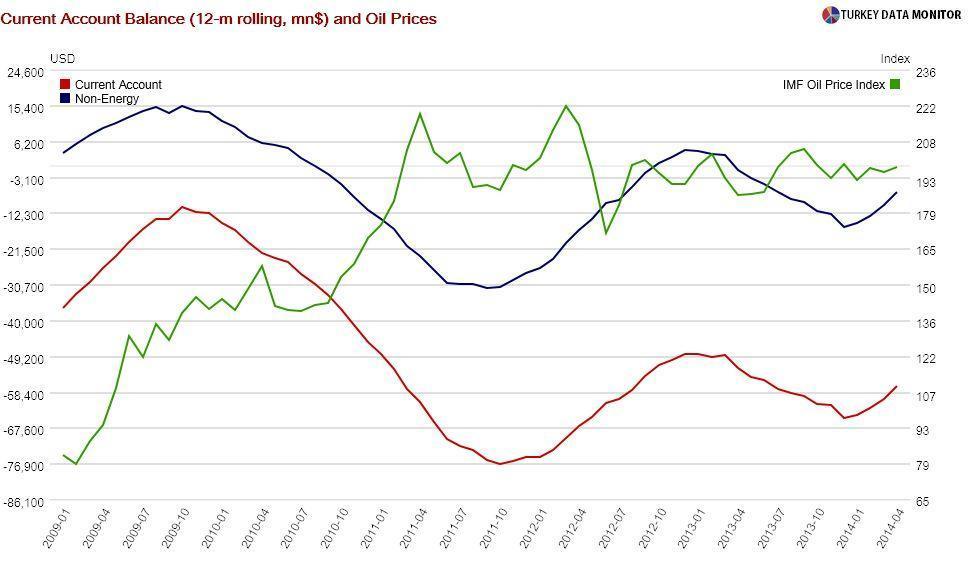

Energy Minister Taner Yıldız said last week that “it was apparent both oil and natural gas prices would rise,” reminding that natural gas prices were indexed to Brent oil prices. Since Turkey is an energy importer, the country’s current account deficit will increase, as Finance Minister Mehmet “

Nominal” Şimşek

noted.

The rule of thumb that every Turkey economist knows is a one-dollar hike in the price of oil increases the deficit by roughly $ 300-400 million. Of course, the billion-dollar question is how much further the price of a barrel, which has risen to $115 from $109 so far in June, will increase.

Exports would also be affected, as Iraq is Turkey’s second largest market. Most of the exports are to Northern Iraq, which is not in the war zone, and so I don’t think Turkish exports to Iraq will plunge. However, if the Kurds were to concentrate on military spending, demand for Turkish imports could fall, causing Turkey’s current account deficit to rise further.

A permanent rise in energy prices would also raise inflation. Statistical analysis reveals a 10 percentage rise in the price of oil would increase inflation by roughly 0.5 percentage points. We would need to pencil in another 1 percentage point or so if natural gas and electricity prices were also to rise 10 percent.

Turkish assets would be negatively affected as well, especially since the Central Bank has entered a loosening cycle despite the challenging inflationary outlook. All the economists surveyed by business channel CNBC-e expect a rate cut at tomorrow’s Monetary Policy Committee meeting. If the conflict got worse, the cut could hasten the Turkish Lira’s demise.

As Şimşek underlined, a country cannot choose its geography, “which is something like fate.” However, a country can choose its economic policy, which is not taking the war next door into consideration.

I am settled in Le Pain Quotidien in Southbank Centre (no typo; when in Britain, you have to do as the Brits do) on a beautiful London Sunday morning.

I am settled in Le Pain Quotidien in Southbank Centre (no typo; when in Britain, you have to do as the Brits do) on a beautiful London Sunday morning.