The deadliest of the seven deadly sins

While vanity is definitely my favorite sin, I would argue that pride is the deadliest of the seven deadly sins. After all, it caused Lucifer to fall from Heaven.

While vanity is definitely my favorite sin, I would argue that pride is the deadliest of the seven deadly sins. After all, it caused Lucifer to fall from Heaven.An ardent Turkey researcher shared with me, over lunch during my London trip in the summer of 2011, that government officials were falling under the spell of this sin. Since then, I have come to realize how accurate his observation was. During Nov. 22’s Financial Times Turkey Summit, the economy’s top brass were almost racing with each other to demonstrate their arrogance.

First on stage was economy tsar Ali Babacan, who slammed the eurozone by contrasting the single-currency area’s woes with Turkey’s solid economic fundamentals. It is true that the euro area is in trouble. Purchasing managers indexes released on Nov. 22 are hinting that eurozone private sector activity may face its sharpest quarterly contraction since the global financial crisis.

You could argue that Turkey significantly lags behind the euro area in terms of living standards, but since euro-bashing is a favorite pastime of policymakers and politicians worldwide these days, I will leave Babacan for now and turn to Finance Minister Mehmet Şimşek.

When he was asked whether the government’s $25,000 GDP per capita target for 2023 was realistic, Şimşek said that you could not go to space unless you aimed at going to space. A back-of-the-envelope calculation reveals that Turkey would have to grow 6 percent per year, in real terms, to realize this objective. To sustain such a growth rate, the country would need to shift to a production and export-led model, but I see no indications of any measures towards that end. If you try to go to space with a balloon, you are sure to end up dead.

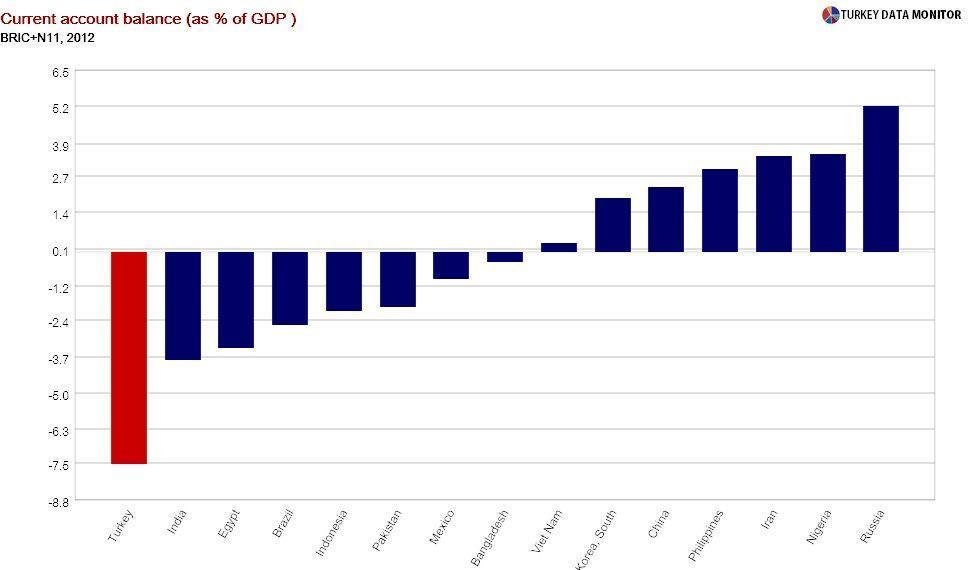

Perhaps more interestingly, Şimşek noted that only Turks were worried about the country’s current account deficit. I had no idea credit rating agencies Fitch and Moody’s were Turkish. After all, the former raised the country’s rating even though it thinks a balance of payments crisis and recession are likely. The latter noted external vulnerabilities as the main reason for not upgrading the country to investment-grade last week.

Since the Turkish economy is doing so well, or is at least “less worse” than peers, some of the policymakers’ pride can be accepted as bragging rights. After all, the Financial Times Summit was called “Investing in Europe’s new BRIC,” and investors I talked to in London early in the month were enthusiastic about the country. But if arrogance leads to complacency, the country could be dragged into crisis due to the failure of policymakers to take certain necessary precautions, such as structurally lowering the current account deficit.

In Dante’s Divine Comedy, penitents guilty of pride are forced to walk with stones on their backs to induce feelings of humility. If Turkey ends up in a crisis, it will not be just Babacan and Şimşek, but everyone living in Turkey, who will be carrying stones.