Taxing times for Turkish business

Last week was dismal for Turkish economic prospects, but not because of data releases. Not that economic figures offered much to cheer about. July 25 was especially gloomy.

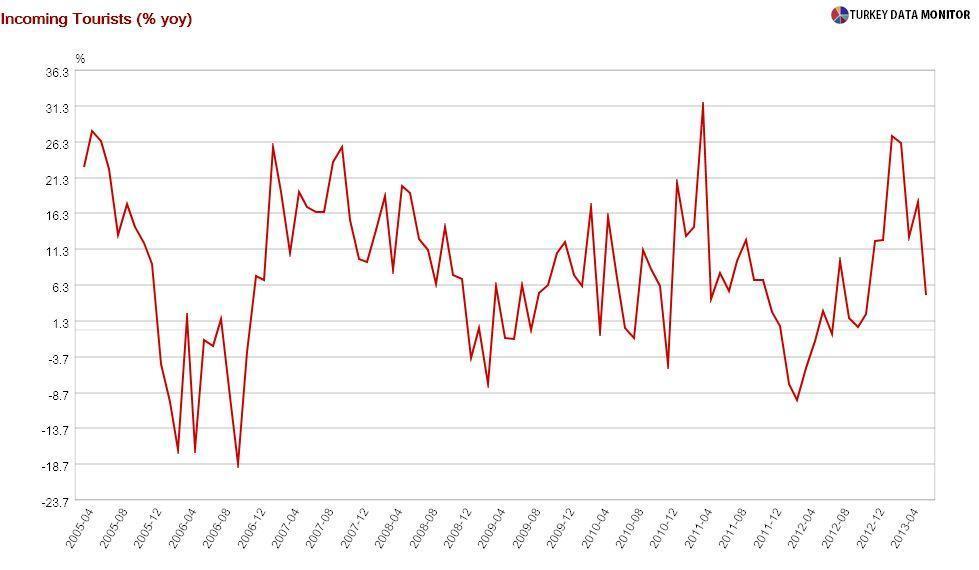

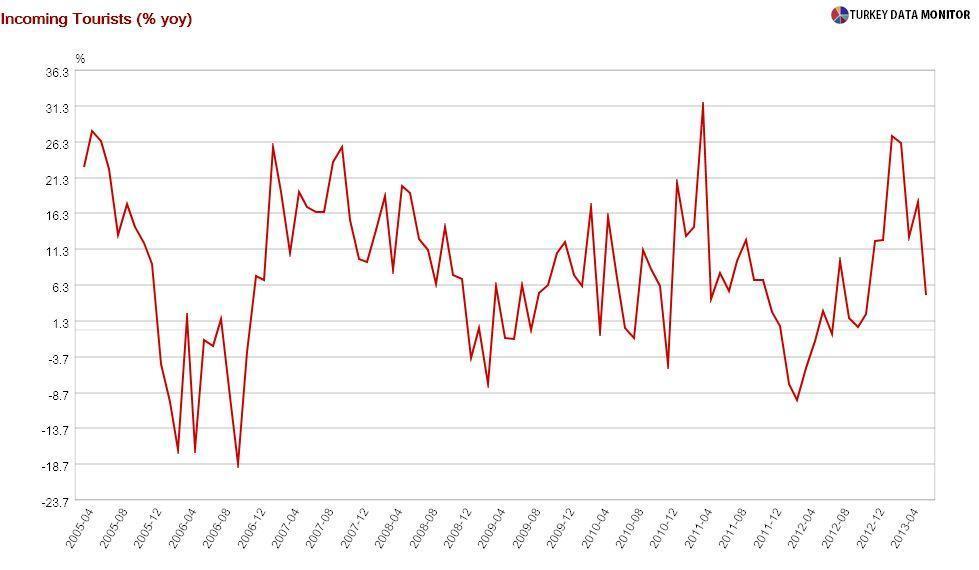

After increasing 19.3 percent annually in the first 5 months of the year, the number of

incoming tourists rose only 4.9 percent in June. I was

expecting some slowdown due to the Gezi protests, but if tourism does not pick up, the current account deficit could come in higher than expected at the end of the year.

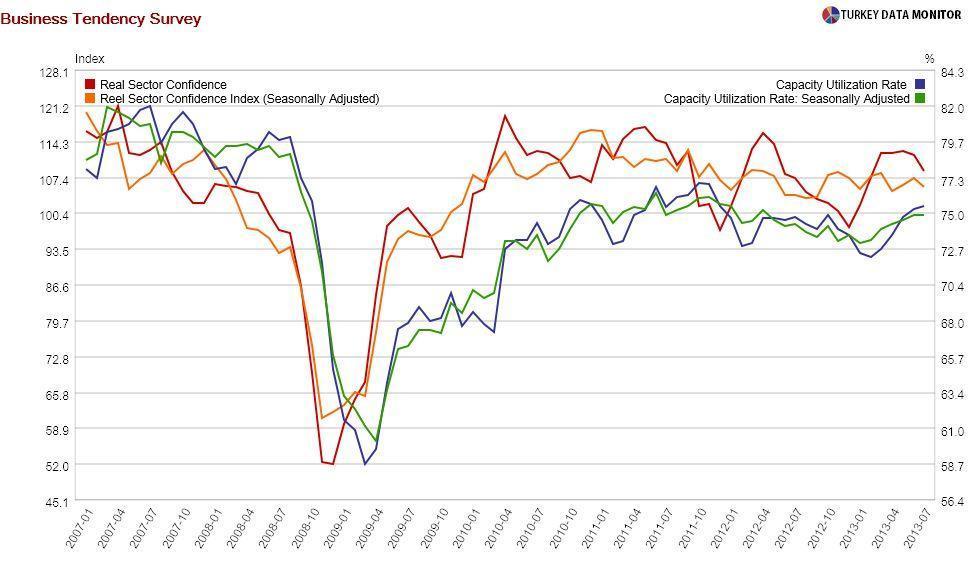

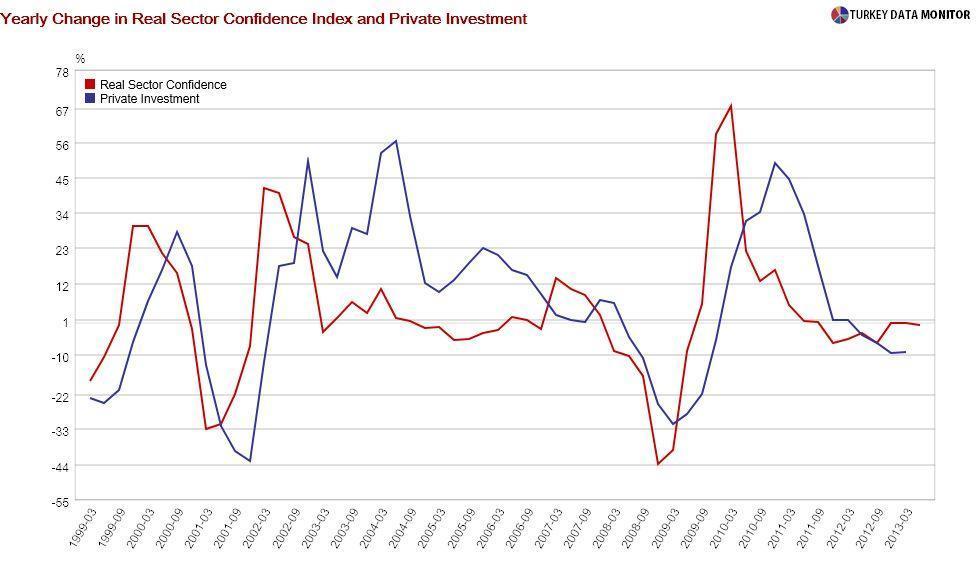

July’s

capacity utilization and

real sector confidence index (RSCI), on the other hand, hinted that the economy has yet to recover. The fall in the RSCI is especially worrying, as it is usually a good leading indicator of investment. The RSCI is suggesting, along with the robust credit data, that growth will depend on consumption and government spending, not private investment.

But despite these depressing figures, I was much more worried about

the raid by Ministry of Finance inspectors and police to Turkey’s leading conglomerate Koç Holding’s refinery Tüpraş, recently announced by the Istanbul Chamber of Industry as

the country’s largest company, on July 24.

The firm’s CEO and Finance Minister Mehmet Şimşek said a routine audit was going on, which may well be the case, but another Koç company is under investigation as well. Besides, Prime Minister Recep Tayyip Erdoğan’s

lashing out at Koç for

harboring and treating Gezi demonstrators at the conglomerate’s Divan Hotel is still fresh.

If the tax administration were fully autonomous, as is the case in developed countries,

pitiful rodents like yours truly would not be harboring conspiracy theories. Similarly, nobody would be claiming that companies “winning” huge government tenders, like

the third airport and

Golden Horn Port, were receiving “discounts” on accrued taxes.

Even if there were no truth to these rumors, a fully autonomous tax collector would also prevent taxpayers from deferring taxes in the hope that they would get

an amnesty before the elections. It would also provide a fair ground for business owners, like

your friendly neighborhood economist, who are stupid enough to pay their taxes.

Erdoğan said the IMF was asking for such an institution during the

never-ending stand-by negotiations in 2009. “This is not possible,” he said at the time. Another of

the fund’s suggestions, consolidation of all tax auditing agencies, was carried out, but they were all brought under the Ministry of Finance, which was definitely not what the IMF was recommending.

An autonomous collector would also unshackle the media. Many are linking

Turkish media’s dismal performance during the Gezi protests to

their owners’ other business interests. Such cross-ownership could result in conflicts of interest and therefore is prohibited in many countries. However, the government

could easily send the taxman to media companies as well.

Maybe, this is exactly why, more than anything else, Erdoğan is vehemently opposed to a fully autonomous tax collector.

Last week was dismal for Turkish economic prospects, but not because of data releases. Not that economic figures offered much to cheer about. July 25 was especially gloomy.

Last week was dismal for Turkish economic prospects, but not because of data releases. Not that economic figures offered much to cheer about. July 25 was especially gloomy.