Sultanateminister of Public Enlightenment and Propaganda in action again

Just like

during the Gezi protests, it has fallen to Finance Minister Mehmet

“Nominal” Şimşek, who is moonlighting as Minister of Enlightenment and Propaganda, to clean up the economic debris.

After talking to the clients of a major investment bank on Monday, Şimşek was on CNNTürk on Tuesday.

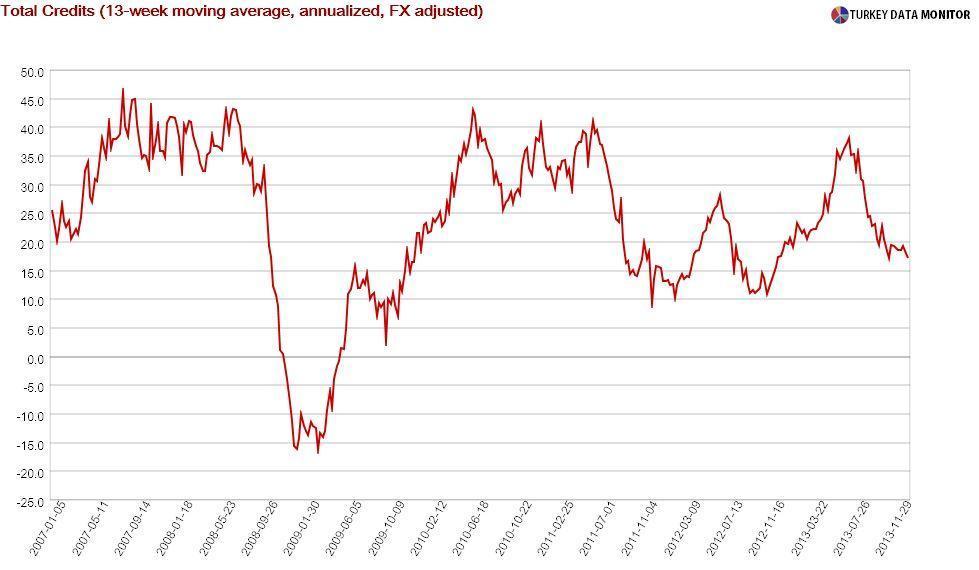

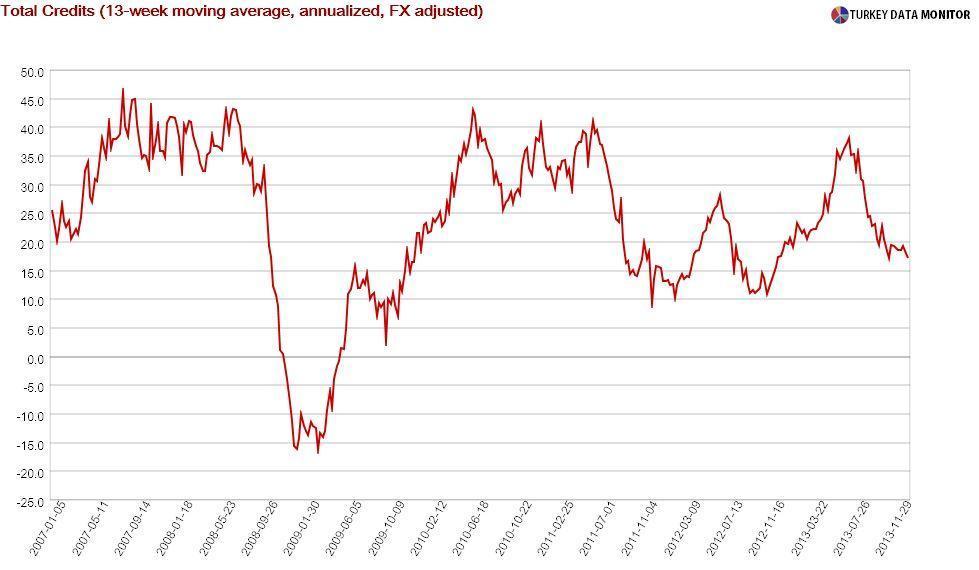

I classified his remarks into two categories: Incorrect data and shaky economics. For example, Şimşek’s claim that the credit growth target has been reached is simply not true. The 13-week moving average of annualized, foreign currency (FX) adjusted loan growth, which is the Central Bank’s preferred measure, turned out to be 17.2 percent, higher than the 15 percent target.

Interestingly, credit growth has been hovering at around 20 percent since September and was 19.2 percent the week of Dec. 13. So you could argue that the graft scandal shaved a full two percentage points off loan growth. Could it then be that the government started the investigations to slow down credit growth as well as to dispose of the rotten apples?

Or take Şimşek’s claim that there will be no election economics. While we have to wait for the January and February budget statistics to be sure, the

recent tax hikes look suspicious. Since the 2013 fiscal targets were easily attained, why would the government need to raise taxes if it is not planning to spend them?

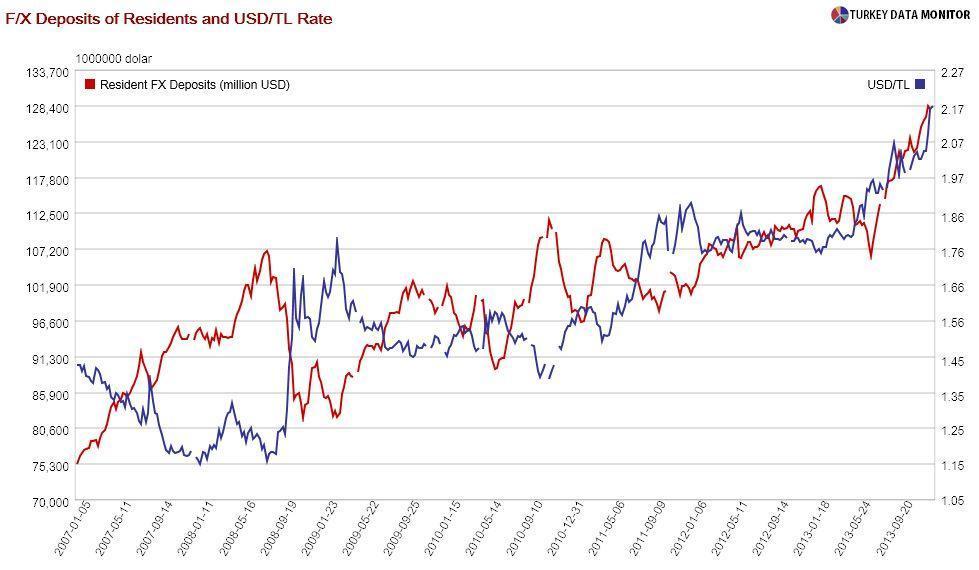

The minister’s comments on economics were even less stellar. For example, he stated that the lira depreciation would be positive for households, which are holding $128 billion of FX deposits. If I were in his shoes, I would be really worried about

the rise in FX deposits since the summer that accompanied the lira depreciation. In the past, residents saw lira deprecations/appreciations as opportunities for selling/buying FX. This buffer seems to have disappeared.

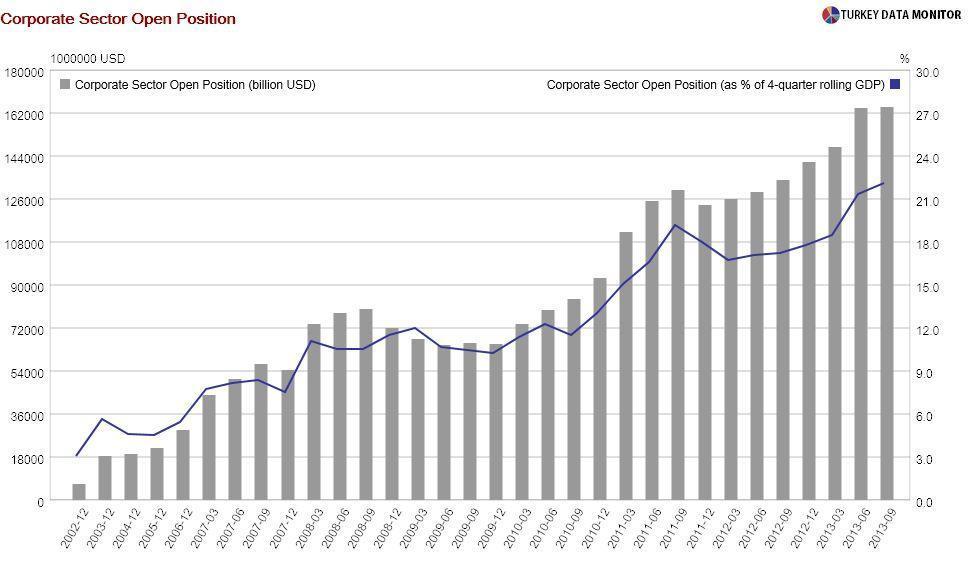

If the government is so sanguine about the weakening lira, they could as well tell the Central Bank not to defend the currency, and we could all sit down and watch as the companies with FX debt unfold. The corporate sector has an open position of $165 billion. It is true that some of the owners of these firms have FX deposits, but you’d need to be smoking non-taxed

(at least in Turkey) stuff to claim that a weak lira is overall beneficial for the economy- especially since the depreciation’s effect on exports will not be as immediate and large as he is suggesting.

Şimşek also presents this week’s yield curve inversion, when the return on the two-year benchmark bond rose over the 10-year’s, as evidence of investors’ confidence in the Turkish economy. As I explained in detail in

a blog post at Nouriel Roubini’s EconoMonitor, the inversion reflected policy rate hike expectations more than anything else. And since it has

disappeared for the moment, should we assume that investors have lost confidence in the economy?

I feel really enlightened each time I listen to Minister Şimşek, which tells me he is doing half of his job well. If only killjoys like me were not trying to get in the way of the other half.

Just like during the Gezi protests, it has fallen to Finance Minister Mehmet “Nominal” Şimşek, who is moonlighting as Minister of Enlightenment and Propaganda, to clean up the economic debris.

Just like during the Gezi protests, it has fallen to Finance Minister Mehmet “Nominal” Şimşek, who is moonlighting as Minister of Enlightenment and Propaganda, to clean up the economic debris.