Still Moody on Turkey

All the investors I spoke to during

my London investor trip two weeks ago were wondering how the Central Bank would respond to excessive capital flows, and whether credit rating agency Moody’s would follow in Fitch’s footsteps by upgrading Turkey to investment grade.

We will get partial answers to both questions this week. Tomorrow we have the Monetary Policy Committee rate-setting meeting, whereas Moody’s is holding its

annual Turkey Credit Risk Conference on Wednesday.

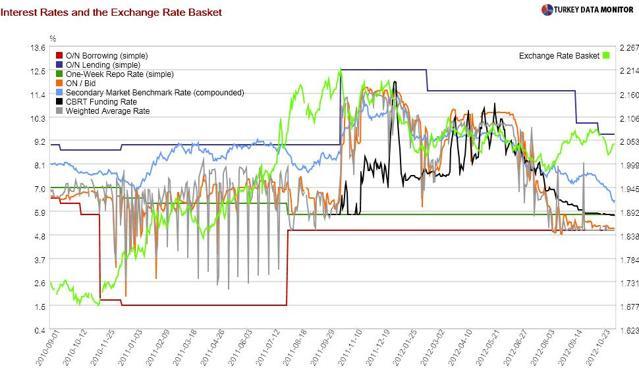

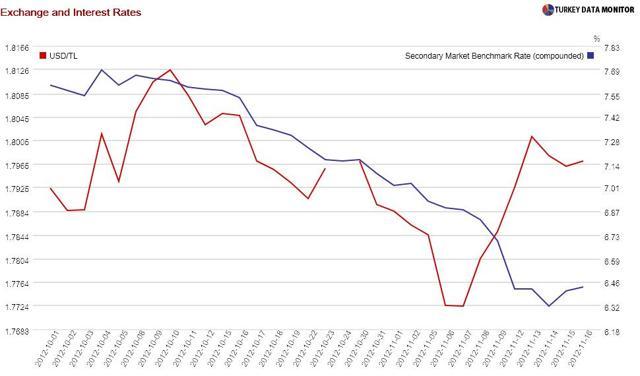

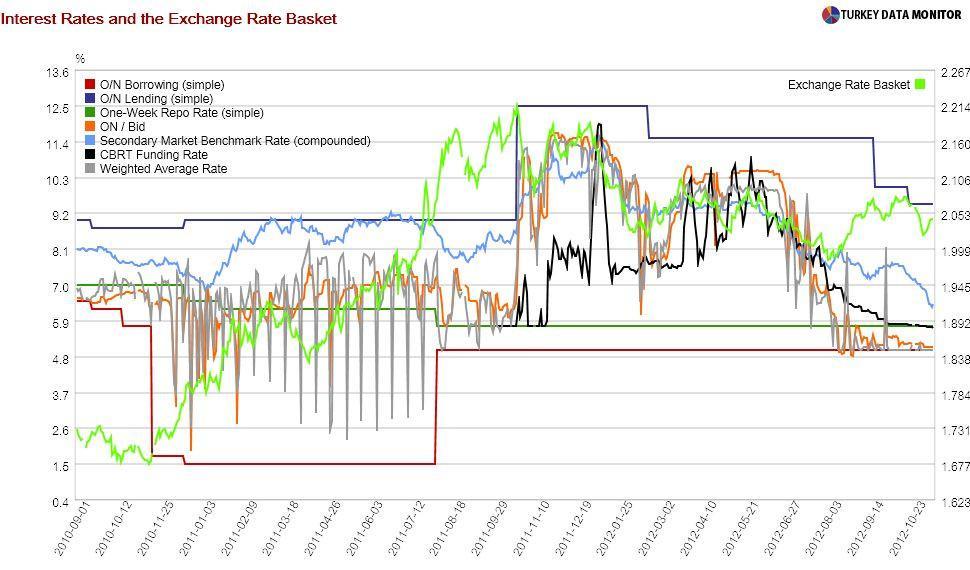

Until last Monday, everyone was expecting that the Bank would continue with another measured cut in the ceiling of the interest rate corridor, while at the same time further raising

Reserve Option Coefficients (ROCs). After Governor Erdem Başçı

stated on Monday that the Bank would respond if the real exchange rate appreciated further, half of the economists surveyed by business channel CNBC-e now believe the floor of the corridor will be lowered as well.

However, U.S. fiscal cliff worries led to risk aversion last week and capital flows to emerging markets dried up - a mini

sudden stop that was largely overlooked in Turkey as locals drove bonds to historic lows on expectations of a cut in the floor. While

I had predicted such market turmoil after an Obama victory, it is likely to be temporary, as the fiscal cliff will be avoided, and

Turkey is set to benefit if the hunt for yield continues. I believe the Central Bank will nevertheless play it safe by waiting for now. We could see a rise in bond rates early next week if I am right.

As for Moody’s, I am of the opinion they are still moody on Turkey because of the country’s external vulnerabilities, but they could easily justify an upgrade. In

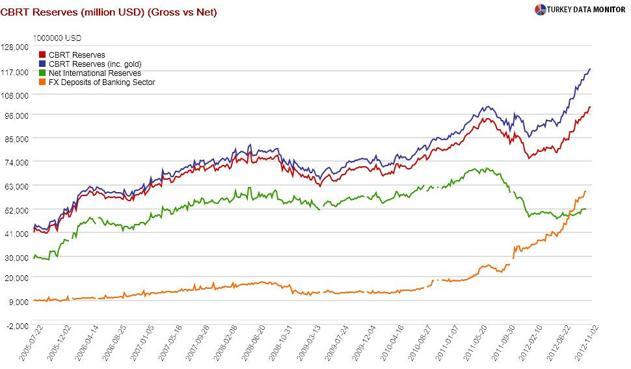

their report at the end of October, they said they would “consider upgrading Turkey’s rating if the government made further progress in lowering its external vulnerabilities by structurally reducing its current account deficit, increasing foreign exchange reserves or reducing the private sector’s external borrowing”.

While it showed that

the external adjustment is losing steam, Thursday’s September current account deficit came in lower than expected, and the improvement in the 12-month figure continued. Besides, the year-end deficit will be significantly smaller than the rating agency’s forecast of 7.8 percent of GDP, as projected in October.

Moreover, reserves are now around $100 billion. Never mind that the reduction in the current account deficit is not structural, and the increase in reserves is mainly because of the rise in banks’ deposits at the Central Bank as a result of ROCs - net reserves have been hovering around $50 billion for a long time. Moody’s could claim that two of its three conditions have been satisfied, and so while I don’t expect an upgrade from them this year, I am not ruling out anything.

But before placing any bets based on my predictions, you should know that I usually do a great job of forecasting exactly the opposite of what will happen.

All the investors I spoke to during my London investor trip two weeks ago were wondering how the Central Bank would respond to excessive capital flows, and whether credit rating agency Moody’s would follow in Fitch’s footsteps by upgrading Turkey to investment grade.

All the investors I spoke to during my London investor trip two weeks ago were wondering how the Central Bank would respond to excessive capital flows, and whether credit rating agency Moody’s would follow in Fitch’s footsteps by upgrading Turkey to investment grade.