Scapegoat for the government’s economic policy

A friend replied to my criticism of the Central Bank

in my Dec. 28 column by noting that the global crisis had shown the importance of financial stability, and that even the

Federal Reserve and

Bank of Japan were undertaking extraordinary measures.

I often hear this misguided claim. If there was one thing the four panelists at

Istanbul think tank BETAM’s Understanding New Monetary Policy panel on Dec. 26 agreed upon, it was that the Central Bank of Turkey’s policies were very different from those of developed countries’ central banks.

As

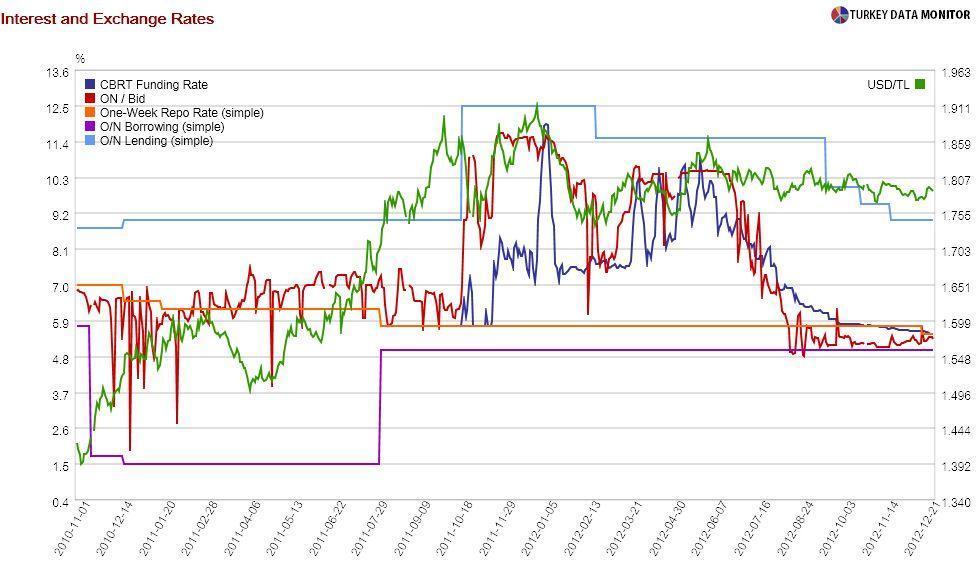

Murat Üçer of

Turkey Data Monitor, one of the panelists, emphasized, while the latter have been trying to cope, first with asset price bubbles, and now monetary policy at zero interest rate, the Central Bank of Turkey’s main challenge has been the age-old problem of managing capital flows.

The consensus view is that the bank has been dealing with this task with truly innovative policies. According to Üçer, that is not true. He notes that it is very easy to explain monetary policy from the end of 2010 with the

trilemma of the Impossible Trinity: With free capital flows, it is impossible to have a fixed exchange rate and independent monetary policy at the same time.

Once the Central Bank decided to keep the exchange rate effectively fixed in 2012, market rates were bound to deviate from the policy rate. In that sense, the bank’s ingenious interest rate corridor was “the foundation of this new framework, not a new instrument,” in Üçer’s words. The bank never posed the issue like this, and I think that turned out to be counterproductive.

All the panelists, with the possible exception of the Central Bank’s chief economist,

Hakan Kara, would also probably agree with Bilgi University Professor

Asaf Savaş Akat’s observation that the Central Bank has moved from the rule-based inflation targeting framework to a discretionary one. Each approach has its advantages, but pretending to stick with the rule is not working.

More generally, Üçer thinks the greatest danger of the current setup is

the misconception that the Central Bank has the power to cure all of the country’s economic problems. That image of an all-powerful central bank, partly created by the bank itself, is a mirage. In fact, central banks hardly have the tools to fine-tune the economy and tackle much more than inflation.

Panelist

Cevdet Akçay of Yapı Kredi, a Turkish bank, argued the Central Bank should be harsh toward critics. I think their target should be the government. Fiscal policy would have been better at dealing with capital flows. The banking regulator has been too late and slow with macroprudential measures. Structural reforms to tackle the current account deficit have been missing.

The bank is quiet on these, parroting that their assumptions depend on “a tight fiscal stance and structural reforms,” as panel moderator

Seyfettin Gürsel noted. It is unfair they are scapegoated for the government’s economic policy, but they really brought this upon themselves.

A friend replied to my criticism of the Central Bank in my Dec. 28 column by noting that the global crisis had shown the importance of financial stability, and that even the Federal Reserve and Bank of Japan were undertaking extraordinary measures.

A friend replied to my criticism of the Central Bank in my Dec. 28 column by noting that the global crisis had shown the importance of financial stability, and that even the Federal Reserve and Bank of Japan were undertaking extraordinary measures.