Mission: Impossible - Christmas Turkey

The International Monetary Fund (IMF) released its Article IV consultation report for Turkey late Dec. 21. These documents are scrutinized by Turkish policymakers before publication. However, reading between the lines can still reveal a lot about where the Fund and the government differ on economic policy.

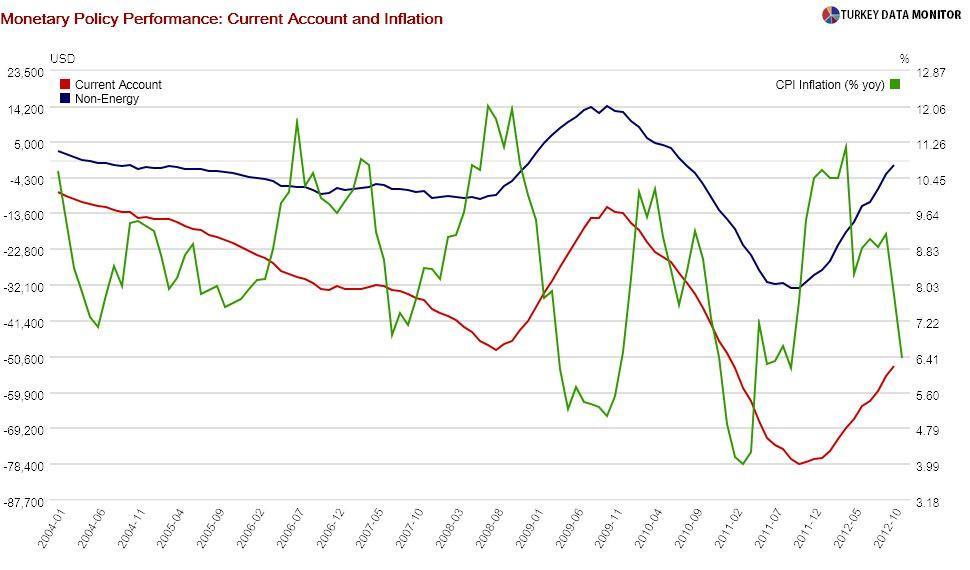

The International Monetary Fund (IMF) released its Article IV consultation report for Turkey late Dec. 21. These documents are scrutinized by Turkish policymakers before publication. However, reading between the lines can still reveal a lot about where the Fund and the government differ on economic policy.One big disagreement is on monetary policy. In an accompanying Selected Issues (SI) chapter, Fund economist Robert Tchaidze argues that “the first version of the framework, in place until October 2011, does not seem to have achieved a timely or significant reduction in external and internal imbalances.” This is because the Central Bank’s operations increased liquidity, undermining the Bank’s fight against inflation and the current account deficit.

This rise in liquidity also led to the weakening of the lira throughout 2011, adding to inflationary pressures. The Bank eventually left this framework for the current one of setting the interest rate on a daily basis by varying liquidity and keeping the exchange rate stable. While inflation and the current account deficit fell significantly this year, the jury is still out on the effectiveness of this new policy mix.

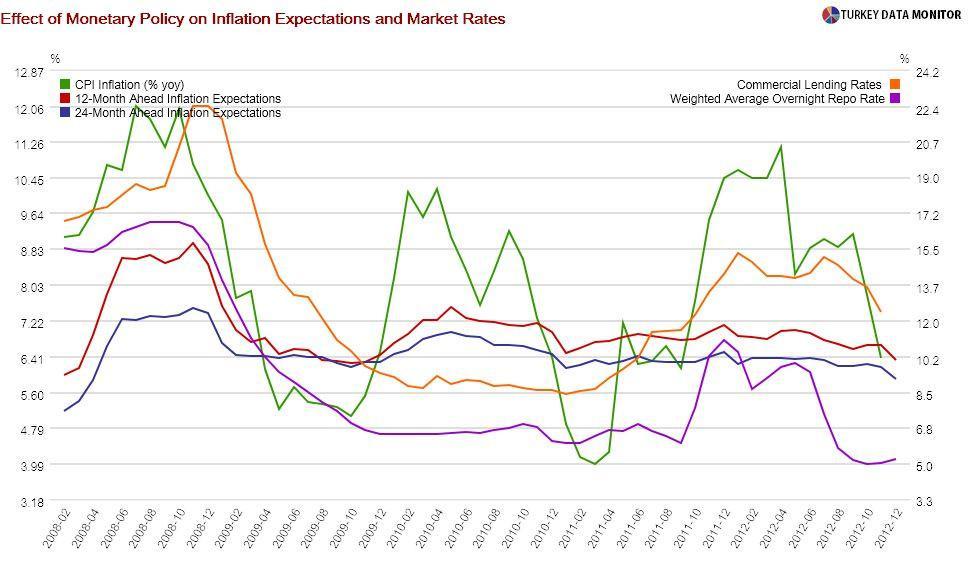

For one thing, another SI chapter by Yanliang Miao shows that the current account adjustment has been driven by a sharp fall in domestic demand. While this was partly engineered by monetary policy, Tchaidze argues a simpler interest rate tightening might have achieved the same result without the costly distortions introduced by unconventional policy. He claims that the transmission of monetary policy to inflation expectations and market interest rates has weakened.

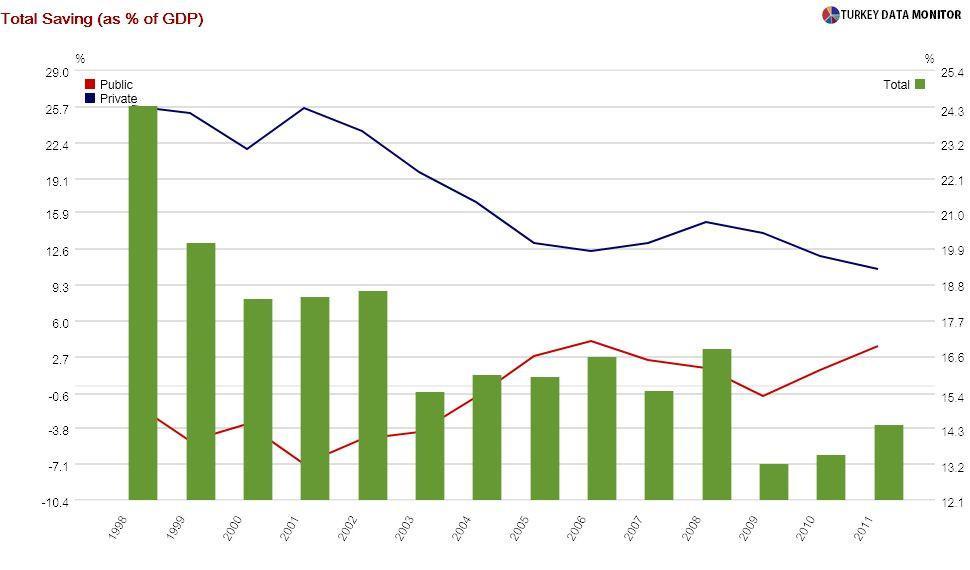

There is also some difference of opinion on the role of fiscal balances in increasing the country’s low savings rate. Government officials argue “past episodes have shown that public savings do not automatically improve national savings.” However, in another SI chapter, Jacques Miniane contends that the increase in public – and the accompanying decline in private – savings in the last decade does not prove crowding out.

Fiscal consolidation was in fact one of the pillars of the post-2001 crisis recovery program. The resulting economic stability, especially lower interest rates and easier access to credit, lowered savings, as several studies have demonstrated. Therefore, Miniane argues a tighter fiscal stance is likely to boost national savings. The Fund argues it could also “relieve pressure on monetary policy, allowing for a more depreciated real exchange rate”.

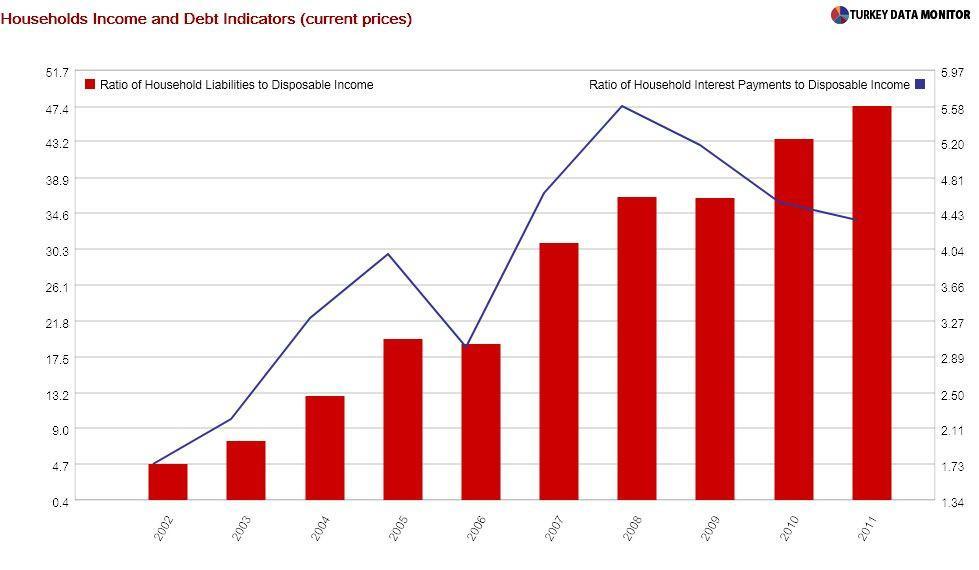

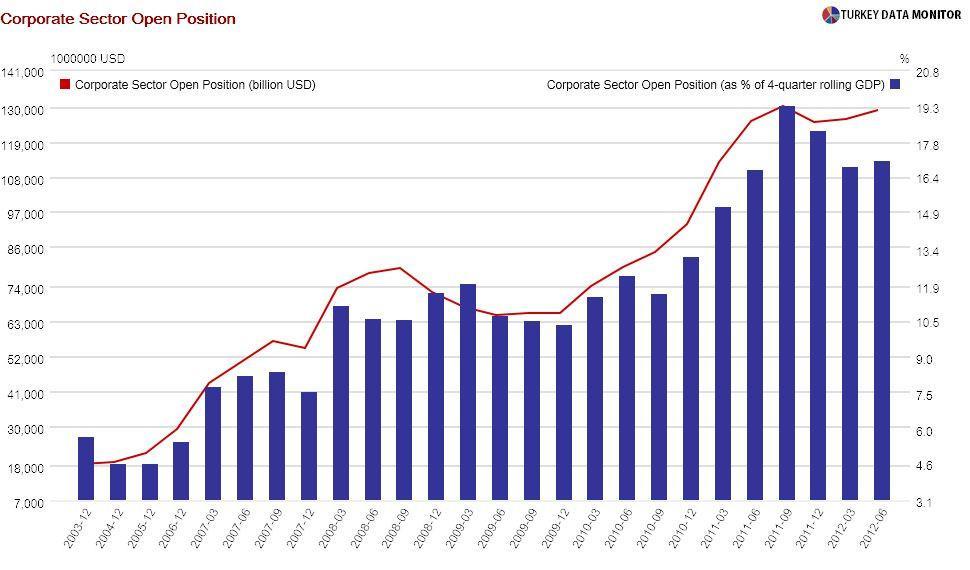

There is also disagreement on leverage. The level of household debt is low compared to peers, which is one of the reasons ratings agency Fitch believes a balance of payments crisis would not be too disruptive. But Heiko Hesse notes in another SI chapter that it has rapidly risen in the last few years. Similarly, his warnings on the large corporate foreign currency (FX) open position seem to be ignored by officials, under the pretext that most FX debt is short-term and rolled over.

These arguments have actually appeared in my columns. However, the Fund has explained them much better than I ever could, so maybe the documents are a Christmas present for me more than anyone else.