Macroeconomics 101 for journalists confused by finance ministers

Turkish Finance Minister Mehmet Şimşek continues to tweet misleading information on the Turkish economy. I’ve

lost all hope in him, but I thought I could help out the journalists he is trying to deceive.

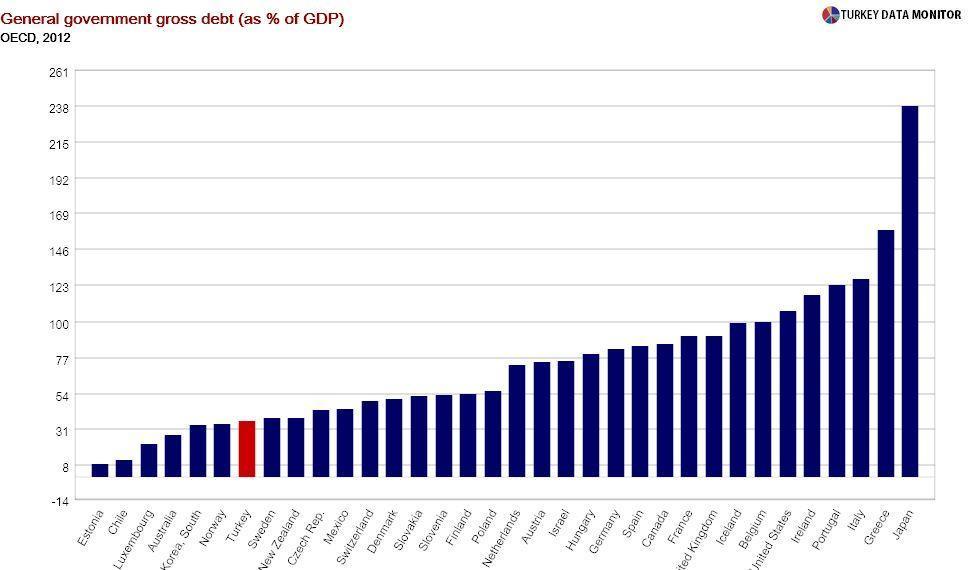

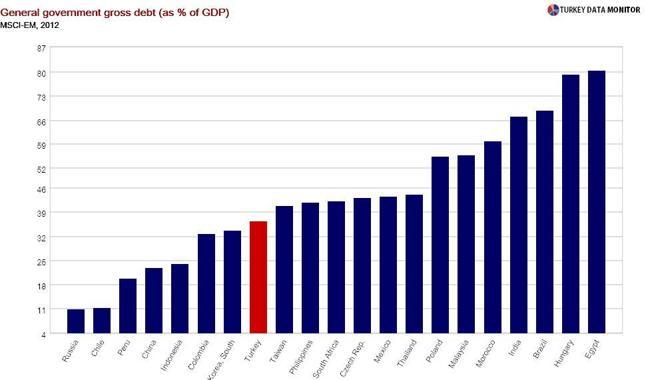

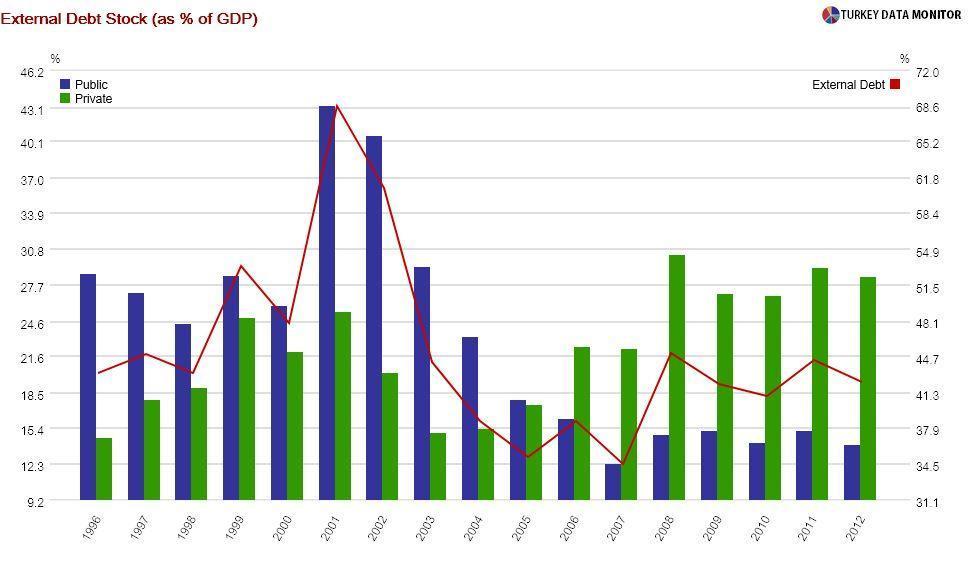

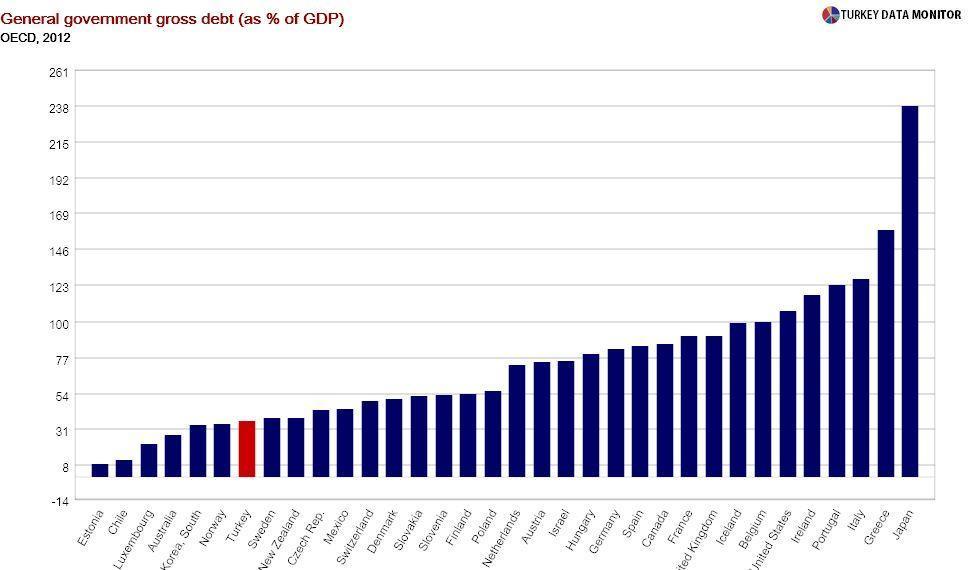

For example, Şimşek recently tweeted that “the gross public debt to GDP ratio is now around 35 percent, about one-third of the OECD average.” While that statement is accurate, and public debt did indeed decrease under the Justice and Development Party (AKP), it is not correct to compare developing and developed countries, as the latter are more tolerant to debt. The average debt ratio of emerging markets is slightly lower than Turkey’s.

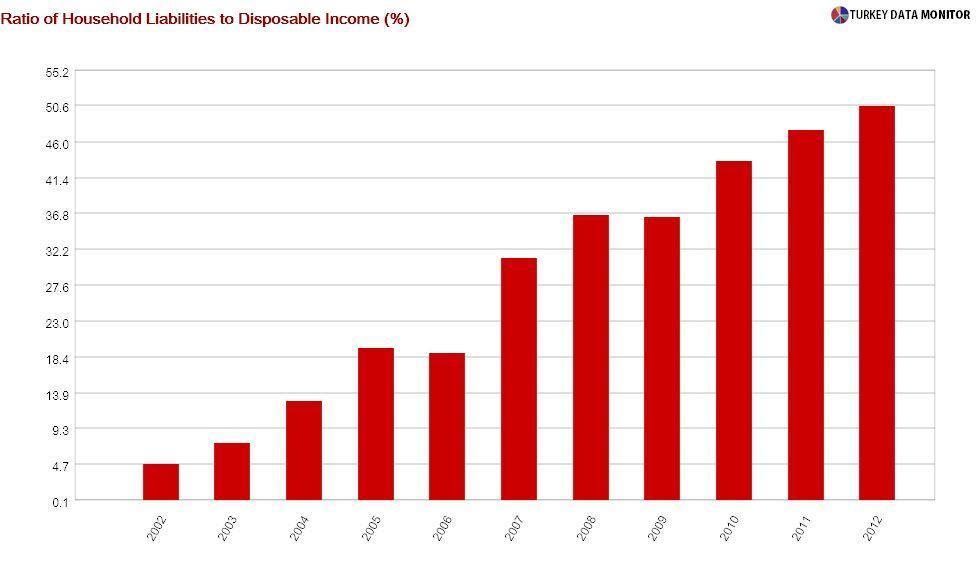

The minister also emphasized Turkey’s low household and corporate debt. At 50.6 percent in 2012, the ratio of household liabilities to disposable income is indeed lower than not only developed countries, but also some of Turkey’s peers. But that ratio was 4.7 percent in 2002.

As for corporates, according to the Istanbul Chamber of Industry’s annual survey, the average debt to equity ratio of the largest 500 firms in Turkey was 141 percent in 2011. Prof. Vefa Tarhan notes that the same ratio is roughly 50 and 70 percent in the U.S. and the EU respectively. He also

explains why Turkish firms should hold less debt than their counterparts in developed countries.

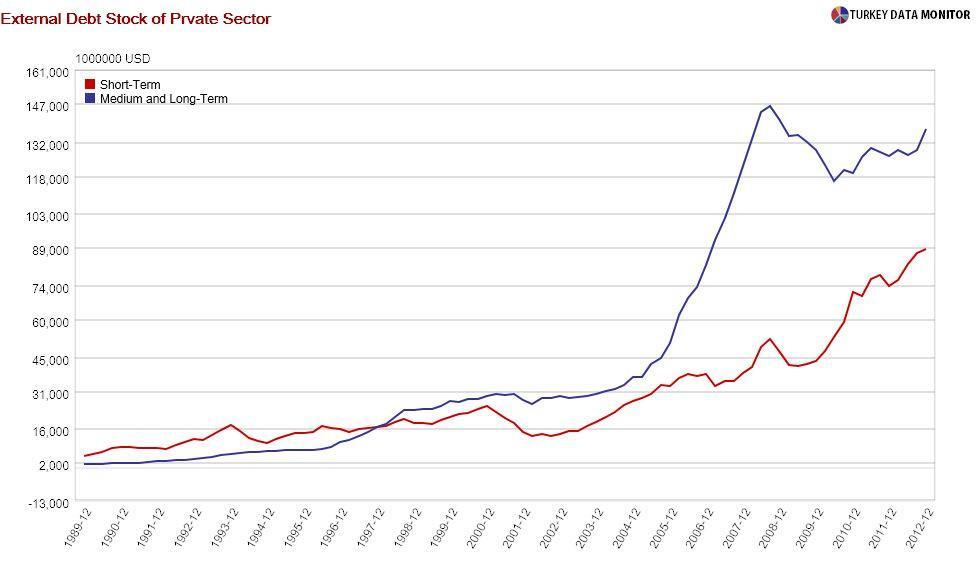

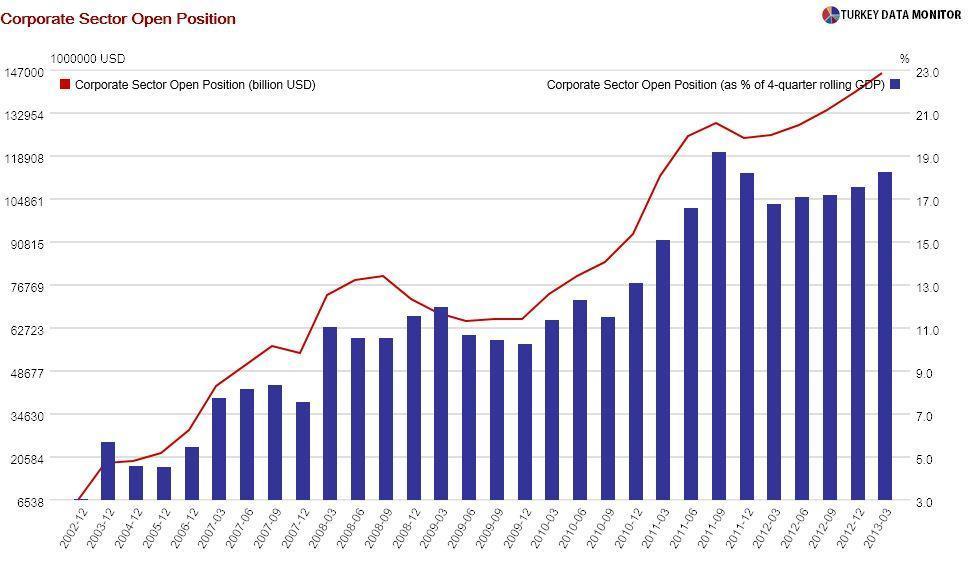

Moreover, Turkish companies have $263 billion of external debt, of which $120 billion is short-term. This wouldn’t be such a problem is these companies were also earning foreign currency (FX), but the difference between their FX assets and liabilities is $150 billion, so they are exposed to significant currency risk.

While it is true that “our Central Bank reserves exceed total public sector external debt”, just like domestic debt, public external debt has been replaced by private sector’s. And that’s why unlike what Şimşek claims, Turkey does not have a fully floating exchange rate. If the Central Bank let the lira wander around freely, many firms’ balance sheets would be ruined.

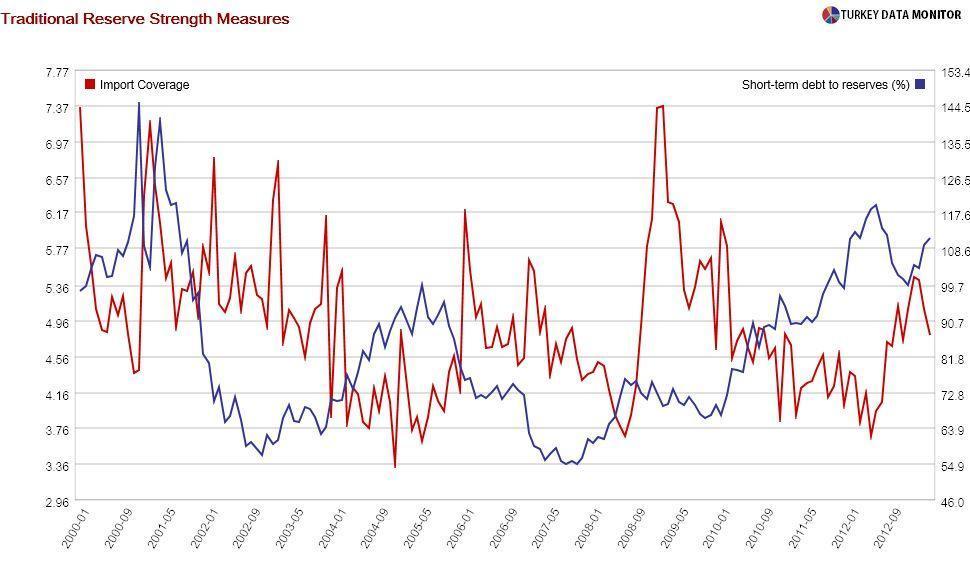

As for reserves, the $100 plus billion figure Şimşek likes to boast is gross. Turkey’s net reserves are around $50 billion. Moreover, the country does not do well under standard reserve strength measures even when gross reserves are used. For example, gross reserves cover less than five months of imports and are less than short-term debt.

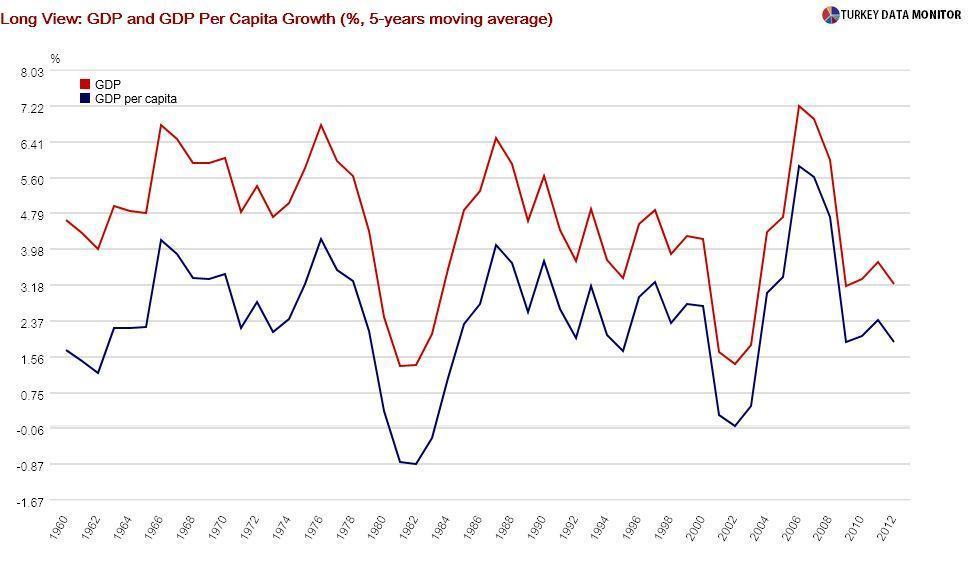

Finally, the growth rates that are Şimşek’s pride and joy were higher than historical five-year averages from 2003 to 2007, but not afterwards. Besides, even if you ignore the bounceback effect after the 2001 crisis, all emerging markets were doing very well in that episode. In fact, Prof. Dani Rodrik

shows that growth was on par with peers until 2007, but lower subsequently.

I do not claim that the AKP has been completely unsuccessful in managing the economy. They

accomplished macroeconomic stability by sticking to the recovery program. Şimşek should emphasize that, rather than try to mislead journalists with what Prof. Tarhan calls “statistical urban legends.”

Turkish Finance Minister Mehmet Şimşek continues to tweet misleading information on the Turkish economy. I’ve lost all hope in him, but I thought I could help out the journalists he is trying to deceive.

Turkish Finance Minister Mehmet Şimşek continues to tweet misleading information on the Turkish economy. I’ve lost all hope in him, but I thought I could help out the journalists he is trying to deceive.