I see debt people

There isn’t a huge Halloween tradition in Turkey, and so I celebrated “witches’ holiday,” as we Turks call it, by watching M. Night Shyamalan’s “The Sixth Sense.”

There isn’t a huge Halloween tradition in Turkey, and so I celebrated “witches’ holiday,” as we Turks call it, by watching M. Night Shyamalan’s “The Sixth Sense.”The next day, on the first day of November, I began seeing debt people. You probably think I am seeing them in my dreams. After all, as fellow Hürriyet Daily News columnist Mustafa Sönmez underlined in his Nov. 3 op-ed, data shows that households have lost their appetite for spending on loans.

No, I don’t see them in my dreams, but in my waking hours. They are walking around like regular people. They don’t see each other. They only see what they want to see. They don’t know they’re in debt. How often do I see them? All the time. They’re everywhere.

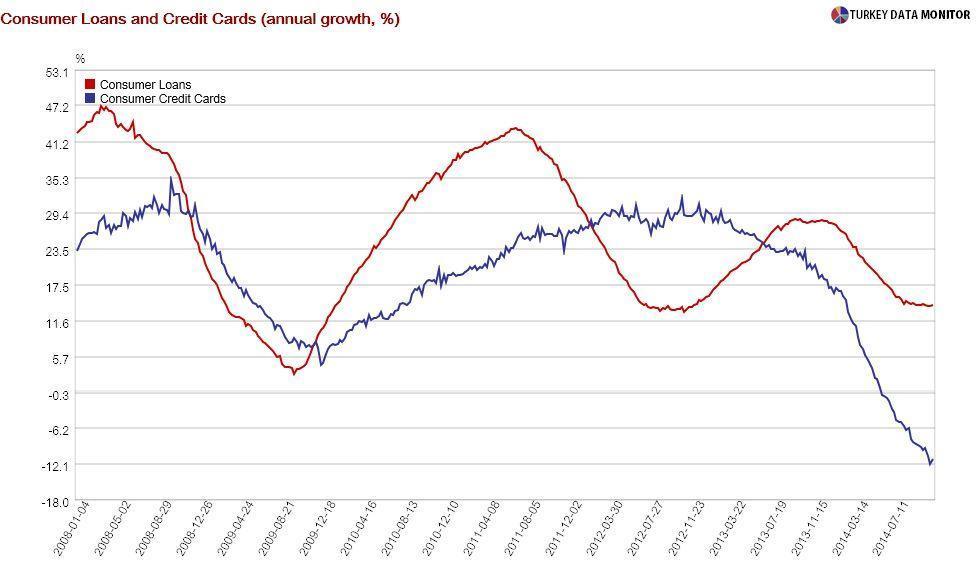

For example, the cab driver who took me to the airport had an iPhone 6 Plus. He told me he could not buy it in installments with his credit card because of the new law limiting installments, but instead used a personal loan to buy it, as well as a dishwasher for his wife. While credit card debt has plunged, annual growth in consumer loans is still around 14 percent.

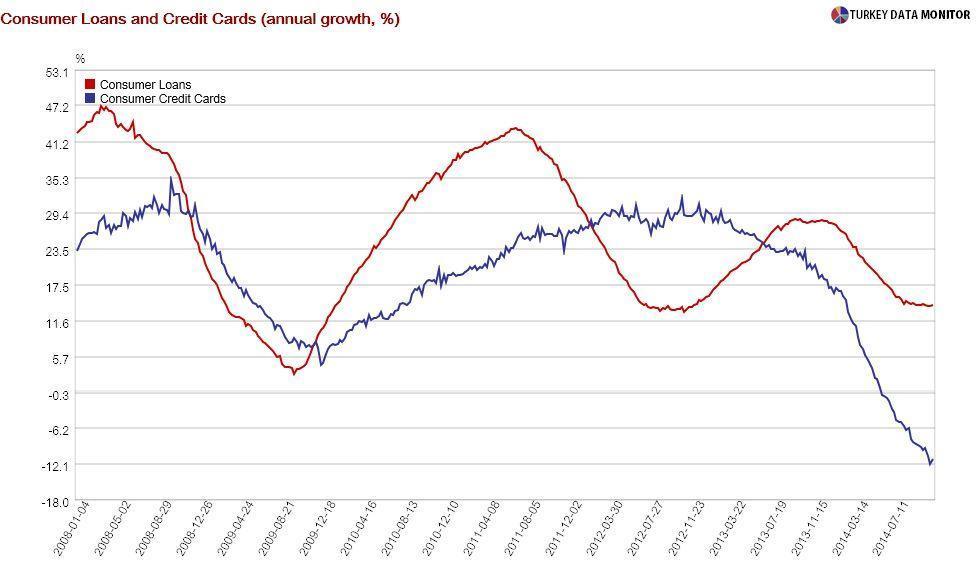

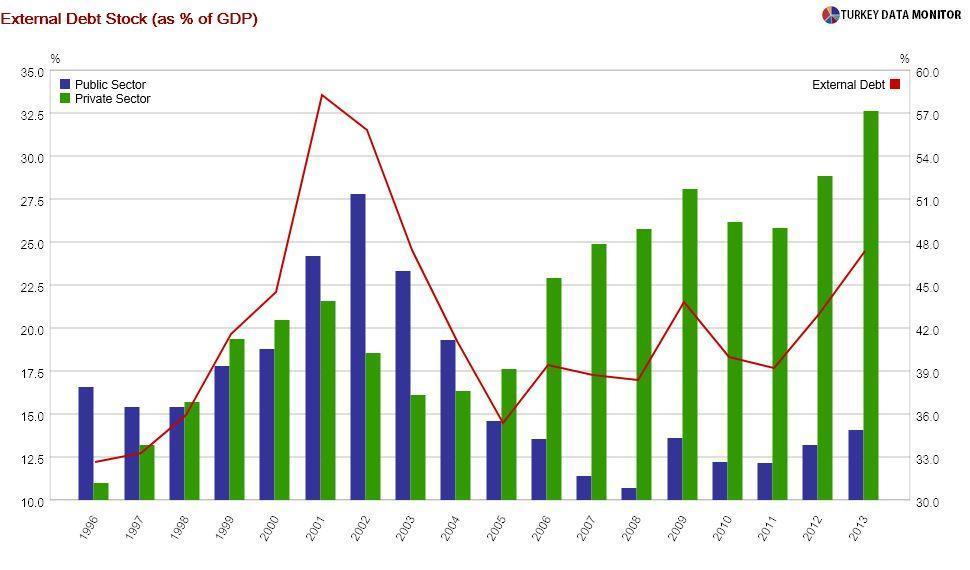

When asked about the rise in debt, Economy Tsar Ali Babacan and Finance Minister Mehmet “Nominal” Şimşek point out that at 55.2 percent, the ratio of household liabilities to personal income is still higher in the U.S. and Europe. Well, those countries had a crisis precisely because of high debt levels.

Moreover, this argument ignores the rapid rise in debt. The ratio of liabilities to income was 4.7 percent in 2002.

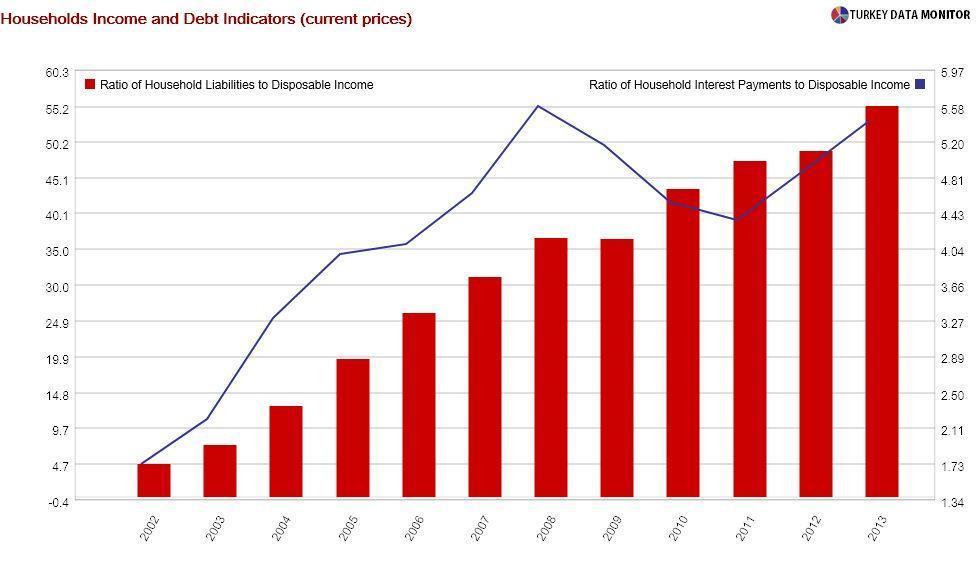

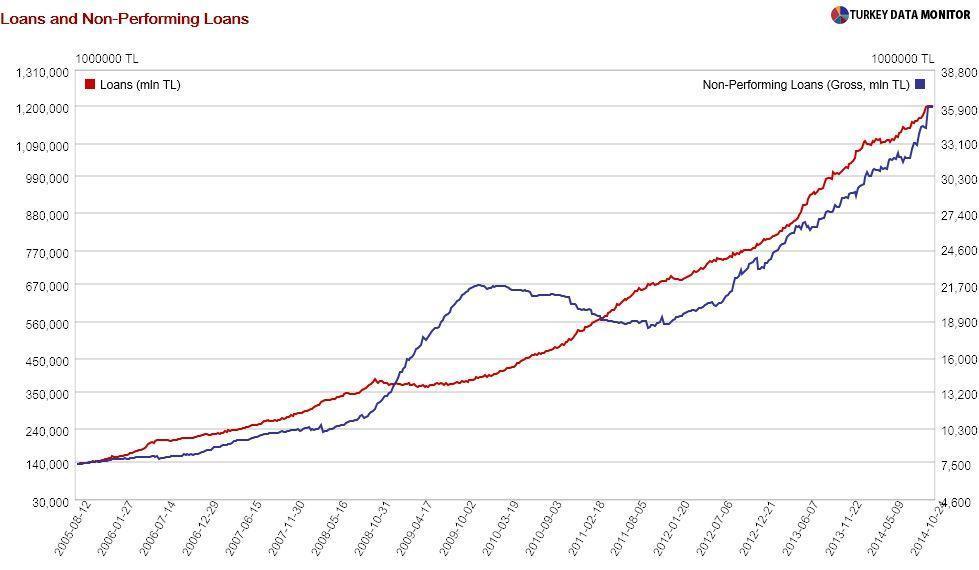

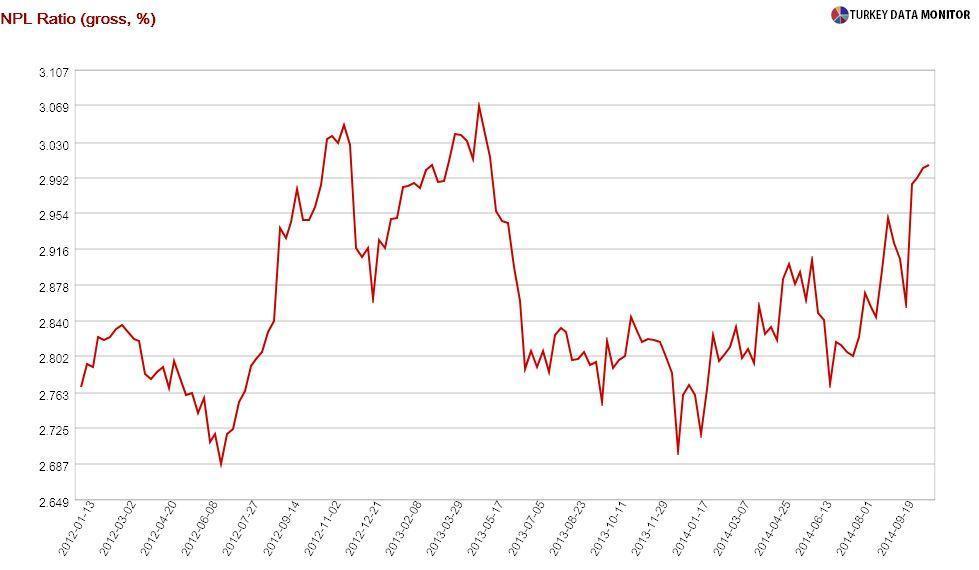

Similarly, officials point out the low ratio of non-performing loans to total loans. They are right, but that only tells you that non-performing loans rose at the same rate as overall loans. In fact, outstanding non-performing and past-due loans have been rising rapidly. According to the Banks Association of Turkey, nearly 150,000 people are behind on their personal loan or credit card payments as of August, 56 percent higher than the same month last year. Even though there are less new loans, consumers are feeling the constraint of their existing loans.

Besides, while still way below its recent peak in 2009, the NPL ratio has been creeping up in the last few months, which can also been seen from the fact that the NPL is rising much faster than total loans.

As growth settles to a lower plateau in the absence of ample external financing and unemployment starts creeping up as a result, it will probably continue to rise.

It is not only individuals. Corporations have increased their debt in recent years. In fact, one of the biggest themes of the Turkish economy during the last decade is that government debt has been replaced by private sector debt.

I am particularly concerned about the rise in external, and more generally foreign currency, debt of corporations, especially in sectors like construction, where most of the revenues are in Turkish Liras. The balance sheets of these companies would take a huge hit if the lira were to depreciate significantly.

But a more detailed analysis will have to wait – as I need to leave now to buy myself an iPhone 6 Plus and an iPad Air 2. After all, I just got an SMS from my bank offering attractive rates for personal loans – which I plan to use. I hope I don’t run into debt people.