General themes on the week’s economic data

We had a lot of data releases in Turkey this week. Rather than delve into the nitty gritties of the statistics, I would like to point out some general themes that emerged.

Business channel CNBC-e’s preliminary consumer confidence index

plunged in January. The sharpest fall is in consumer sentiment, which, other than being historically volatile, could have been affected by the

recent measures to curb loan growth and

tax hikes as well as seasonality. However, domestic demand is likely to fall if the current political crisis is not resolved soon.

The only positive side effect of this demand slowdown is its impact on the country’s current account deficit, which has led Berkeley academic Barry Eichengreen

to single out the county, or blogosphere’s celebrity economist Tyler Cowen to hypothesize that it could

have the next financial crisis. The current account deficit

came in lower than expected in November, but

capital flows decreased, too – even though neither the tapering nor the graft scandal had yet happened.

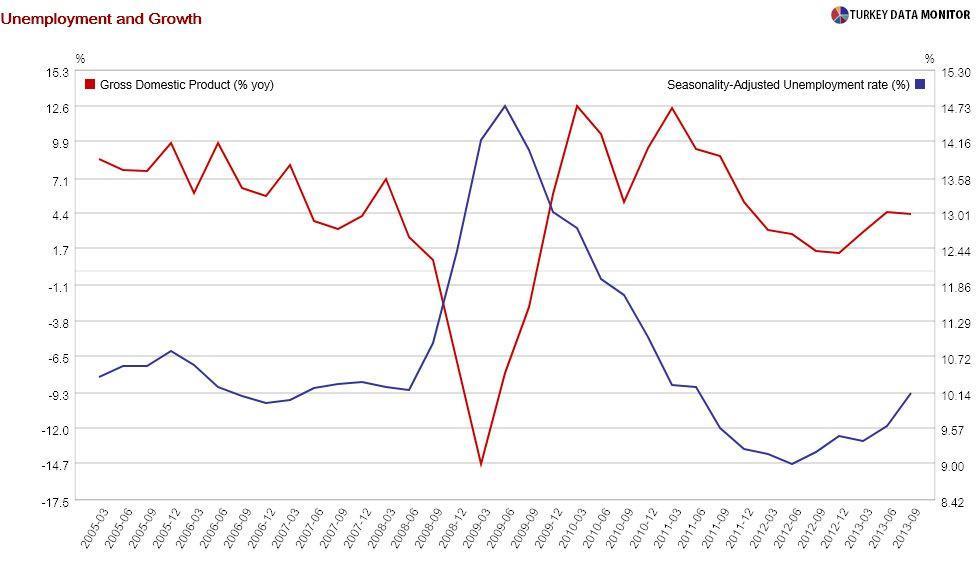

Another important statistic that is dependent on growth is unemployment. The

fall in seasonally-adjusted unemployment in October wasn’t a surprise, given that the economy grew 4.5 and 4.4 percent in the second and third quarters.

As Istanbul think-tank Betam, whom I consider to be Turkey’s labor market experts, noted, the increase in the labor force and employment were in line with structural trends and a growth rate of around 4 percent. I calculated the minimum growth required to keep unemployment at bay to be 3-3.5 percent, which may not be possible in 2014.

As in the past two months, the largest increase in employment was in construction. Interestingly enough, real estate information company REIDIN’s residential property price indices rose in December. I was

really worried in 2012 that the construction bubble would burst because of the supply-demand mismatch. Demand has turned out to be strong since then, supported by ultra-low interest rates. But given

the sector’s involvement in the graft scandal as well as the weak lira – a Central Bank study

claims that 70 percent of the total debt in the sector is in foreign currency – questions remain.

Last but definitely not the least, the annual budget deficit turned out to be the lowest since 2006 when Finance Minister Mehmet “

Nominal” Şimşek

announced the December figures on Jan. 15. I don’t want to be a party pooper, but I have to note that the strong headline figure was driven by value-added taxes on imports and domestic goods. If domestic demand slows down, you should not expect such a strong turnout from these items this year.

More importantly, as the IMF recently noted

in a blog post, the budget is not flexible in the sense that a significant chunk of the expenditures is made up of “non-discretionary primary spending such as compensation to employees and transfers to social security.” On the revenue side, the dependence on indirect taxes means that revenues are correlated with economic growth.

We had a lot of data releases in Turkey this week. Rather than delve into the nitty gritties of the statistics, I would like to point out some general themes that emerged.

We had a lot of data releases in Turkey this week. Rather than delve into the nitty gritties of the statistics, I would like to point out some general themes that emerged.