An economist’s field trip for credit

I have been talking to banks for the past month or so about a loan

for our family business, which has led to some quite interesting observations.

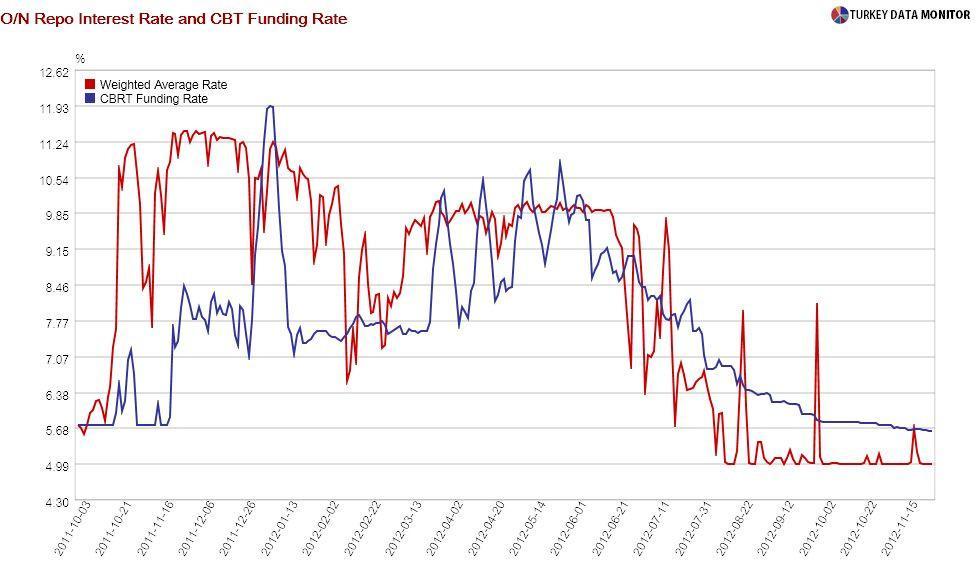

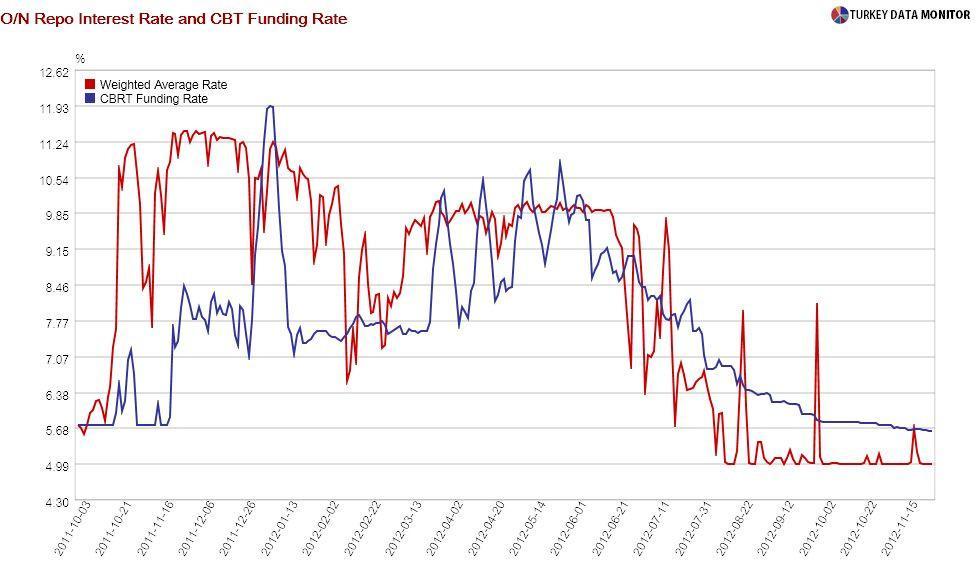

First of all, I am amazed by the sharp fall in lending rates this month alone. Foreign currency (FX) rates have plunged by a full percentage point since Fitch’s decision to upgrade Turkey to investment grade, and the cost of borrowing in Turkish Liras has decreased even more, as the Central Bank’s effective funding and money market rates are very low.

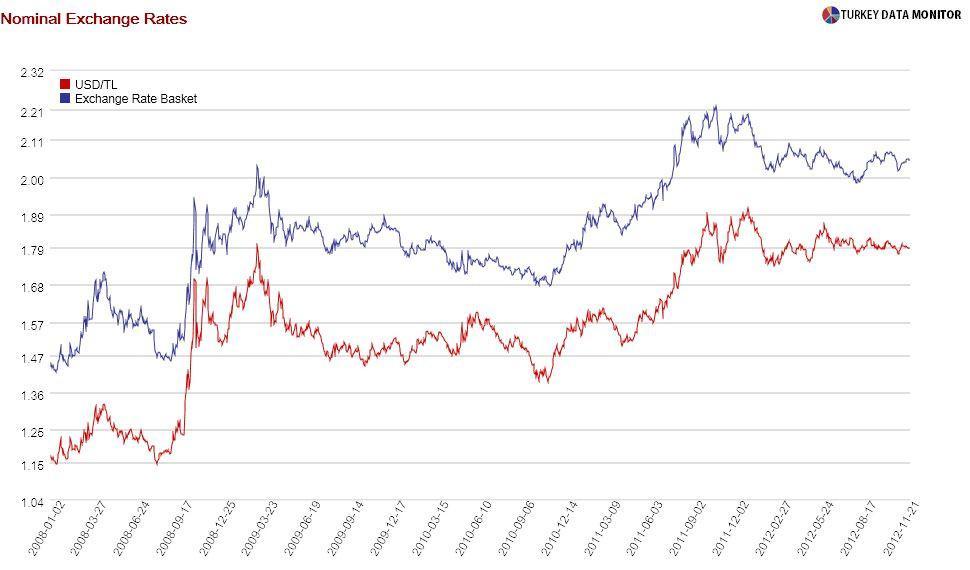

However, there is still a significant difference between foreign and domestic currency lending rates. You can now borrow in dollars or euros at around 4.5 percent per year, whereas commercial lira loan rates are still in double-digits. But FX borrowing is risky: An entrepreneur could lose a lot of money, or even go out of business, if she borrows in FX and the lira depreciates a lot.

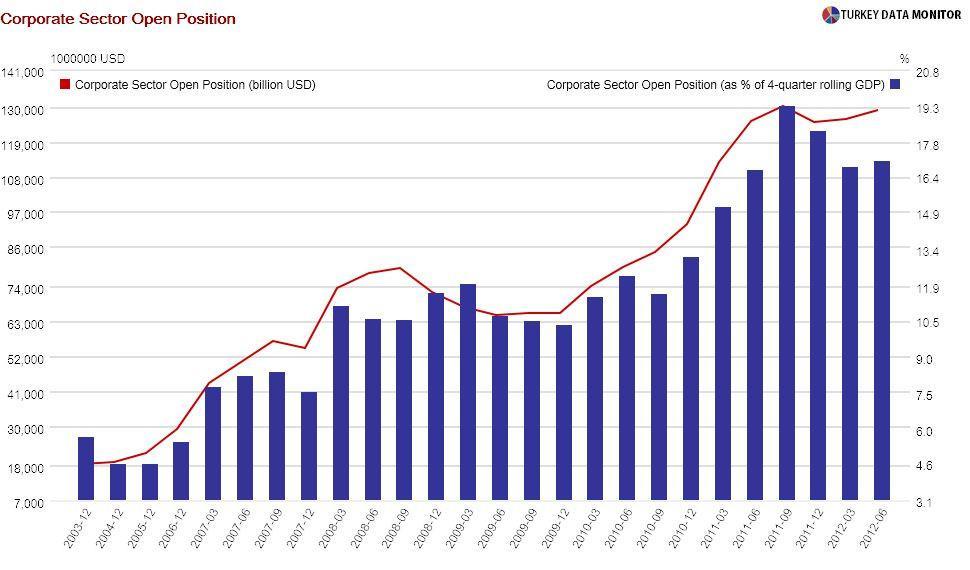

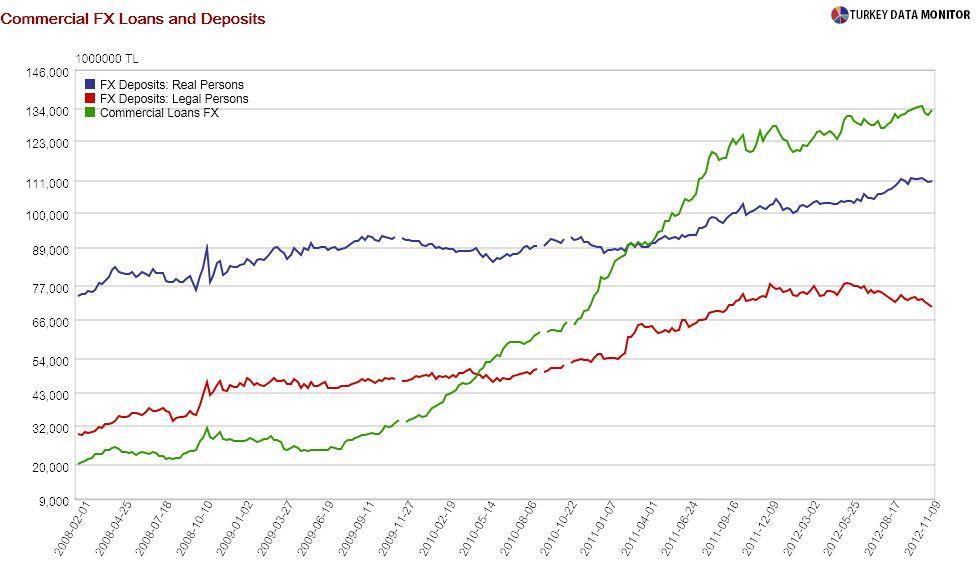

Of course, firms are aware of this

currency mismatch risk, but the difference in cost between lira and foreign currency loans is just too tempting. It is not surprising, therefore, that firms are borrowing more FX and their open positions, which measure the difference between their foreign currency liabilities and assets, are also growing.

Oddly enough, the Central Bank used to warn firms not to take on currency risk until a year ago, but it has almost been mute since then. I think this silence reflects a “mea culpa”: By keeping the lira stable, almost pegged to the dollar and euro, the Bank has been encouraging firms to borrow in FX. As long as they continue with this policy, there is no risk, at least as long as Turkey avoids the balance of payments crisis and exchange rate depreciation that

credit ratings agency Fitch expects.

You may argue the situation is not that bad. After all, while they get their commercial loans in FX, many Turks put their savings in foreign currency, and they could lend to their firms in FX if need be. Besides, as Central Bank Deputy Governor Turalay Kenç

recently told me, most of the firms that borrow in foreign currencies are exporters that earn FX as well, and so there is not much risk.

Based on my own experience, I would argue the opposite: All exporters could be carrying FX risk if they are not earning euros or dollars, which are the staple currencies of FX lending in Turkey. Since our revenues are mainly in pounds, I tried borrowing in that currency, but banks could not offer sterling loans, or interest rates were just too high.

You may wonder why firms do not

hedge their foreign currency risk by fixing the future value of the exchange rate with forwards or options, but for small businesses, those instruments are either unavailable or quite expensive for long maturities/uncommon currency pairs. My own attempts at fixing the euro-pound exchange rate ended in vain.

And now I am about to take on a euro loan and significant currency risk despite being an exporter - thanks to Turkey’s underdeveloped financial markets.

I have been talking to banks for the past month or so about a loan for our family business, which has led to some quite interesting observations.

I have been talking to banks for the past month or so about a loan for our family business, which has led to some quite interesting observations.