Oil rises on Europe woes, Tehran fears

SINGAPORE - Agence France-Presse

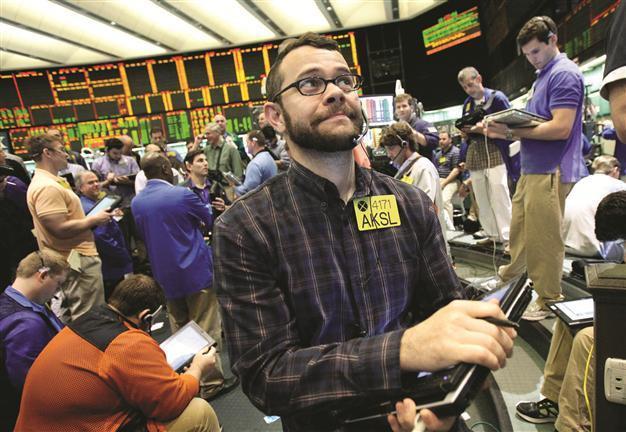

Traders work in the oil options pit at the New York Mercantile Exchange. New York’s main contract West Texas Intermediate crude for delivery in July was $91.75 yesterday. AP photo

Oil prices edged higher in Asian trade Monday as major crude producer Iran and Western powers failed to reach agreement over Tehran’s nuclear program, analysts said.Markets were also supported by signs Greeks would elect a pro-austerity government in upcoming polls, easing concerns the debt-wracked country would exit the eurozone and trigger a global economic crisis.

New York’s main contract, West Texas Intermediate crude for delivery in July was up 89 cents to $91.75 per barrel while Brent North Sea crude for July gained 68 cents to $107.51 in the afternoon.

“The Iranian stand-off looks likely it will remain difficult to break down,” said Justin Harper, market strategist at IG Markets Singapore. Over the weekend, the head of Iran’s Atomic Energy Organization said Tehran had “no reason” to suspend its enrichment of uranium to 20 percent.

The issue of Tehran’s uranium enrichment and stockpile had been at the center of talks last week between Iran and major world powers -- who believe the country’s nuclear activities mask a push to build atomic weapons.

Iran, already under heavy sanctions for refusing to suspend its nuclear program, has denied the accusations and threatened to disrupt Middle East oil supply if it is faced with further sanctions.

“Iran is desperate for oil revenues to return and was hoping its more accommodating attitude would see oil supply bans lifted immediately,” said Harper.

“This has back-fired and it is now back to square one as it reverts to its traditional defiant mood,” he added.

Eurozone effect

Prices were also lifted by a slight easing of bearish sentiment over the eurozone’s debt troubles, analysts said. Opinion polls published Sunday showed Greek pro-bailout conservative party New Democracy is expected to secure most seats in the June 17 general elections but without an outright majority.

Such a result would be welcomed by investors who feared that radical left party Syriza -- which rejects austerity measures outright -- would sweep into power.