October morale boost in local currencies against the dollar

Mustafa Sönmez - mustafasnmz@hotmail.com

AFP photo

Within the framework of the U.S. Federal Reserve’s (the Fed) normalization process, the uncertainty on when the first rate hike will happen is continuing, thus allowing several local currencies, including the Turkish Lira, to catch their breaths and take a break in their losses during the month of October.

While the Fed’s uncertain stance caused foreign funds to prefer emerging countries again, this trend made local currencies gain value against the dollar – even though in small amounts – and it has stopped their devaluation in October.

According to IMF data, among emerging countries the highest increase in value was seen in the Indonesian currency with nearly 8 percent. The Colombian peso also gained 5.2 percent in value against the dollar in October. The Russian ruble, which particularly had huge losses against the dollar in 2014, gained strength at a rate of 4.8 percent against the dollar in October. South Korean currency won and Malaysian currency gained more than 4 percent of value in October.

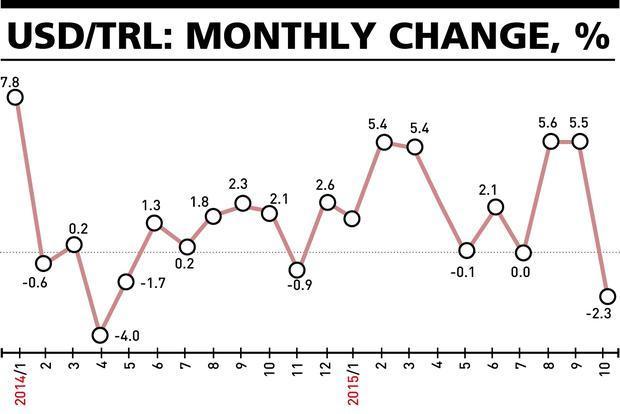

The lira’s average dollar price in October was 2.94 liras and compared to September’s average of 3.01 liras, its value gain was 2.3 percent.

The South African rand among other emerging countries also stopped losing blood in October and gained around 3 percent of value while the Mexican peso gained 2 percent. Others among the emerging ones, the Indian rupee and the Brazilian real gained about 1 percent.

The Chinese yuan on the other hand lost only 0.1 percent value against the dollar in October. The euro gained 0.6 percent against the dollar while among non-euro zone countries the Czech currency lost 0.4 and the Polish zloty lost 0.5 percent against the dollar. The U.K. pound sterling on the other hand lost 1.7 percent value against the dollar. The Japanese yen lost 0.6 percent.

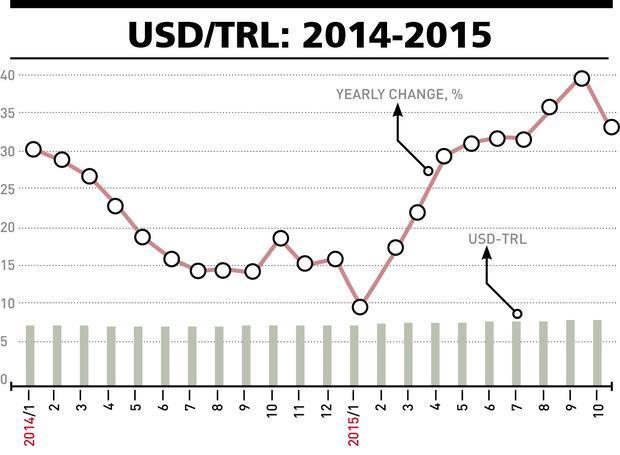

Morale boost for the lira The lira, which lost an average of 3.2 percent every month in 2015 and by the end of September reached an annual devaluation of 36 percent, was able to catch its breath slightly with the return of withdrawn foreign capital in October. The dollar/lira rate which was 3.05 lira at the beginning of October dropped to 2.9 lira at the end of the month, averaging 2.94 lira for the month, gaining 2.3 percent value compared to September.

In the October performance of the lira against the dollar, the comeback of foreign investors was effective. Before October, the foreign capital exit, which reached an average of $900 million monthly, left its place to a net inflow in October, although it is only $200 million. In October, foreigners stayed away from government securities; they invested more than $500 million on stocks, prices of which had dropped. While this return slowed down the climb in the dollar’s price, it has also curbed, for the moment, the rush toward the dollar.

Despite the halt in the lira’s devaluation in October and despite its gaining value, its loss of value for the past 12 months stayed at 30 percent. This value loss is again the most important devaluation rate compared to others.

There are some who explain the performance of the lira in October with the return of foreigners because of the uncertainty of the Fed; there are also others who interpret it as the preference of foreigners to return, having picked up the likelihood of a decrease in political risk.

There are those who claim that the lira has gained value because of expectations that the political uncertainty will come to an end, politicians will end the political deadlock of five months and form the government.

The credit risk of Turkey increased with the Justice and Development Party (AKP) losing its absolute majority after the June 7 elections, the first time since 2002 and following the inability of political groups to form a coalition government, thus with the finance markets of the country becoming more sensitive to the slowdown of emerging markets. However, there are some who argue that the expectation of a government to be formed after the elections has caused the appetite for Turkish assets to increase.

The US situation

Including Turkey, the Fed interest rate decision plays the key role in determining the situation of local currencies in emerging countries against the dollar and is regarded as the main variable determining the direction of foreign capital movements.

The course of indicators in the U.S., on the other hand, causes the Fed rate hike decision to be postponed again and again. Despite the improvement in employment markets, the pressure of increase in low wages, descending energy prices and because of the strengthening dollar, inflation continues to stay below the target rate. It is not only domestic economic circumstances but also global economic outlook that will definitely be effective in the timing of the rate hike decision of Fed.

Because of the uncertainty created by the normalization period of the Fed’s monetary policy and because of the slowdown of economic activities in developing countries, between the period of July and September, a significant portion of developing countries’ economies opted for changes in benchmark interest rates. The Chinese and Russian central banks once and Indian central bank twice decreased interest rates while the South African central bank twice increased rates and the Brazilian central bank once during the three month period.

China and other emerging countries One of the most important variables that influence the Fed’s rate decision is China’s situation.

The downward risks in the Chinese economy are becoming distinct. The weakening export performance of the Chinese economy, the sharp fall in producer prices and the observed slowing down in the manufacturing industry, as well as the fluctuations experienced in stock and forex markets in August, are seen as the biggest risks ahead of China in reaching its growth target of 7 percent in 2015.

China devaluated its local currency 3 percent on Aug. 11 and Aug. 13 to provide foreign exchange stability and has taken steps to make market actors in the forex market more active. The target of the intervention is thought to be maintaining the high employment and growth path of the Chinese economy and fasten the process of becoming an international reserve and thus increasing the diplomatic reputation of the country.

Brazil, which is also the most important trade partner of China in emerging countries, is continuing to be affected negatively from the slowdown in China. In the first quarter of the year, the Brazilian economy shrank 1.7 percent and 2.4 percent in the second quarter, thus entering a recession. Three major international credit rating agencies lowered Brazil’s rating in August and September one after the other.

Standard & Poor’s (S&P) lowered Brazil’s rating to “junk,” a level where no investment is recommended.

Meanwhile, India, which stood out with its growth at the beginning of 2015, lost speed in the second quarter of the year. Its growth which was 7.5 percent in the first quarter became 7 percent in the second quarter because of the weakening of the global demand and the Chinese economy.

As part of another emerging country, Russia’s economy is continuing to shrink. Low oil prices which have been ongoing for a long time as well as international sanctions continue to negatively affect the Russian economy. In the first quarter of 2015, the Russian economy shrank 2.2 percent and again in the second quarter it went down 4.6 percent.

An important variable that will affect the Fed’s rate decision and, therefore, the fate of local currencies, is oil prices. They hit their lowest in six years in January, but then started increasing until June when they entered a decreasing trend again. In addition to the U.S., West Africa and Kazakhstan’s increasing oil supply, the return of Iran to global markets have caused an increase in global supply. When considered together with the slowdown in global economic activity, this horizontal course in oil prices are expected to continue.