New law to extend consumer protection to come into play

ANKARA

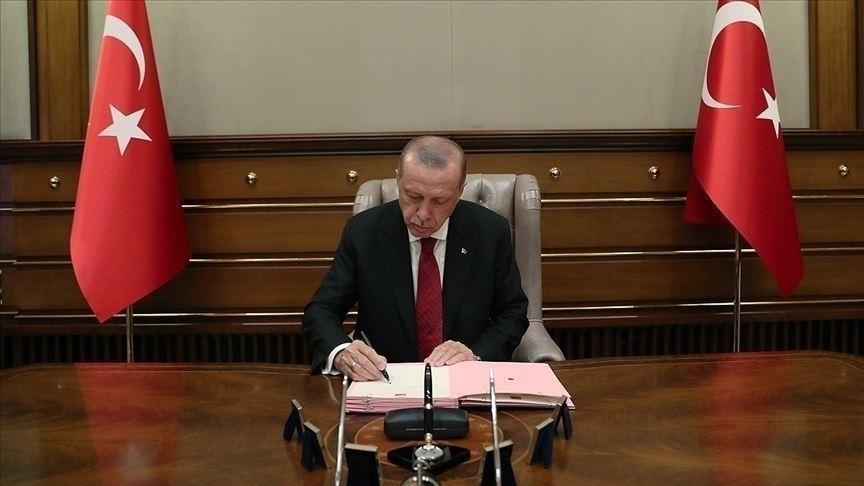

Customs Minister Hayati Yazıcı has said the new law will extend the scope of consumer protection and ensure more fair and transparent contracts. AA Photo

The Customs and Trade Ministry has revealed details of the new Consumer Law, which introduces a series of new measures to regulate commercial relations.Speaking at a press meeting to announce the regulations introduced by the new law, Customs Minister Hayati Yazıcı said it is aimed at ensuring “transparent and understandable contracts between customers and companies.”

The new law aims to avoid “undeserved” commission and fees in the financial sector, in which service receivers have the most problems, Yazıcı said, adding that the biggest focus of these new measures would be preventing customers from encountering surprise payments that they were not previously aware of.

- As previously announced, the government has made it obligatory for banks to offer at least one type of credit card that doesn’t have a fixed annual fee. Banks will also no longer be able to charge commission and fees from the credit cards that customers are forced to open to receive loans.

- Yazıcı also said the new law would oblige lenders to allow customers to use alternative insurance companies even if they have used credit to work with their banks’ insurance subsidiary.

- Mortgage borrowers who pay their debt early will also be provided with more convenience than before.

Speaking to reporters, Yazıcı also said the country’s banking watchdog would be introducing secondary changes to deal with the remaining issues:

- Permitting buyers to give up on a deal to buy a house up until the house delivery date, on condition of paying a 2 percent fine.

- Subscription contracts signed for services such as water, electricity and the Internet can be cancelled if the consumer sees that the seller is not fulfilling its contractual duties.

- The scope of issues about which customers can apply to consumer courts will be extended.