Nations seek to stimulate economies

Bloomberg

refid:10319858 ilişkili resim dosyası

|

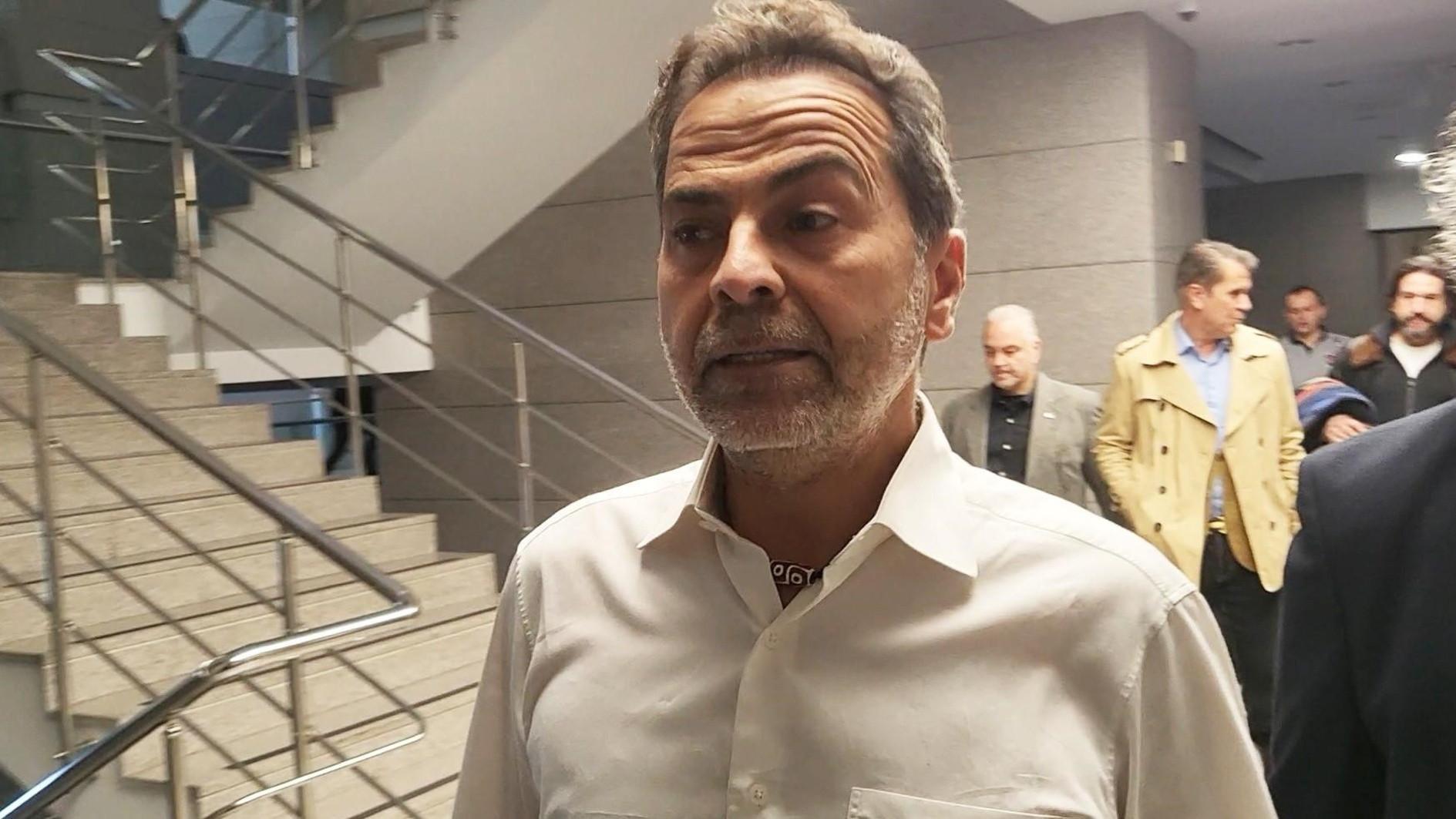

IMF as a system of early warning Turkish Economy Minister Mehmet Şimşek said the Group of 20 industrialized and developing countries discussed whether the IMF may become an “early warning” system to identify potential crises. “Leaders will decide on a new financial architecture,” Şimşek said in an interview in Sao Paulo. There's “a lot of focus on the IMF to be the main institution for surveillance, for early warning.” Still, Simsek warned not to be overly optimistic on the outcome of the G-20 talks in Sao Paulo, which will continue in Washington Nov. 15. “One should keep expectations reasonably low,” he said. |

Growth dragged down

The ministers are meeting amid evidence the financial crisis that is pushing the world's biggest industrialized economies into recession is dragging down growth in Asia and Latin America. India, Russia and Brazil have already injected funds into commercial banks and South Korea last week unveiled a 14 trillion won ($10.8 billion) fiscal stimulus plan.

“This is a global crisis and demands global solutions,” Brazilian President Luiz Inacio Lula da Silva told delegates. “The participation of the developing world is essential.”

Finance ministers and central bankers from the G-20 were meeting in Sao Paulo to lay the groundwork for a Nov. 15 heads of state summit in Washington.

“Finance ministers of BRIC countries have worked out measures for the near future,” Kudrin said. “We have agreed that we can jointly increase trade and capital flows. The major thing is that we are prepared to coordinate.”

The International Monetary Fund, or IMF, is forecasting that Britain, Japan and the euro region will all contract next year, their first simultaneous recessions since the Second World War. With slower growth damping inflationary pressures, central banks are likely to cut borrowing costs further, Canadian Finance Minister Jim Flaherty said.

Interest rate cuts

“There are ongoing conversations about who plans to do what when” on interest rates, Flaherty said. “I expect that these discussions will lead to some degree of coordinated action.”

Canada's central bank joined the Fed, the European Central Bank and the Bank of England in an unprecedented coordinated interest rate cut on Oct. 8 after the collapse of Lehman Brothers sent credit markets into seizure. The Reserve Bank of India on Nov. 1 lowered its main interest rate for the second time in two weeks while China cut its key interest rate for the third time in two months on Oct. 29.

“We are closely watching the development of the financial crisis and the situation regarding global activity,” Zhou Xiaochuan, governor of the People's Bank of China, said Saturday. “If China can maintain domestic demand, it's helpful for global stability.”

Calls from the IMF and U.K. Prime Minister Gordon Brown for coordinated fiscal stimulus will probably fail to win backing from the group because some countries are concerned about increasing public spending, Flaherty said.

“Ideally that would be so - it's just not likely to happen,” Flaherty said. “Some countries feel that they are more constrained than others.”

Photo: Reuters