Moody’s downgrades Greek Cyprus to junk

NICOSIA - The Associated Press

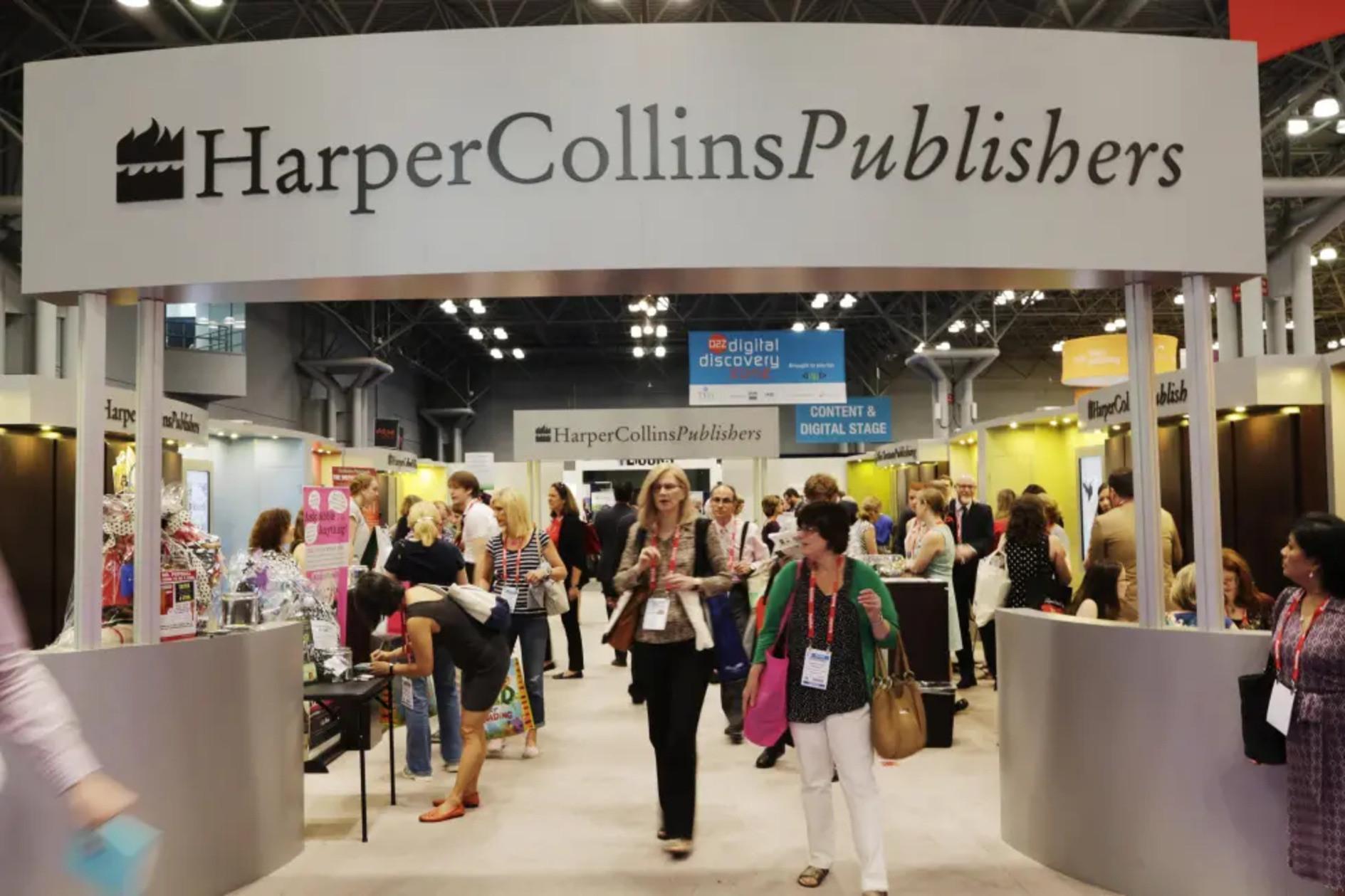

A passenger waits at Larnaca international airport, Cyprus. Cypriot air traffic controllers walked off the job for four hours last week to protest stalled negotiations. AP photo

International ratings agency Moody’s downgraded euro member Greek Cyprus to junk status yesterday on heightened concerns over the exposure of its large banking sector to Greece.The agency reduced its rating on Greek Cyprus by one notch to Ba1 and assigned a negative outlook, meaning that further downgrades are possible.

Moody’s is the second agency to push the island nation’s credit rating to junk after Standard & Poor’s in January, mainly because of the banking system’s Greek exposure. Fitch rates Greek Cyprus a notch above junk.

The downgrades have effectively shut Greek Cyprus out of the international markets, prompting it to seek a 2.5 billion euros ($3.3 billion) low-interest loan from Russia to meet its financing needs for this year.

Moody’s said apart from their significant Greek government bold holdings, Greek Cypriot banks’ woes are compounded by their large Greek loan portfolios. It said those stresses on the banking system combined with weak private sector confidence and adverse external conditions will constrain the island’s growth potential in the next few years and add to the fiscal challenges facing the government.

“Although the government seems well positioned to achieve significant progress this year, unfavorable economic conditions present implementation risks in 2013 and beyond,” Moody’s said.

The agency said that although Greek Cypriot banks are looking to bolster their capital buffers through private sector investment, there is a “very material risk” that the government will have to step in to cover a likely shortfall that could amount to 5-10 percent of the island’s gross domestic product. That could, in turn, deepen the eurozone member’s debt load.

The Greek Cyprus Finance Ministry said in a statement that the agency’s downgrade is not justified because its reasoning does not substantially vary from the one it used for its previous ratings cut last November.

It said the Greek Cyprus government is aware of the challenges that the economy faces in light of Europe’s debt crisis and the unfolding situation in Greece.

“The government remains committed to meeting its fiscal targets, implementing growth-oriented measures and policies and to securing the necessary funding to cover the state’s financial needs,” the ministry said.

It added that in conjunction with the central bank, it’s looking at all options to effectively handle the problems that banks face.