Lack of appetite in investments persists in Turkey

Mustafa Sönmez - mustafasnmz@hotmail.com

Turkey’s economy has been slowing down for the last four years, although there was some recovery in 2015.

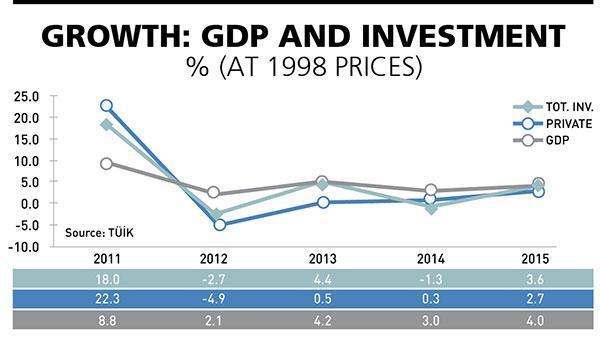

Turkey’s economy has been slowing down for the last four years, although there was some recovery in 2015. The 2015 GDP data, which was announced at the end of March, has shown that the contribution of investments to the economic growth of 4 percent was around one-fourth, equaling 0.9 percent. This figure is comparatively welcome as the 2014 figure was negative. While the contribution of investments was again one-fourth of GDP growth in 2013, the figure was again negative in 2012. How the economic growth can be accelerated again will be one of the main issues challenging the Turkish economy in the near future.

Growth and investments

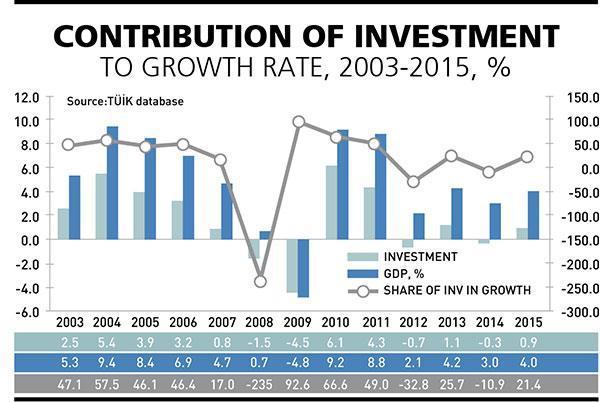

Household consumption spending and investments constitute the two pillars of economic growth. In Turkey, the former now plays a bigger role, although the latter was the main source of GDP growth between 2003 and 2007, when Turkey welcomed a huge influx of foreign capital. In those years, a massive foreign capital inflow in the form of FDI, stock exchange investments and foreign loans boosted domestic demand, and Turkey’s economic growth duly hit 7 percent.

This investment spending provided 3 percentage points to the 7 percent in GDP growth during this “dolce vita” period. It means that almost 43 percent of the growth was fueled by investments.

During the 2008-2009 global economic crisis, the Turkish economy shrank, and the country saw an outflow of foreign capital, just like many other countries. Both the foreign exchange rates and interest rates skyrocketed, cooling down investments and loosening expectations.

By the end of 2009, foreign investors had started to return to Turkey’s stock exchanges, lowering the forex and interest rates. This enabled domestic demand and investments to boom again. The share of investments in the 9 percent of GDP growth hit 60 percent between 2010 and 2011.

The anomaly of the skyrocketing growth in those years was the dangerously rising current account deficit. The share of the current account gap almost totaled 10 percent of the national income. As this was not sustainable, the economy’s administrators announced 2012 as the “year of cooling down,” and the economy closed that year with around just 2 percent growth.

The economic growth declined to an average of 3.5 percent between 2012 and 2015, dramatically pushing down investments, especially by the private sector, although there was some slight recovery in 2015.

Investments by public, private sectors

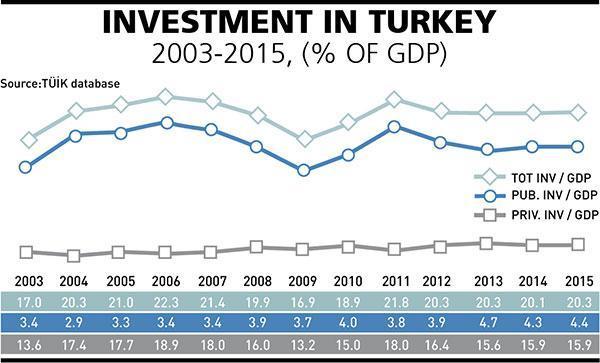

With the effect of neoliberal economic policies after the 1980s, the share of the public sector started to decrease in total investments, especially in the industrial and energy sectors.

The share of total investments in the national income was 17 percent in 2003. While the private sector made almost 14 percent, the public sector was responsible for just 3 percent of this total.

The share of investments in the national income was around 20 percent, but only 4.5 percent was made by the public sector. Namely, just one-fifth of the investments were made by the public sector.

Investment by sectors

Investments in the manufacturing sector ranked highest, although the share of the sector has been decreasing in recent years. This industry is followed by the transport and communications and housing sectors’ which among them conducted around two-thirds of all investments.

As a result of a massive privatization program, the share of the state in investments in the manufacturing sector has contracted dramatically. For instance, 95 percent of the investments in the sector were made by the private sector.

The share of state investments in the transport and communications sector has been much higher than in others. While some 41 percent of investments in this sector were made by the public sector, the remaining 59 percent was by the private sector.

Housing investments, which are of great importance for the country’s construction-based growth model, have taken around 20 percent of the share in total investments with the private sector making around 99 percent of these construction investments. The private sector has also had the lion’s share in tourism investments, which constitute around 6 percent of total investments.

The health sector and the education sector used to be dominated by the public sector in Turkey. The private sector has, however, started to increase its share in health and educational investments as well. These two sectors had around a 10.5 percent of share in total investments in 2015. While almost half of educational investments were made by the private sector, around three quarters of health investments were made by private companies rather than the state.

The energy sector has received 4 percent of total investments. Although the share of the public sector in energy witnessed a gradual decline, its share has increased to 31 percent with planned nuclear power plant investments.

The state’s share in agricultural investments is around 60 percent with huge irrigation investments as part of the Southeast Anatolia Project as well as in the Konya plains.

The public sector has made investments mainly in transportation, education, agriculture and partly in energy. On the other hand, the private sector has taken the lion’s share in investments in manufacturing, transportation and communications, housing, tourism, health, energy and mining.

Deceleration in investments

The slowdown in investments in the last five years has not been due to the deceleration in public investments but in private investments. The state has continued making mainly infrastructure, energy and irrigation investments, preserving its 20 percent share in total investments in a bid to reach growth targets in line with budget limits. The state is expected to keep investing to realize its target of 4.5 percent annual growth in 2016.

The private sector, however, has apparently cooled down its investments, mainly in the manufacturing sector, in light of the slowdown in domestic and foreign demand. While the share of the private sector in manufacturing investments was 40 percent in 2008, this figure regressed to 35 percent in 2015.

Investment climate

Both local and foreign businesses make their investment decisions by reviewing economic conditions and calculating political and geopolitical risks. Investors have adopted a “wait and see” tendency after the U.S. Federal Reserve started to signal a rate hike in 2013, precipitating an outflow of hot money and a rapid increase in U.S. dollar-Turkish Lira parity. The rise in the U.S. dollar’s value has pushed up interest rates, shrinking domestic consumption, which is the main constituent of economic growth. This has been the main reason why the private sector cooled down its investments, mainly in the manufacturing sector.

In addition to the rising economic fragilities, an intensive election cycle in Turkey in 2014 and 2015 was also responsible for more cautious behavior by investors.

The escalating tensions in the Middle East and their reflections in Turkey as well as the country’s rising problems with some of its neighbors have also restrained local and foreign investment decisions.

It will be possible for Turkey to decrease its unemployment rate to around 10 percent only through new investments. If Turkey wishes to revive its investment climate once more, it must undertake critical economic, political and diplomatic reforms.