Japan poll buffets vulnerable yen

LONDON - Reuters

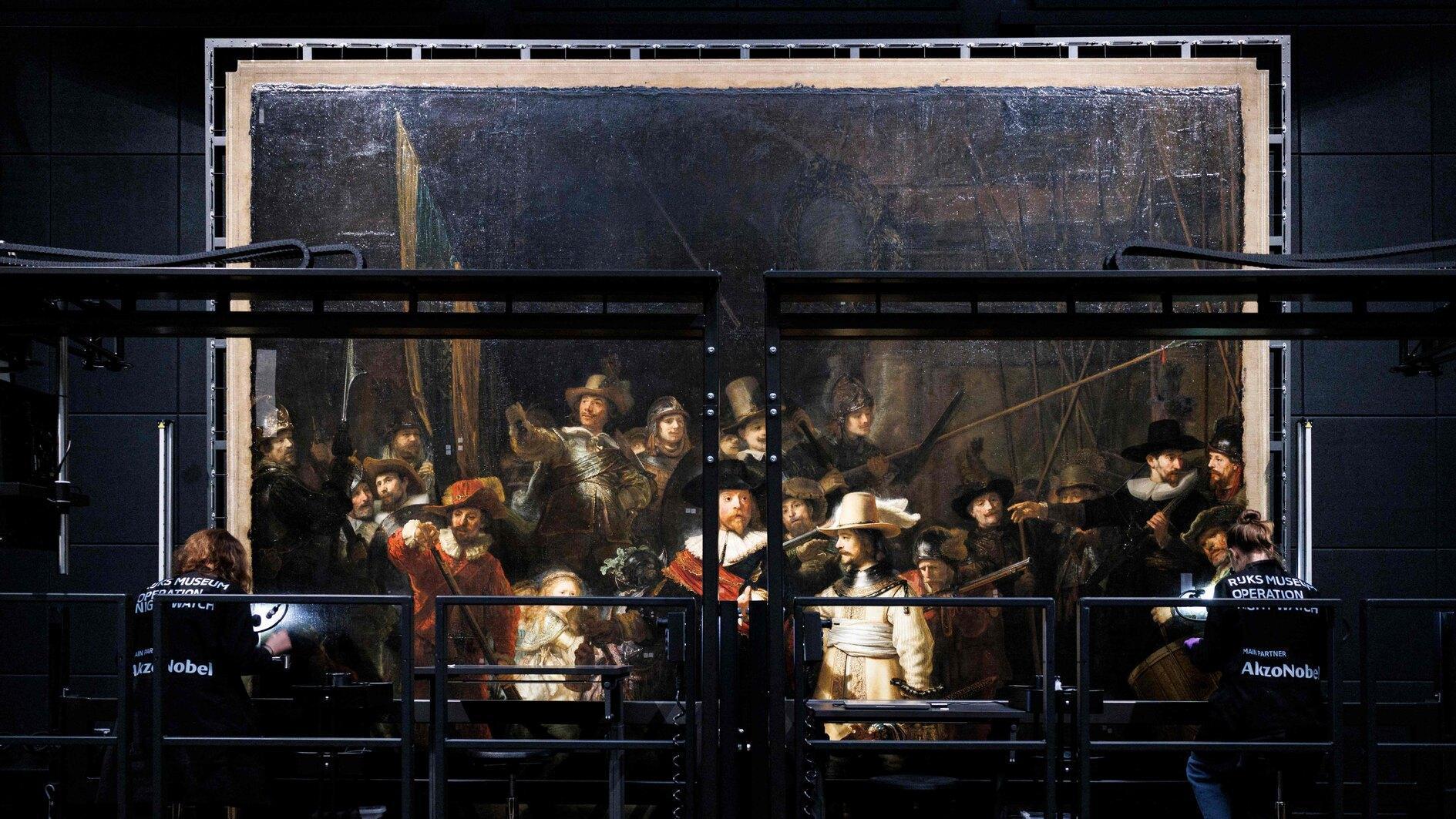

Japan’s premier-in-waiting Shinzo Abe’s party LDP is committed to aggressive monetary easing, which has caused the yen to foll to its lowest value against the dollar. Ex-Prime Minister Yoshihiko Noda was defeated in parliamentary elections. AFP photos

The yen fell to its lowest value against the dollar in more than 18 months yesterday after a landslide election victory for Japan’s Liberal Democratic Party (LDP), which is committed to aggressive monetary easing.The LDP’s victory will propel ex-Prime Minister Shinzo Abe, who has called for “unlimited” monetary easing, an increase in the inflation target and big spending on public works to rescue the economy, back to power.

Analysts expect the prospect of ultra-loose monetary policy to cause the yen to lose further ground in coming weeks, depending on the pace of policy change. However, the fact that bets against the yen are already hefty could limit its losses.

‘Significant policy changes’

The dollar was last up 0.5 percent on the day at 83.91 yen, having earlier hit 84.48 yen, its strongest since April 2011. This left it with the potential to target the 200-week moving average at 85.008 yen.

The extent of the LDP’s victory will give the new government a greater chance of pushing through policies. The LDP and its ally, the New Komeito party, secured the two-thirds majority needed to overrule Parliament’s upper house.

“The fact that the LDP secured a two-thirds majority gives them a strong mandate and will lead to significant policy changes,” said Ian Stannard, head of European currency strategy at Morgan Stanley. “The yen weakening trend will be sustainable and the dollar/yen will move higher while the euro/yen also has the potential to move sharply higher.”

He said Morgan Stanley forecasts that the dollar will rise to 90 or 92 yen by the end of 2013, while the euro could rise to 113 yen by the end of this year.

The euro jumped to around 111.30 yen, its highest since late March. It was last up 0.6 percent at 110.50 yen. The next test is this year’s high of 111.43 yen.

The Bank of Japan is scheduled to meet this week, when it will most likely increase its asset-buying and lending program, currently at 91 trillion yen, by another 5 trillion to 10 trillion yen, sources have said.

Abe told a news conference yesterday that Japan needed a sizable supplementary budget to beat deflation, given the country’s output gap. The euro’s gains against the yen also helped it against the dollar. It was last steady at $1.3163, having hit $1.3187 overnight in Asia, its highest in seven-and-a-half months.

Analysts said the dollar may be hampered by any signs of troubles in U.S. talks to avert a “fiscal cliff” of $600 billion worth of tax increases and spending cuts due next month. Although analysts believe the yen will continue to fall following the LDP’s victory, its falls could be limited in the short term as investors cut back short positions.

Data from the Commodity Futures Trading Commission on Dec. 14 showed speculators’ bets against the yen were at their highest in over five years. Investors had already turned bearish on the yen in anticipation of an LDP victory. Some analysts also warned the yen may be poised for a rebound as Abe’s actions could fall short of his tough talk, at least in the short term, while the Bank of Japan’s easing steps are expected to trail those of the U.S. Federal Reserve for now.

Energy stakes surge as pro-nuke Abe elected

TOKYO - Agence France-Presse

Fukushima operator TEPCO soared almost 33 percent yesterday, leading an energy firm rally after a pro-nuclear election win in Japan likely means any short-term plan to ditch atomic power will be shelved.

Tokyo Electric Power (TEPCO) rocketed 32.89 percent to 202 yen by the close, Chubu Electric Power jumped 9.59 percent to 1,188 yen and Kansai Electric was up 17.64 percent at 920 yen.

The huge surge on the Tokyo Stock Exchange came after voters dumped Prime Minister Yoshihiko Noda and his Democratic Party of Japan (DPJ), giving the pro-business Liberal Democratic Party a landslide victory. Anti-nuclear sentiment has run high in Japan after last year’s Fukushima atomic crisis, with opinion polls showing a majority of voters wanted to phase out nuclear power. However, that failed to translate into wider support for the DPJ, which had pledged to work toward a zero-nuclear country, or a group of small anti-nuclear parties which had little impact at the polling booth.

Premier-in-waiting Shinzo Abe, the LDP’s hawkish head, derided the zero-nuclear goal as unrealistic and “irresponsible” and hinted at keeping atomic power. The LDP has said it would decide on reactor restarts in three years and the nation’s “best energy mix” within a decade.

Japan’s private sector had bemoaned the nation’s energy bills as already too high with less nuclear meaning more challenges for Japan Inc. which was wrestling with a strong yen and weakening overseas demand.