House insurance rises on new law

ISTANBUL

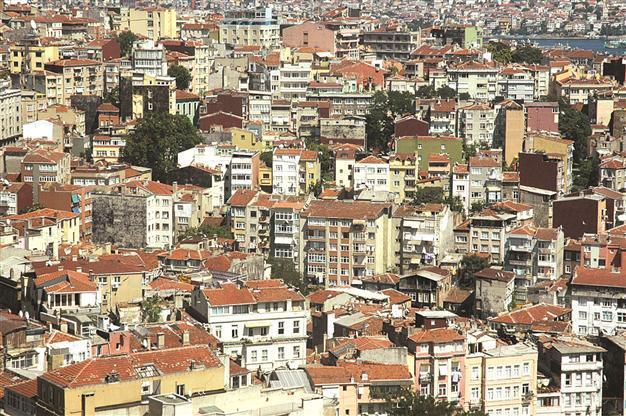

The number of houses covered by earthquake insurance has increased 1 million since the Disaster Insurance Code came into force last August. DAILY NEWS photo

The number of houses covered by earthquake insurance increased 1 million in the last six months after a law requiring earthquake insurance for water and electricity subscription took effect, Deputy Prime Minister Ali Babacan has said.The number of houses covered by earthquake insurance showed a considerable rise since the Disaster Insurance Code, which made earthquake insurance compulsory for water and electricity subscription applications, came into force in August 2012, Babacan said at a press event of the Turkish Catastrophe Insurance Pool (DASK). He said the number of insured houses jumped to more than 5 million in a 35 percent increase in the last six months, noting that 1 million houses out of the total number took out mandatory earthquake insurance in this period.

“We should increase these figures. DASK’s target of reaching 10 million insured houses by 2017 is important for this issue,” he said, adding that the goal could be achieved in less than five years when considering the large increase of the last six months.

Babacan said earthquakes cause 61 percent of losses of life and property due to natural disasters. He said only a small part of property losses could be compensated by insurance because the rate of insured houses was quite low. He said this rate was around 9 percent in the eastern province of Van, where more than 640 people died in a 7.2-magnitude quake on Oct. 23, 2011 and 5.6-magnitude earthquake on Nov. 9, 2011. “DASK paid the owners of insured houses 120 million Turkish Liras. The amount of compensation would be higher if all houses were insured.”

DASK chairman Selamet Yazıcı said the rate of insured houses had increased from 4 percent in 1999 – the year of Marmara earthquake – to 30 percent currently. “The Natural Disasters Code is a milestone for DASK. The rate of houses covered by insurance should rise more than 50 percent,” he said, adding that the recent rise in insurance policies should be sustainable.

However DASK began to use addresses registered in the National Address Database March 1, said DASK Manager Okan Utkueri. “We aim to follow insured houses better and loss management in a more efficient way thanks to this common system that allows the use of standard address information by all institutions.”