High-paid athletes under scrunity over tax evasion, unreported income

ANKARA

The Treasury and Finance Ministry has initiated an investigation into athletes with substantial earnings who have failed to declare their income, examining the earnings of 1,900 individuals across various sports disciplines.

As part of a broader wave of tax audits, the ministry has now shifted its attention to professional athletes.

The Revenue Administration scrutinized whether professional athletes in football, basketball and volleyball declared the significant sums they received. In Türkiye, clubs are responsible for withholding taxes on payments to athletes.

Authorities conducted a rigorous cross-referencing process, utilizing data from club declarations, contractual agreements, media reports, and transfers reported to the Public Disclosure Platform (KAP).

The investigation revealed significant tax losses in earnings during the 2021-2023 period. Among the findings were 400 athletes, including high-profile names with multimillion-dollar contracts, who concealed approximately 5 billion Turkish Liras ($146,000) in earnings over the past three years.

Additionally, 100 athletes, despite filing tax returns, failed to report their full earnings.

The Turkish media covered the audit with headlines like "red card for athletes evading High taxes," capturing public attention.

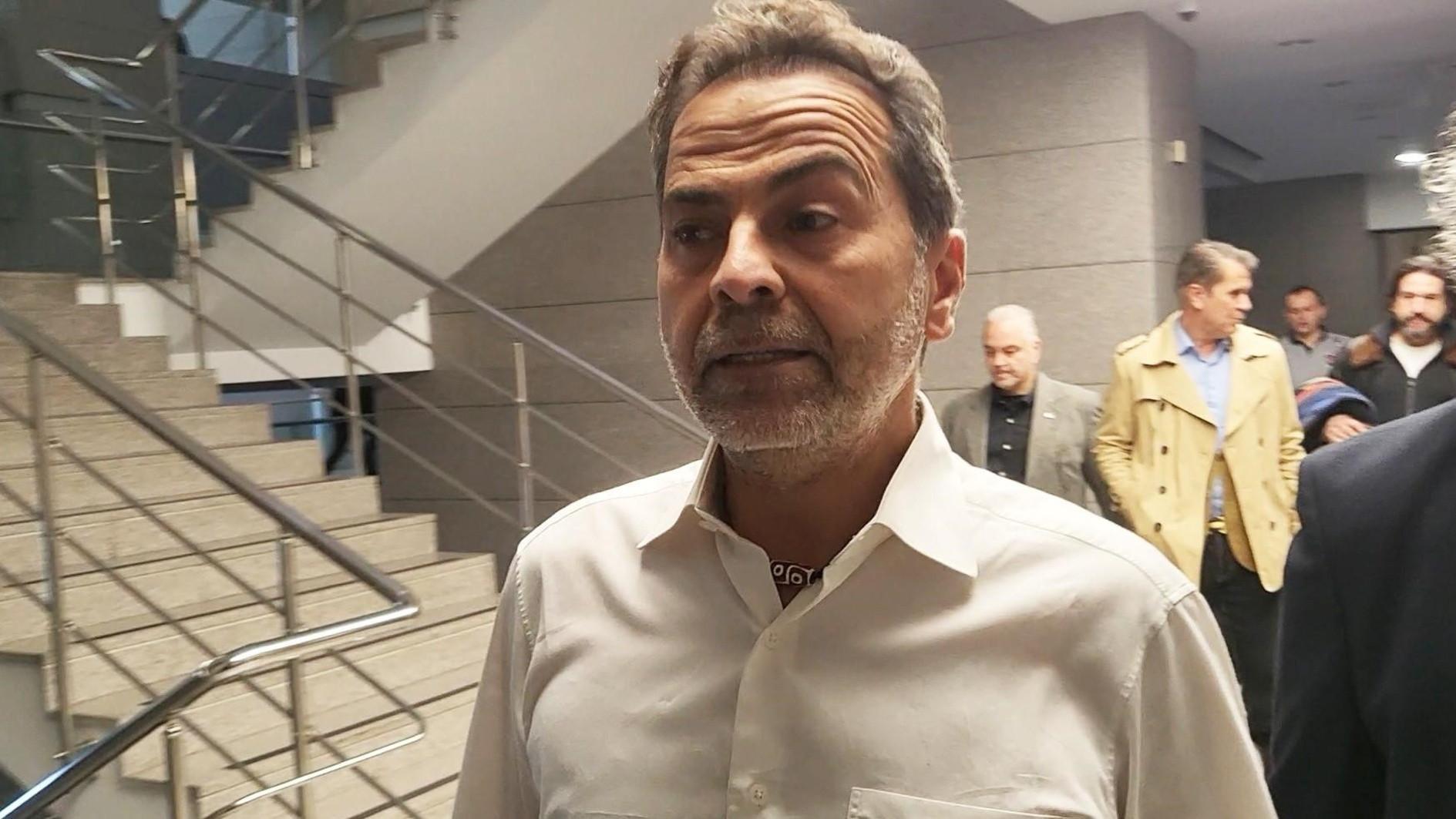

Treasury and Finance Minister Mehmet Şimşek remarked that athletes who fail to declare their earnings will be called upon to provide explanations, and unpaid taxes will be collected with penalties.

"As the ministry, we continue to knock on the doors of those who earn substantial incomes but report minimal earnings. Our audits targeting high earners who obscure their income will persist," Şimşek affirmed.

"We will take whatever steps necessary to recover taxes on undeclared income. With our commitment to fairness and efficiency in taxation, we are expanding our thorough inspections of those who deliberately omit their earnings."

Turkish authorities have been conducting tax audits on groups suspected of underreporting their income, many of which consist of high-income corporations. Most recently, the ministry announced an inquiry into luxury yacht and boat sales.

Concentrating on high-risk taxpayers, the Revenue Administration found that over 45,000 private boats and yachts were sold in those three years.

The investigation revealed a significant discrepancy between the declared and actual prices for private boat and yacht sales involving 15,000 natural entities and 1,527 companies out of these transactions.