Greek government gains extra months

ATHENS - Agence France-Presse

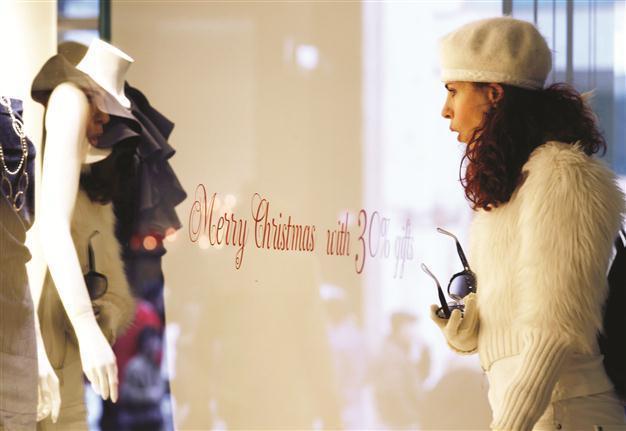

A woman looks at a window display in Athens on Dec 27. Greek stores had their worst Christmas in decades, with retail sales dropping by 30 percent since 2010. REUTERS photo

Early elections in Greece have been delayed to give the interim government more time to rescue the country’s crisis-hit economy, but political uncertainty looks set to complicate delicate talks with creditors.Finance Minister Evangelos Venizelos late on Dec. 27 said ballots would be set in late April to enable critical negotiations with the eurozone and banks holding Greek sovereign debt to be concluded.

Venizelos made the announcement at an internal meeting of the Socialist party. No official date has been set by the government.

The election issue has undermined an uneasy coalition of three parties backing the caretaker government of Lucas Papademos, a technocrat given a limited mandate in November to conclude a debt-saving deal for Greece, comprising new eurozone loans and a voluntary rollover of maturing sovereign bonds held by banks.

The conservative New Democracy party, a senior coalition partner, this week consented to a lease of life for the government but insisted on elections before Orthodox Easter, which falls on April 15.

The conservatives, who lead opinion polls, are eager to dissolve parliament before new austerity measures are voted in early 2012.

Papademos’ government was originally expected to be in power until mid-February, but the bank talks have taken longer than expected. The finance minister on Dec. 27 warned that the country’s future would be decided in the debt rollover over the next month.

“The future of the country will be decided from January 16 and for the following two or three weeks, during which negotiations on the new program will be held,” Venizelos said, referring to the eurozone bailout which includes the debt rollover.

Negotiations with banks began in November to work out the details of how creditors will write down 100 billion euros’ ($131 billion) worth of the Greek government bonds they hold, aiming to cut the total debt of 350 billion euros.

The banks agreed in principle to a write-down of about 50 percent of the value of the Greek bonds they hold under pressure from a eurozone summit at the end of October.

Although progress has reportedly been made, talks with the Greek government are far from over.

The bond rollover was part of a package of measures agreed at the October summit which also involved a loan of 100 billion euros from eurozone countries, and 30 billion euros to recapitalize Greek banks which hold nearly 50 billion euros’ worth of Greek debt.