Foreign investors in Turkey close to finance, distant from industry

MUSTAFA SÖNMEZ - mustafasnmz@hotmail.com

The finance sector, banking and insurance have the biggest share in direct investment with 37 percent. HÜRRİYET photo

The focus from the foreign resource inflow into Turkey from 2003 onwards, when the Justice and Development Party (AKP) took power, as well as the focus of foreign direct investments have been radically different from previous eras.

In the period under AKP rule, the acceleration of the inflow of foreign resources is mostly associated with the results due to the IMF’s controlled measures package for the 2001 crisis.

While a new IMF program was implemented in 1998, the 2000-2001 fluctuation dragged Turkey’s economy into a major crisis; the outflow of capital forced the Bülent Ecevit-led coalition government to take emergency measures to overcome the crisis. Kemal Derviş, trusted by the IMF and World Bank, was invited to Turkey as deputy prime minister and as a result of the bitter medicine administered by the IMF, equilibriums were reconstructed.

The policies implemented included the rehabilitation of the banking system, which had collapsed with the bankruptcy of about 20 banks, as well as a serious revision policy for central budget, social security system, the state economic enterprises (KİT), the privatization process, municipalities and agriculture sales cooperatives. Through these policies, public finance was also rehabilitated. These radical measures produced serious political results and coalition partners failed to pass the threshold in 2002 elections. This huge voter reaction was beneficial for the AKP. The recovering economy attracted extraordinary foreign resources.

The AKP became the only ruling party thanks to the election system, which has a 10 percent threshold. One-party rule, plus the rehabilitated finance system and public finance, was attractive for foreign investors. The IMF control was a separate assurance. As a sum of all these factors, it resulted in an extraordinary resource inflow, some of them buying KİTs in the industry sector. The banking sector of the economy, which grew at an average of 7 percent during the 2003-2007 period, was a separate attraction for foreigners who also entered the finance sector by buying banks.

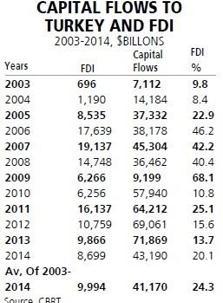

When the 2003-2014 period is reviewed, the foreign direct investment in these 12 years neared $120 billion. Almost one-third of the foreign resource inflow in the same period came as direct foreign capital while the remaining two thirds came as portfolio investment and credits – these are “debt raising capital.”

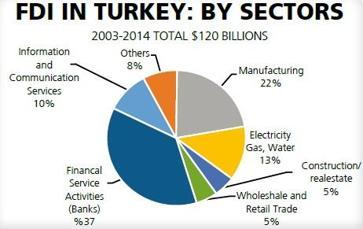

The sector breakdown of the FDI reveals another striking fact. Foreigners have chosen to invest in the finance sector more than in industry. The finance sector, banking and insurance have the biggest share in direct investment with 37percent.

The mobile phone market has been another attractive sector for foreign investors, nearing 10 percent of total direct investment. Foreigners engaging in commercial activities primarily did so in the retail sector, with the percentage exceeding 5 percent. Construction and real estate sector also attracted nearly 5 percent of foreigners. Other sectors such as transportation, health and other service sectors also attracted foreign capital, corresponding to a share of 62.5 percent of total foreign capital, constituting nearly $75 billion of the nearly $120 billion direct foreign capital in 12 years.

Capital foreign to industry Industry has constituted a share of 37.5 percent in direct foreign capital in the general sense in this period; however, when the definition is narrowed to the manufacturing industry, only 22 percent of FDI has gone to the manufacturing industry. Energy investments have a share of 13.5 percent in total, while mining has almost a 2 percent share.

Thus, we can say that during the 2003-2014 period foreigners have invested $2.2 billion in manufacturing industry and $1.3 billion in energy industry annually. This is equal to the amount invested in the finance sector alone. In other words, foreigners have invested in the manufacturing industry, energy and mining an amount equal to what invested in the banking-insurance sector alone. This preference is associated with profitability. Because foreigners saw that profit rates in finance were higher than industry, they steered their investments in that direction.

While 22 percent of the almost $210 billion foreign direct investment in 12 years was directed to the manufacturing industry, their subsectors were food, alcoholic beverages and tobacco which had a one-fourth share. The entries to this manufacturing branch was nearly $7 billion in 12 years, with the privatization of Tekel and investments in the tobacco sector playing a major role.

The chemical industry (including medicine) has 17 percent share in manufacturing investments of foreigners. While the computer and electronic utensil subsector came third in attracting foreign investors in the manufacturing industry, the main metal industry is the fourth subsector with its nearly 11 percent share. It can be seen that foreign investments in the subsectors of manufacturing are mostly domestic market-oriented sectors. It should also be noted that chemical and computer-electronics sectors have quite a high rate of imported inputs.

Foreign in the bourse

Foreign in the bourse Foreign investments also came as investments in shares on the bourse. Investors involved in buying and selling shares traded on bourse are exporting capital this way. According to Central Bank data, the value of shares of Turkish companies bought by foreigners at the end of 2014 was $62 billion. This amount was around $33 billion in 2005. This means an increase of around 88 percent in 10 years.

In 2005, in the portfolio of foreigners, 24 percent of shares belonged to industry firms and their market value was $8 billion. When it was 2014, the value of foreigners’ shares in industry firms reached $15 billion; the share did not change.

The sector preferences of foreigners where they became partners to companies do not vary much from their preferences in the stock exchange market.

In 2014, shares belonging to foreigners were predominantly from the finance sector, while 52 percent of the portfolio was made up of banking shares. At the end of 2014, the amount of shares of the financial sector that belonged to foreigners was $32 billion, with a share of 52 percent.

The AKP became the only ruling party thanks to the election system, which has a 10 percent threshold. One-party rule, plus the rehabilitated finance system and public finance, was attractive for foreign investors. The IMF control was a separate assurance. As a sum of all these factors, it resulted in an extraordinary resource inflow, some of them buying KİTs in the industry sector. The banking sector of the economy, which grew at an average of 7 percent during the 2003-2007 period, was a separate attraction for foreigners who also entered the finance sector by buying banks.

The AKP became the only ruling party thanks to the election system, which has a 10 percent threshold. One-party rule, plus the rehabilitated finance system and public finance, was attractive for foreign investors. The IMF control was a separate assurance. As a sum of all these factors, it resulted in an extraordinary resource inflow, some of them buying KİTs in the industry sector. The banking sector of the economy, which grew at an average of 7 percent during the 2003-2007 period, was a separate attraction for foreigners who also entered the finance sector by buying banks.  Foreign in the bourse

Foreign in the bourse