Foreign exchange rate increases amid fluctuating foreign trade

Mustafa SÖNMEZ - mustafasnmz@hotmail.com

Exports, which reached 53.7 billion dollars in the first four months of 2014, have increased $4.2 billion compared to the first four months of 2013, which corresponds to a rise of 8.5 percent, with the automotive industry constitutes 16 percent of the total. DHA Photo

The structure based on a low foreign exchange rate policy that Turkey has been following for some time due to the effect of changes in the economic and political climate, both internationally and domestically, has come to an end.

We are now in a new climate, the effect of which has been felt more in 2014 and which is based on a relatively more realistic foreign exchange rate. The effect of this can be seen immediately on foreign trade and in connection with that in the current account deficit.

How did the transition from low rate to a more realistic rate affect imports and exports?

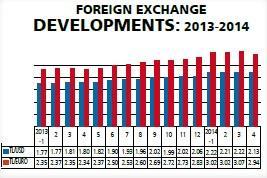

Theoretically, it is argued that a realistic foreign exchange rate is a boost of morale for exporters, because they gain more money in terms of local currency, while it also becomes a lever for exportation. The dollar exchange rate which was 1.80 Turkish Liras or 2.34 euros in May 2013 has hiked, leading one to ask whether exports were affected positively by that as expected and whether there were noticeable increases in exports.

According to the exports data for the first four months of 2014, when compared to the first four months of 2013 of the low-rate period, we cannot say there was a “boost” in exports, whereas the increase in the foreign exchange rate is not at all a small one.

Automotive, textiles, food

Automotive, textiles, foodDuring the April 2013-April 2014 period, the monthly average of the U.S. dollar increased from 1.80 liras to 2.13 liras and its value increase exceeded 18 percent. The value loss of the lira to the euro which constitutes more than half of the exports, on the other hand, is higher. While the April 2013 monthly euro average was 2.34 liras, it went up to 2.94 liras, with a rise of almost 26 percent. The rise in exports between January 2013 and April 2014 was 8.5 percent. From April to April, the rise in exports was 8 percent.

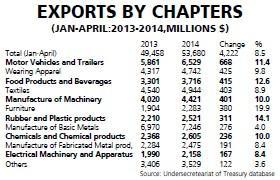

Exports, which reached 53.7 billion dollars in the first four months of 2014, have increased $4.2 billion compared to the first four months of 2013, which corresponds to a rise of 8.5 percent. When the composition of this rise is reviewed, the automotive industry constitutes 16 percent of the total, followed by conventional sectors such as textile/readywear and food. The latter two have a low rate of the usage of import input. However, the exports of those sectors that have a high rate of the usage of import have not yet been able to use the increase in value of the dollar as catalyst.

Exports in motor vehicles and trailers increased 11.4 percent in the first four months, exceeding $6.5 billion. In the first four months of 2013, the sector was only able to increase its exports by 1 percent. Other sectors which were able to increase their exports effectively in the first four months have been textile and wearing apparel. Readywear apparel exports reached $4.7 billion in four months, rising nearly 10 percent while textile exports increased 9 percent, nearing $5 billion.

The food sector also increased 10 percent in the first four months, making $3.7 billion in exports.

Topping those sectors that have not been affected by the appreciation of the foreign currency is the manufacturing of basic metals – a category that includes iron and steel. In this sector where scrap imports are predominant, the dollar has increased the price of imports, while exports have also slowed down.

The export increase in the primary metal industry stayed at 4 percent, or $7.2 billion. In total exports, the sector lost half a point, dropping to 13.5 percent.

Effect on imports

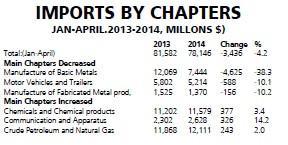

Effect on imports The rising foreign exchange rate, as expected, made imports more expensive, leading to a reduction in several sectors. Imports, which dropped to $78 billion in the first four months of the year, fell below 4.2 percent, the figure from 2013 for the same period. Metal imports in particularly have fallen 38 percent, while there was also a 10 percent drop in the imports of motor vehicles and trailers.

However, despite the increasing foreign exchange rate, imports from certain sectors did not decrease, but actually rose.

Imports in the communication apparatus sector, which is dominated by mobile phones, as well as the chemicals and chemical products sector and energy sector, increased despite the foreign exchange rate.

As a result, while exports increased 8.5 percent in the first four months, the foreign trade deficit dropped from $32 billion to nearly $24.5 billion – a drop of almost 24 percent – with the drop in imports staying at 4.2 percent. Of course, this has an important effect on the current account deficit.

Dependency It can be said that, in the face of the real exchange rate, the capacity for Turkish exports to grow has weakened, and the shrinking ability of imports has dropped to a great extent. The fact that exports in sectors such as chemicals and energy are increasing despite the hike in the foreign exchange rate shows that there is significant hardening and an absolute dependency.

The loss of the ability to increase in imports, though, is related to the rise in time of the ratio of imported input usage of sectors other than textile and food. This dependency in imports negatively affects the costs in sectors and has caused an erosion in competitive power in exports.

Automotive, textiles, food

Automotive, textiles, food Exports in motor vehicles and trailers increased 11.4 percent in the first four months, exceeding $6.5 billion. In the first four months of 2013, the sector was only able to increase its exports by 1 percent. Other sectors which were able to increase their exports effectively in the first four months have been textile and wearing apparel. Readywear apparel exports reached $4.7 billion in four months, rising nearly 10 percent while textile exports increased 9 percent, nearing $5 billion.

Exports in motor vehicles and trailers increased 11.4 percent in the first four months, exceeding $6.5 billion. In the first four months of 2013, the sector was only able to increase its exports by 1 percent. Other sectors which were able to increase their exports effectively in the first four months have been textile and wearing apparel. Readywear apparel exports reached $4.7 billion in four months, rising nearly 10 percent while textile exports increased 9 percent, nearing $5 billion.  Effect on imports

Effect on imports