Fitch rates Iraq ‘stable’ but with elevated risks

ANKARA – Anadolu Agency

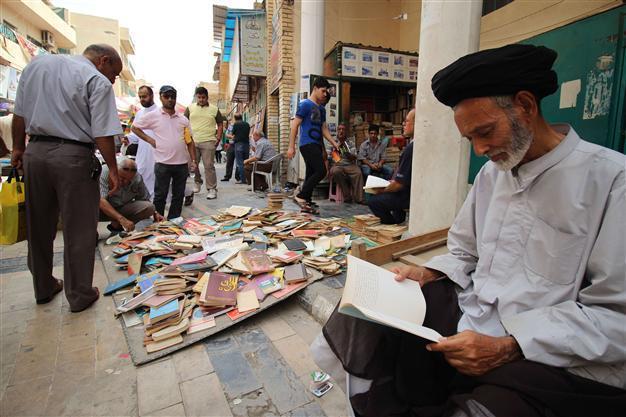

Iraqis look at books displayed outside bookshops on al-Mutanabi street in central Baghdad on August 7, 2015. AFP Photo

Credit agency Fitch Ratings has described the Iraqi economy as “stable,” but warned of “elevated political risks” in a note released on Aug. 7.Fitch gave Iraq a “-B” rating which denotes a significantly elevated default risk relative to other issuers or obligations.

“Political risk and insecurity [in Iraq] are among the highest faced by any sovereign rated by Fitch,” the agency said.

“Sectarian conflict has raged with varying intensity since 2003, ISIS militants currently effectively hold three of the 18 provinces, relations with the Kurdish regional government are volatile and governance indicators are exceptionally weak,” Fitch warned, using another acronym for the Islamic State of Iraq and the Levant (ISIL) militant group.

However, Iraq’s oil production provides a relatively stable resource, Fitch said.

“Iraq holds the world’s fifth largest oil reserves and significant amounts of gas. Oil production has risen rapidly to 3.3 million barrels per day in May 2015, from an average of 2.4 million barrels per day in 2010, with Iraq becoming the world’s second largest exporter in 2014.

“Production costs are low. The bulk of oil production facilities and infrastructure are away from areas of domestic insecurity. Investment is under way to further raise production capacity, although infrastructure bottlenecks remain a constraint and investment plans were set back by payment arrears in 2014,” according to Fitch.

Fitch pointed out arrears in payments to international oil companies have been cleared.

“Commodity dependence is among the highest of all rated sovereigns. Oil accounts for around 40 percent of GDP and over 90 percent of fiscal and current external receipts,” the agency said.

“Despite some modest initiatives to introduce new excise and consumption taxes this year, there is little prospect of revenue diversification over our forecast period to end 2017,” Fitch said.

Government finances are still a major challenge for Baghdad.

“Iraq’s fiscal position has deteriorated rapidly since 2013 and Fitch forecasts a double-digit fiscal deficit for 2015, owing to lower oil prices, higher military spending and costs associated with civil conflict. Savings buffers built during previous years of high oil prices have been largely eroded, and the deficit will be financed by debt, likely including a euro bond and funding through an IMF [International Monetary Fund] rapid financing instrument that was approved in July.

“Rising oil production and prices should lead to a narrowing of the budget deficit in 2016.”