Fed bound for ‘moderate increase’

Mustafa Sönmez - mustafasnmz@hotmail.com

Janet Yellen, chairman of the U.S. Federal Reserve, speaks at a press conference following a Federal Open Market Committee meeting in Washington March 18, 2015. REUTERS Photo

For long years, the world economic literature was not locked into a word such as “patient.” When the U.S. Fed turned the topic of the timing of the rise of interest rates into a lotto, then the answer to the question “when?” was formulated as: “being patient and not being patient.” The patient stance meant there would be no rush in the decision to raise interest rates; removing the patient stance meant “that moment” was nearing. Then came the awaited March 18 statement, when Fed governor Janet Yellen said they would not be in their patient stance anymore in increasing interest rates but they would not be impatient either, giving the signal of a soft rise. This is also called the “dovish stance.”

Yellen said, “Today’s modification of the forward guidance does not mean that an increase will necessarily occur in June, although we can’t rule that out.”

Yellen emphasized that interest rate decisions were totally based on economic conditions and “an increase in the target range for the federal funds rate remains unlikely at our next meeting in April.”

Despite that, Yellen said, “Let me emphasize, however, that the timing of the initial increase in the target range will depend on the Committee’s assessment of incoming information. Today’s modification of our guidance should not be interpreted to mean that we have decided on the timing of that increase.”

She also said, “… market participants should be is looking at incoming data, just as we are…”

IMF warningsThe warnings of the International Monetary Fund (IMF) were influential in the Fed’s caution. On March 16, IMF head Christine Lagarde said more than six years after the global financial crisis, “the recovery remains too slow, too brittle and too lopsided.”

Speaking in New Delhi, India, Lagarde said, “Looking ahead, something better may yet come on the back of low oil prices and low interest rates. Still, there are significant risks to this fragile global recovery.”

Reminding that the global economy is expected to grow by 3.5 percent in 2015, Lagarde also said, “This is still below what could have been expected after such a crisis.” She warned about “asynchronous monetary policy” in advanced economies, which may result in excessive volatility in financial markets.

In the Fed’s moderate pace decision, these warnings are influential. The Fed has to consider the global reaction of each step it takes; it needs to.

Forex rates

Forex rates Since mid-2013, the Fed’s signals on raising rates have caused global funds to take new positions and turn their faces to the U.S., thus resulting in the devaluation of local currencies against the dollar by those funds leaving their host countries. Against the strengthening dollar, several central banks devaluated their own currencies against the dollar; especially the euro rapidly lost value against the dollar.

According to IMF data, the devaluations against the dollar and repositions, which accelerated in 2014, continued to accelerate in the first two-and-a-half months of 2015. With the message of the Fed’s March 18 meeting, fluctuations in local currencies restarted and they will continue.

According to the IMF, when the one-year period covering March 18, 2014, and March 18, 2015, is taken into consideration, the sharpest devaluation was seen at the Russian ruble with 69 percent. The Crimea and Ukraine issue was the most important factor in this loss; however, since the beginning of 2015, the decline in the ruble has stopped.

In the yearly basis, the Brazilian real has become the most devaluated “emerging” local currency with 39 percent, with its loss nearing 22 percent since the beginning of 2015.

The loss of value of the euro against the strengthening dollar has become 24 percent in one year. The euro/dollar parity was 1.33 on March 18, 2014; it was 1.05 one year later. The new Fed decision is expected to decrease this toward 1.

While the Japanese yen devalued over 19 percent against the dollar in one year, the Chinese yuan’s loss has been 0.4 percent since the beginning of 2015. It is now being mentioned that for China to maintain its growth based on exports it may opt for devaluation against the dollar, which would create new fluctuations in world equilibriums.

Losses in the Turkish Lira The Turkish Lira, while it lost 18 percent value against the dollar on a yearly basis, has started losing fast against the dollar since the beginning of 2015. In 2015, the lira’s loss neared 13 percent in two-and-a-half months, accompanying the Brazilian real in the biggest losses.

After the Fed’s recent statement on the interest rate, it is wondered now whether it will trigger new capital outflows from Turkey and whether lira savings will be directed to the dollar.

The “moderate stance” statement and the lifting of the “pressure from the palace” on the Central Bank for now may have positive effects on the dollar/lira parity. Meanwhile, the “reconciliatory” meeting between President Recep Tayyip Erdoğan and the Central Bank did not have any effect on the climb of the dollar. The factor has always been the external dynamics; it has been proven by these developments.

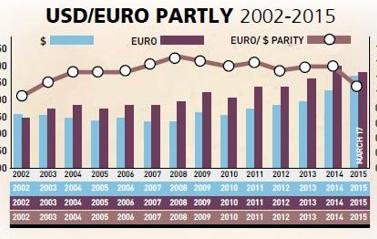

Escape from the euro With the attraction of the strengthening dollar, escape from the euro has accelerated; the dollar/euro parity has gone down to 1.05. This rate was 1.33 in 2014.

Even the currency of the 19 member countries of the European Union cannot withstand the dollar strengthening in the entire world. With the interest rate increase decision of the U.S., the euro and the dollar are expected to equalize. As the U.S. economy recovers, global funds are leaving not only countries like Turkey, but also the EU, which is stagnated and taking positions in the United States.

Resorting to liquidity expansion to overcome the disinflation problem of the EU will result in an interest toward the U.S. and the dollar. This situation is expected to equalize the euro and the dollar.

After 2002, the euro gained value against the dollar and it peaked at 1.47 dollars before the global crisis. However, during the crisis years, in 2009 and afterward, with the effect of the shrinkage in the Eurozone, the euro could not keep its supremacy against the dollar. Since 2013, as the U.S. economy gave signals of recovery and as positions toward the dollar accelerated, the euro’s devaluation against the dollar also accelerated. Despite this, in 2014, the dollar/euro difference remained at 1.33. The euro’s sharp loss of value happened in 2015 when the dollar strengthened against all currencies and the parity was near 1.05 in mid-March.

Euro after March 18

Euro after March 18 With any sign of a U.S. interest rate raise perception, the euro will lose value. Those who were staying in the euro are now opting for the dollar. Exporters to the EU with the euro in Turkey have started losing, both because of decreasing demand and because of the euro’s devaluation against the dollar.

This has a declining effect on exports.

Euro-savers have started switching to the dollar.

What about the yuan? It is a special source of wonder what the stance against the strengthening dollar the currency of emerging giant China will be. It is a widespread belief that there is no other alternative for China but to devaluate the yuan to increase its exports and its wavering growth. In this respect, it is argued that China will remove its currency from the dollar band and this would choke the world into waves of deflation. In possibility evaluations, it is being reminded how the devaluation of the yuan in 1994 contributed to the Asian crisis.

Competitive power There are two faces to the strengthening dollar. On one face, the strengthening in the dollar is taking the U.S. to the leadership position again. But strengthening also stimulates exportation to the U.S. market from those weakened currencies; the strong dollar increases export motivation. This is true for the Eurozone, China and several other countries with exportation power. The export motivation to the U.S. market is a development which would lower the growth and employment in the U.S. as well as toughen the industry and service sectors. For this reason, the Fed has to take cautionary steps and has to foresee what outcomes its steps will create in the world economy.

For the weakening lira against the strong dollar, it is not that easy to switch to exports. This is such a neglected industry in the past 10 years that the dollar attraction solely is not adequate to motivate the exporter. Despite the attraction of the dollar, exports do not increase; actually they even decrease.

Forex rates

Forex rates  Euro after March 18

Euro after March 18