Fed agrees to Basel III banking rules

WASHINGTON - Agence France-Presse

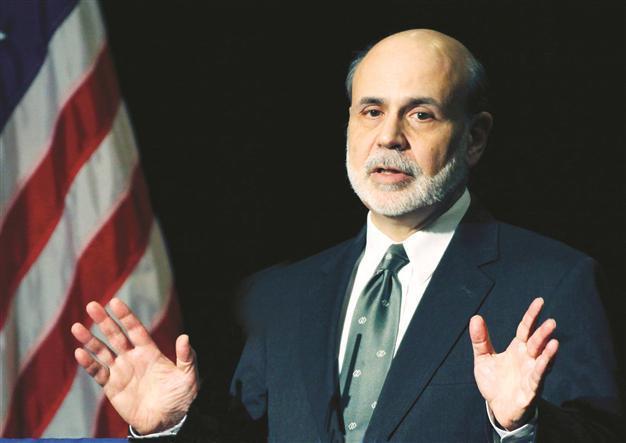

Fed Reserve Chairman Bernanke has not hinted on a stimulus measure, as banking rules are tightened. REUTERS photo

The U.S. Federal Reserve signed off on proposed new regulations to bring U.S. banks in line with the Basel III global standards, aimed at giving banks more crisis-resistant footings.The U.S. rules will give bank holding companies and savings and loans companies with at least $500 million in assets until 2019 to meet the new capital rules, which have met resistance from banks as too hefty.

The rules tighten the definitions of bank capital and set new minimum levels: a seven percent base of common equity, including 4.5 percent of risk-weighted assets and another 2.5 percent “capital conservation buffer’. Such a cushion, far larger than that required of banks now, should, when combined with other new U.S. regulations, “enhance their ability to continue functioning as financial intermediaries, particularly during stressful periods,” the Fed said.

“This, in turn, should improve the overall resiliency of the banking system.” The push for globally harmonized, better regulation and stronger capital bases for banks has gained strength since the 2008 crisis exposed deep weaknesses across the global financial system. But banks especially in the U.S. have fought the rules as too burdensome, limiting their potential to make money.

Meanwhile oil prices fell in Asian trade June 8 as hopes dimmed for stimulus measures to re-energise the faltering U.S. economy, analysts said.

New York’s main contract, light sweet crude for delivery in July, was down $1.43 to $83.39 a barrel and Brent North Sea crude for July delivery shed $1.24 to $98.69 in the Friday afternoon.

“Oil prices have fallen along with equity markets after (U.S.) Federal Reserve chairman Ben Bernanke [in remarks June 7 to a Congressional panel] tempered hopes that there would be more stimulus for the U.S. economy,” said Victor Shum, a senior energy consultant in Singapore.